- United States

- /

- Packaging

- /

- NYSE:SON

Sonoco Products (SON): Exploring Valuation Following Major Consumer Packaging Restructure and Leadership Changes

Reviewed by Simply Wall St

Sonoco Products (SON) is shaking up its structure by consolidating Metal Packaging and Rigid Paper Containers into a unified Consumer Packaging segment. The move creates leadership roles for EMEA/APAC and the Americas, signaling a clear shift in strategy.

See our latest analysis for Sonoco Products.

Sonoco’s latest business restructure comes at a time when momentum is starting to pick up. After a tough stretch, shares have rebounded with a 5% share price return over the past month, though the one-year total shareholder return remains down at -13%. This recent lift follows news of strategic leadership changes and high-profile conference appearances, both of which are drawing new investor attention and hint at a possible shift in sentiment.

If you’re interested in where capital and strong leadership could unlock new opportunities, now’s a smart moment to broaden your search and discover fast growing stocks with high insider ownership

With shares still well below analyst targets and recent gains starting to draw fresh interest, the real question is whether Sonoco is trading at a discount or if the market already recognizes its turnaround. Is this a genuine buying opportunity, or is future growth already factored into the price?

Most Popular Narrative: 22.7% Undervalued

Sonoco’s most closely watched narrative indicates a fair value well above the last closing price, which suggests meaningful upside potential if company transformation efforts keep producing results.

Sonoco is capitalizing on surging demand for sustainable and recyclable packaging by expanding its premium product lines (for example, all-paper and paper-bottom cans) and winning notable sustainability awards. This is expected to drive revenue growth and enable pricing power that supports increased net margins.

Want to see what’s driving this optimistic view? The narrative hinges on ambitious revenue and profit growth, as well as a reduction in the company’s valuation multiple. Discover which bold projections and market shifts lie at the heart of this valuation.

Result: Fair Value of $53.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softness in international demand and delays in achieving cost savings targets could quickly dampen the current optimism around Sonoco's turnaround story.

Find out about the key risks to this Sonoco Products narrative.

Another Perspective: Multiples Tell a Cautionary Tale

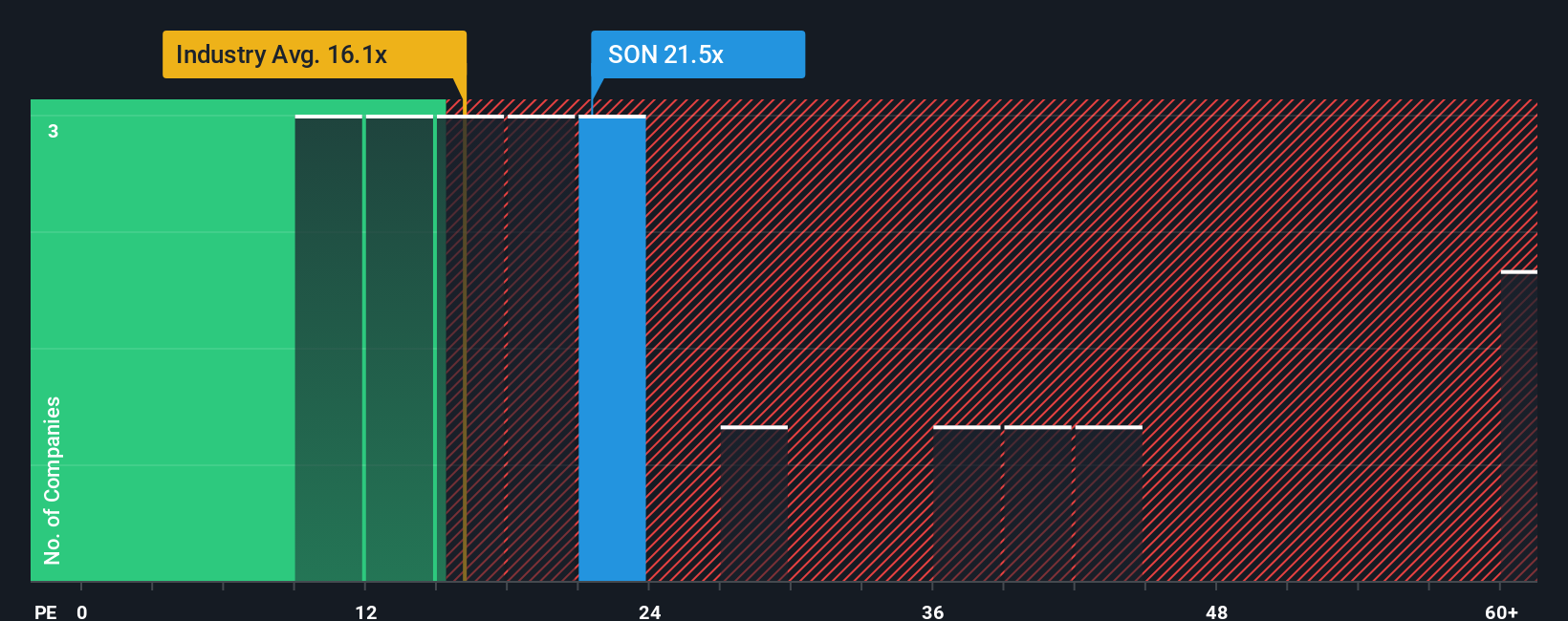

While the consensus sees Sonoco as undervalued, a look at its price-to-earnings ratio paints a less optimistic picture. The company trades at 22.2x earnings, which is higher than both the peer average (16.2x) and its fair ratio of 20x. This premium suggests the market may be pricing in more growth or stability than is realistic and could limit upside if expectations fall short. Is it a warning sign for overvaluation, or does the story go deeper?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sonoco Products Narrative

If the current take doesn’t fit your view or you’re someone who likes to dig into the numbers yourself, you can piece together your own story in just a few minutes, Do it your way

A great starting point for your Sonoco Products research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t wait for opportunity to knock twice. The right stock idea can set you ahead of the crowd. Let these handpicked screeners guide your next winning move.

- Start earning more by targeting stability and yield with these 15 dividend stocks with yields > 3% delivering payouts above 3% in today’s market.

- Catch the companies behind AI’s explosive growth and shape your portfolio with these 27 AI penny stocks before the next tech headline breaks.

- Unlock future potential by focusing on these 27 quantum computing stocks powering tomorrow’s breakthroughs in computing and innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SON

Sonoco Products

Designs, develops, manufactures, and sells various engineered and sustainable packaging products in the United States, Europe, Canada, the Asia Pacific, and internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives