- United States

- /

- Chemicals

- /

- NYSE:SMG

A Fresh Look at Scotts Miracle-Gro (SMG) Valuation Following Earnings Turnaround and New Consumer Guidance

Reviewed by Simply Wall St

Scotts Miracle-Gro (SMG) just posted its fiscal fourth quarter and full-year results, shifting from last year’s net loss to positive net income. The company also provided a new outlook for its U.S. Consumer segment.

See our latest analysis for Scotts Miracle-Gro.

Scotts Miracle-Gro’s latest earnings turnaround and a confirmed dividend have not yet sparked a sustained recovery in its share price. After a somewhat choppy ride this year, with the latest close at $56.73 and a year-to-date share price return of -13.67%, recent results have not reversed the longer-term trend, as the 1-year total shareholder return remains down at -20.57%. Momentum still appears muted, even as the company positions itself for steadier growth in its U.S. Consumer business.

If you’re on the lookout for what else is showing promise, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

So with the stock still trading well below analyst targets and recent growth just beginning to take hold, is Scotts Miracle-Gro currently undervalued, or is the market already factoring in its future prospects?

Most Popular Narrative: 23% Undervalued

Based on the current narrative, Scotts Miracle-Gro’s estimated fair value stands well above the latest closing price, suggesting significant upside potential. Strong performance catalysts are balanced by ongoing execution risks, making the company’s transformation a central story for valuation.

Significant ongoing investments in supply chain technology, automation, and process efficiencies are expected to unlock approximately $75 million in cost savings for fiscal '25, with another $75 million planned for '26 and '27. These measures are directly driving gross margin recovery (aiming for 35% or higher), boosting EBITDA, and improving long-term net margins.

Want to know why this turnaround story could be bigger than it looks? The projections behind the fair value rely on a future profit margin shift and surprisingly ambitious financial goals. Click through to see the bold assumptions behind this number.

Result: Fair Value of $73.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory pressures and heavy reliance on key retailers could still derail the turnaround story if industry or consumer dynamics shift unexpectedly.

Find out about the key risks to this Scotts Miracle-Gro narrative.

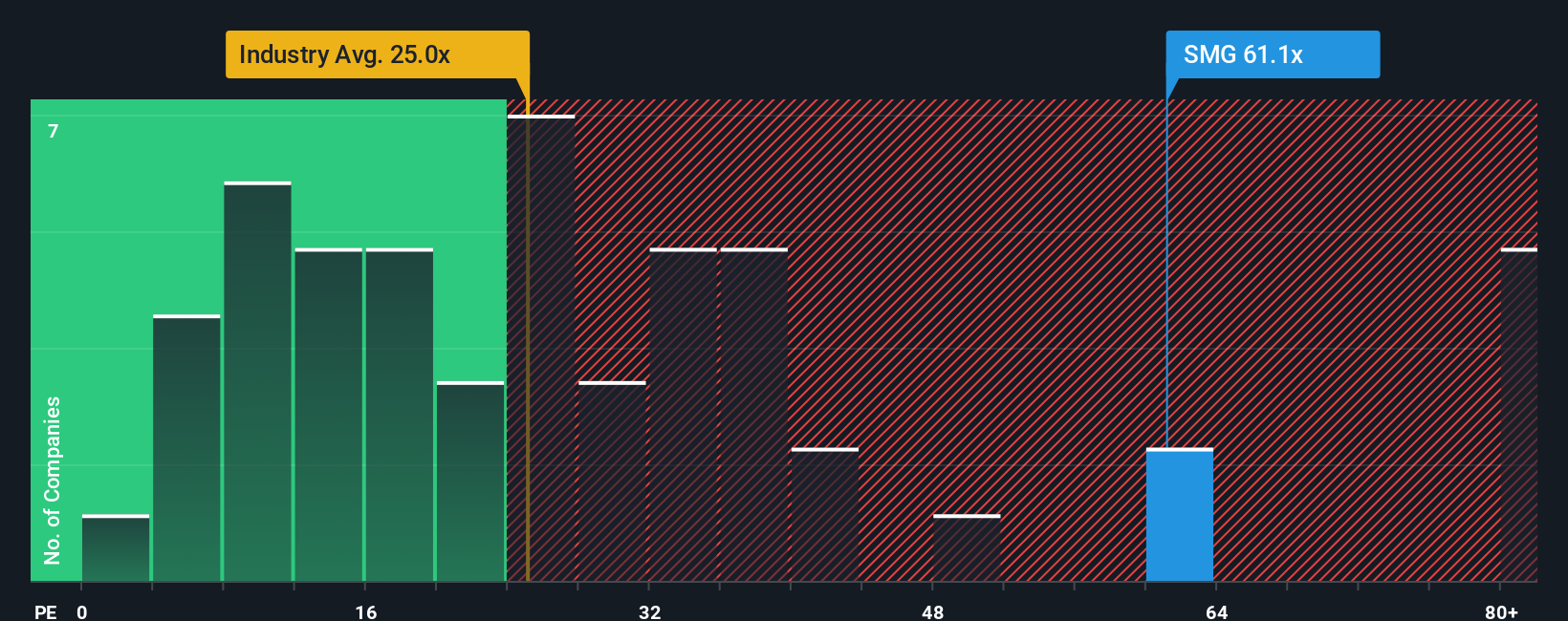

Another View: Comparing Earnings Ratios

While the consensus fair value suggests Scotts Miracle-Gro is undervalued, a look at its current price-to-earnings ratio reveals a more complicated picture. The company trades at 22.6x earnings, which is slightly cheaper than the US Chemicals industry average of 23.4x. However, it is notably more expensive than its direct peer average of 10.9x. The fair ratio sits at 20.3x, which indicates the market could tighten this gap if business momentum stumbles. Could this premium signal risk, or is there upside if growth targets are met?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Scotts Miracle-Gro Narrative

If you want to dig into the numbers or take a different approach than what's presented here, building your own perspective is quick and easy. Do it your way

A great starting point for your Scotts Miracle-Gro research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit their search. Shake up your strategy with fresh stock picks you might be missing on Simply Wall Street’s screener. Jump on these opportunities today and take your portfolio up a notch.

- Uncover potential market movers generating strong returns with these 878 undervalued stocks based on cash flows, where value and momentum come together for savvy investors.

- Boost your passive income outlook by searching for reliable yield with these 16 dividend stocks with yields > 3%, delivering attractive dividends above 3%.

- Ride the innovation wave as artificial intelligence transforms industries, and tap into tomorrow’s winners through these 24 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMG

Scotts Miracle-Gro

Engages in the manufacture, marketing, and sale of products for lawn, garden care, and indoor and hydroponic gardening in the United States and internationally.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives