- United States

- /

- Chemicals

- /

- NYSE:SMG

How Scotts Miracle-Gro’s (SMG) Use of AI to Halve Inventory Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Earlier this week, Scotts Miracle-Gro reported that it has used advanced machine learning and artificial intelligence to cut its inventory from US$1.3 billion to US$625 million in 2025 by improving demand forecasting and supply chain efficiency.

- This significant reduction highlights how data analytics and AI-driven tools are actively enabling operational improvements and potential cost savings across Scotts Miracle-Gro's inventory management processes.

- We'll explore how this use of AI-powered inventory management could influence the company's prospects for improved margins and future growth.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Scotts Miracle-Gro Investment Narrative Recap

Shareholders in Scotts Miracle-Gro are often putting their faith in the company's ability to offset rising regulatory and demand risks with digital transformation and operational efficiency. The news of inventory reductions through AI and machine learning appears advantageous for margin improvement, but it does not immediately lessen the exposure to ongoing environmental and retailer concentration risks facing the business today.

One recent announcement that connects closely to the AI-driven supply chain improvements is the reaffirmation of full-year 2025 earnings guidance. This shows management's confidence in underlying operations, but rapid technology adoption alone may not shield the company from broader shifts in consumer and regulatory behavior affecting the core product mix.

On the other hand, investors should be aware that concentrated retail partnerships could still present volatility for margins if major customers...

Read the full narrative on Scotts Miracle-Gro (it's free!)

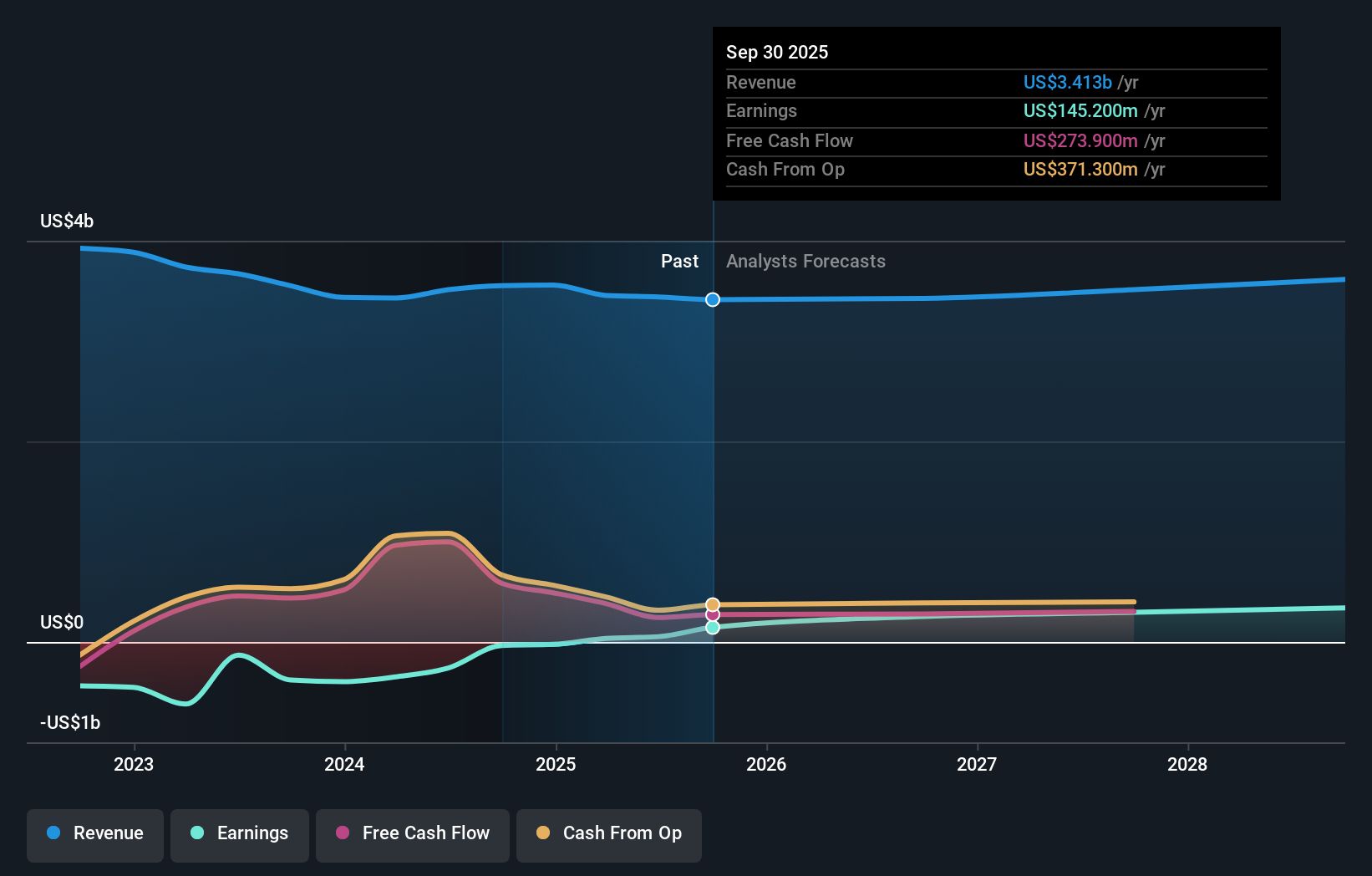

Scotts Miracle-Gro's narrative projects $3.5 billion revenue and $348.1 million earnings by 2028. This requires a 0.8% annual revenue decline and an increase in earnings of $295 million from the current $53.1 million.

Uncover how Scotts Miracle-Gro's forecasts yield a $73.71 fair value, a 39% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members assigned fair value estimates for Scotts Miracle-Gro ranging from US$48.25 to US$83.30, with four analyses represented. While profit growth remains a key catalyst, ongoing reliance on synthetic products creates uncertainty about future demand and margin stability, explore more viewpoints to see how opinions compare.

Explore 4 other fair value estimates on Scotts Miracle-Gro - why the stock might be worth as much as 57% more than the current price!

Build Your Own Scotts Miracle-Gro Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Scotts Miracle-Gro research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Scotts Miracle-Gro research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Scotts Miracle-Gro's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMG

Scotts Miracle-Gro

Engages in the manufacture, marketing, and sale of products for lawn, garden care, and indoor and hydroponic gardening in the United States and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives