- United States

- /

- Chemicals

- /

- NYSE:SQM

Investors Appear Satisfied With Sociedad Química y Minera de Chile S.A.'s (NYSE:SQM) Prospects As Shares Rocket 28%

The Sociedad Química y Minera de Chile S.A. (NYSE:SQM) share price has done very well over the last month, posting an excellent gain of 28%. Looking back a bit further, it's encouraging to see the stock is up 51% in the last year.

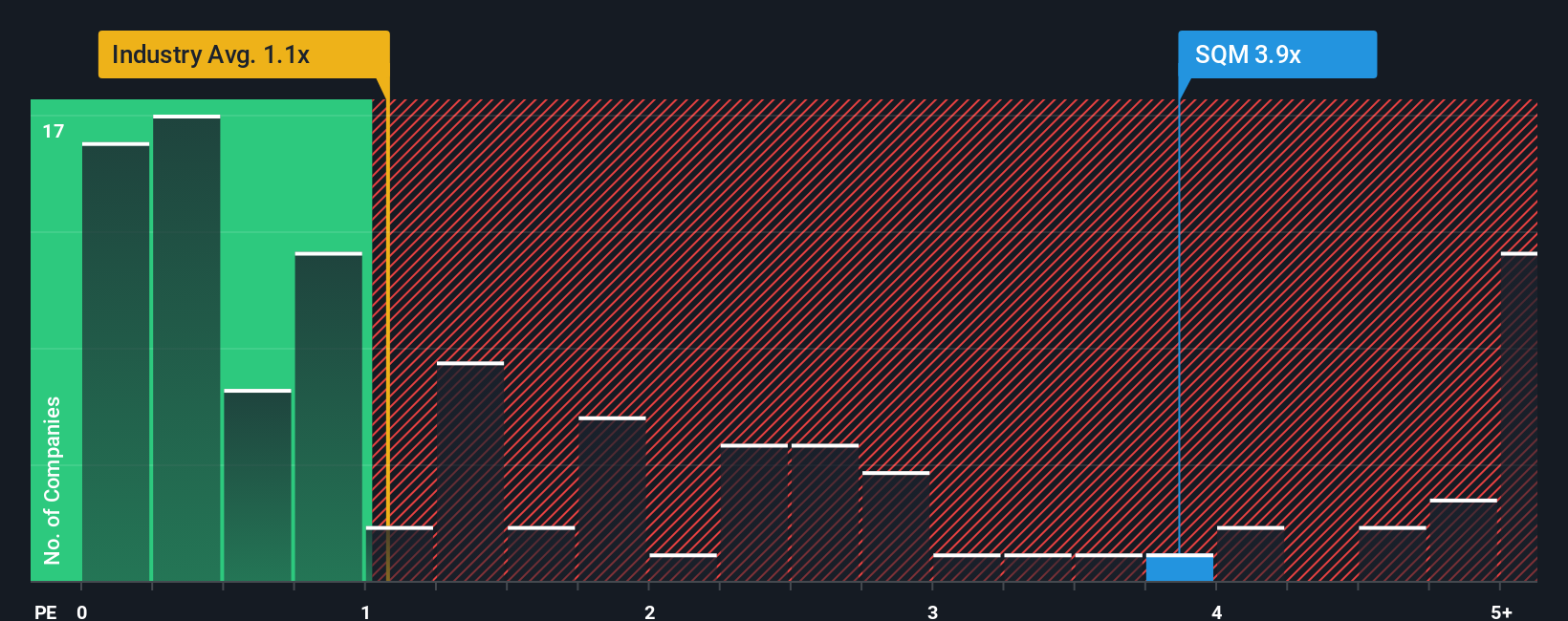

Following the firm bounce in price, you could be forgiven for thinking Sociedad Química y Minera de Chile is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.9x, considering almost half the companies in the United States' Chemicals industry have P/S ratios below 1.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Sociedad Química y Minera de Chile

How Has Sociedad Química y Minera de Chile Performed Recently?

Sociedad Química y Minera de Chile could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Sociedad Química y Minera de Chile will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Sociedad Química y Minera de Chile would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 9.2%. This means it has also seen a slide in revenue over the longer-term as revenue is down 50% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 16% per year as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 8.8% per annum, which is noticeably less attractive.

In light of this, it's understandable that Sociedad Química y Minera de Chile's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Sociedad Química y Minera de Chile's P/S

Shares in Sociedad Química y Minera de Chile have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Sociedad Química y Minera de Chile shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 2 warning signs for Sociedad Química y Minera de Chile (1 is significant!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SQM

Sociedad Química y Minera de Chile

Produces and sells specialty plant nutrients, and iodine and its derivatives worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success