- United States

- /

- Metals and Mining

- /

- NYSE:SXC

SunCoke Energy (SXC) Margin Decline Reinforces Bearish Narrative on Earnings Contraction

Reviewed by Simply Wall St

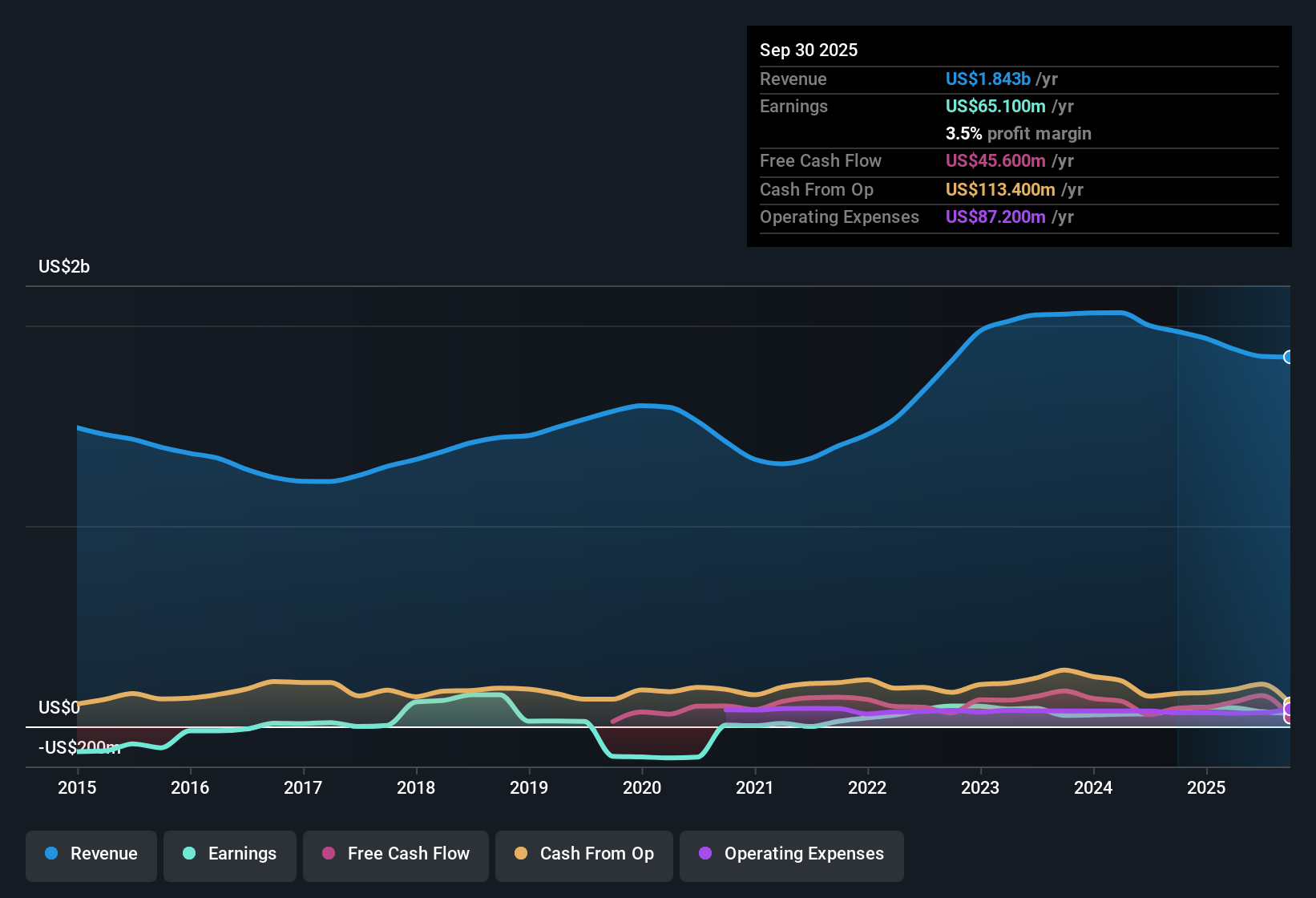

SunCoke Energy (SXC) faces a tough road ahead, with earnings projected to decline by 2.3% per year and revenue expected to contract at an even sharper rate of 8.5% annually over the next three years. The company’s net profit margin has slipped to 3.5%, down from 4.4% the year before, reflecting a negative turn in recent profitability after five years of strong average annual profit growth. As a result, investors are likely viewing SunCoke’s earnings update as a move from years of expansion into a period of contraction. This comes against a backdrop of mounting margin pressure and financial headwinds.

See our full analysis for SunCoke Energy.To put these numbers in context, let’s compare the latest results to the current market and community narratives, and see which expectations hold up and which might need a rethink.

See what the community is saying about SunCoke Energy

Customer Reliance Raises Revenue Risks

- SunCoke’s revenue outlook is clouded by its dependence on just a few major customers, with the EDGAR summary highlighting that heavy concentration makes earnings vulnerable to contract renewals or reductions.

- Bears argue that the North American steel market’s shift, especially plans by Cliffs to reduce external coke needs and the broader move toward idling blast furnaces, could structurally reduce domestic coke demand.

- Cliffs’ post-Stelco acquisition plan to become self-sufficient directly threatens a major SunCoke revenue stream and exposes the company to sudden contract losses.

- Increased spot coke sales, which earn lower margins than long-term contracts, combined with soft demand in logistics, heighten the risk that segment revenues and consolidated earnings could shrink further if steel market dynamics worsen.

Margin Stability Faces Commodity Pressures

- The company’s net profit margin stands at 3.5%, down from 4.4% last year, and analysts see this shrinking further to 3.7% within three years. This signals that margin resilience is under pressure from both operational and commodity exposures not fully offset by long-term contracts.

- Consensus narrative notes that while the acquisition of Phoenix Global boosts asset base and logistics integration, ongoing downsides such as softness at key logistics assets (notably CMT) linked to weak export coal demand could continue compressing margins.

- Despite $75 million in recent capital investments aiming to improve efficiency, the persistence of margin squeeze highlights that even with operational upgrades, commodity cycles remain a critical challenge for SunCoke’s earnings durability.

- The mix of take-or-pay contract structures and pass-through pricing mechanisms helps to buffer some margin swings, but does not fully shield against declining domestic coke demand and volatile export markets.

Valuation Discount Despite Earnings Slide

- SunCoke is trading at a price-to-earnings ratio of 8.9x, which is significantly below both its peer average (15.9x) and industry average (23.7x), and sits at a $6.83 share price even as analysts set a $12.00 target, a 75.7% upside, despite consensus forecasts for continued declines in revenue (down 9.5% a year) and profits over the next three years.

- Analysts' consensus view sees this deep valuation discount as a potential opportunity, arguing that the company’s diversified contracts, international expansion via Phoenix Global, and logistics integration could ultimately deliver more stable earnings and justify a re-rating.

- The fact that SunCoke’s current profitability and outlook remain challenged underscores a clear tension: the stock’s low valuation may reflect justified caution given ongoing operational and financial headwinds, even as the price target signals scope for reappraisal if the company stabilizes margins and sustains revenue in new markets.

- For the consensus target to be hit, SunCoke needs to achieve $1.4 billion in revenue and $50.8 million in earnings by 2028 and be valued at a lofty future PE of 26.3x, which is well above today’s multiple and slightly above the industry’s current standard.

See how the latest numbers test the consensus thinking by digging into the full company narrative. 📊 Read the full SunCoke Energy Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for SunCoke Energy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these results? Add your perspective to the story in just a few minutes and influence the conversation. Do it your way.

A great starting point for your SunCoke Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

SunCoke Energy’s unstable margins, shrinking revenues, and exposure to volatile steel and commodity demand paint a picture of inconsistent performance ahead.

If you want stocks delivering steadier growth and resilience to market swings, focus on stable growth stocks screener (2077 results) to discover companies that consistently expand revenues and profits through economic cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SXC

SunCoke Energy

Operates as an independent producer of coke in the Americas and Brazil.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives