- United States

- /

- Chemicals

- /

- NYSE:SHW

Sherwin-Williams (NYSE:SHW) Partners With Paige Bueckers To Celebrate Radiant Lilac And Self-Expression

Reviewed by Simply Wall St

Sherwin-Williams (NYSE:SHW) has seen a 6% rise in its stock price over the past month, reflecting recent strategic moves in product innovation and market positioning. The introduction of the distinctive Radiant Lilac color aimed at promoting self-expression, coupled with a high-profile collaboration with Paige Bueckers, highlights the company's commitment to merging cultural trends with its offerings. While broader market concerns regarding global trade tensions with the EU negatively impacted many sectors, Sherwin-Williams' positive momentum may have helped counteract these pressures, indicating resilience within the company's strategic initiatives and market strategies.

We've spotted 2 possible red flags for Sherwin-Williams you should be aware of.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent introduction of the Radiant Lilac color and the collaboration with Paige Bueckers could bolster Sherwin-Williams' brand appeal, potentially influencing both revenue and earnings forecasts. These initiatives align with the company's focus on cultural trends, which may enhance market penetration and customer engagement. If successful, such initiatives could support revenue expansion by tapping into new consumer segments and boosting sales in existing markets. However, broader market challenges remain, including regulatory pressures and input cost inflation, which could offset some of these gains.

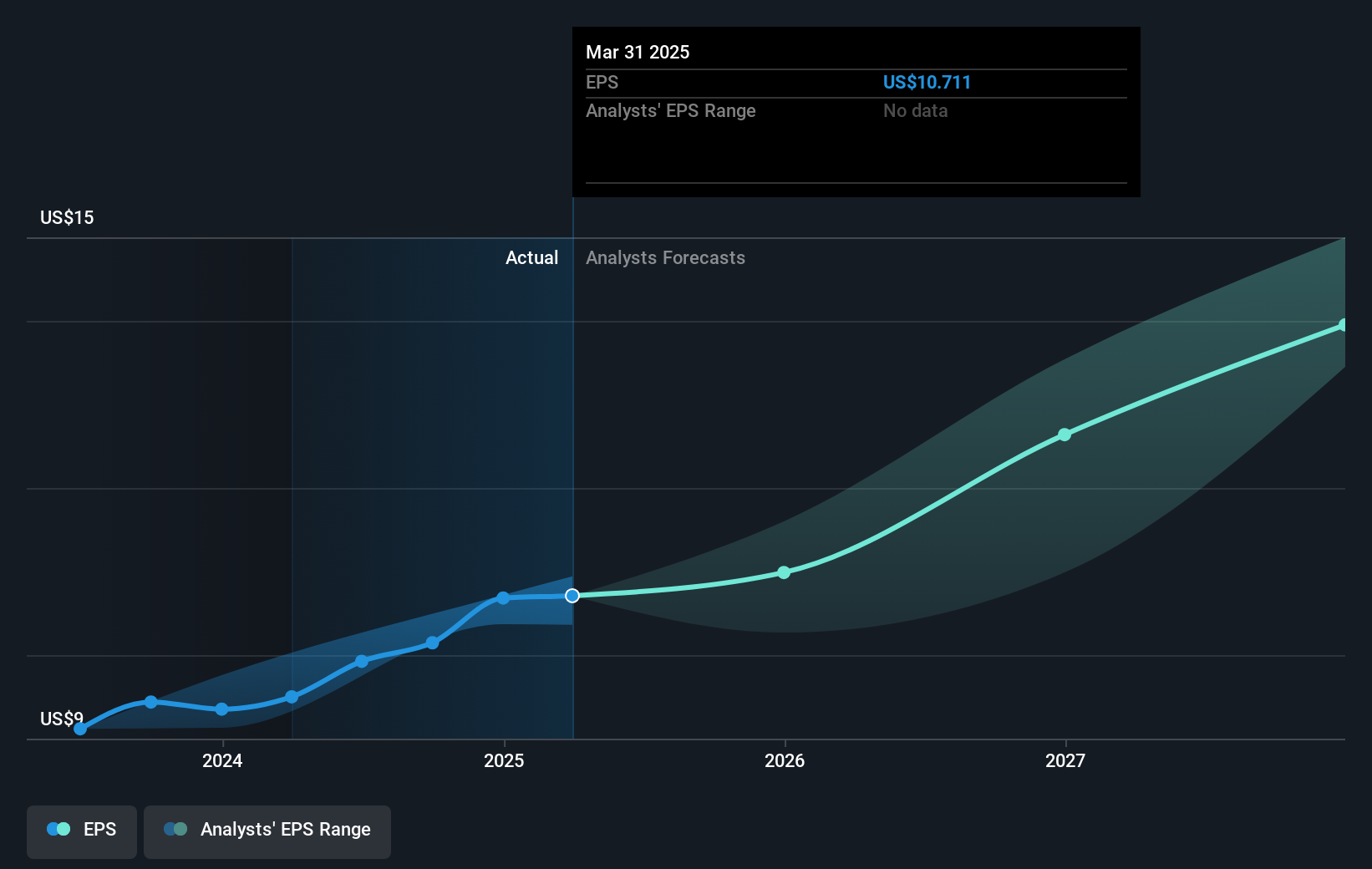

Over the past five years, Sherwin-Williams achieved a total shareholder return of 87.51%, reflecting a solid performance in terms of both share price and dividends. For the past year, the company's earnings growth of 10.9% surpassed the broader US market's return of 9.1%. In contrast, the US Chemicals industry has experienced a decline of 8.7%. While this short-term outperformance highlights Sherwin-Williams' resilience, it's essential to consider whether these results are sustainable in the face of ongoing market challenges.

Regarding the company's current share price of US$352.52, it trades at a discount to the analyst consensus price target of approximately US$377.75. This gap suggests that analysts expect further upside potential, provided the company can address risks and capitalize on growth opportunities. The news surrounding product innovation and strategic collaborations might serve as catalysts, supporting progress toward this target. Nonetheless, the underlying economic conditions and competitive pressures will ultimately play crucial roles in shaping long-term share performance.

Learn about Sherwin-Williams' historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SHW

Sherwin-Williams

Engages in the development, manufacture, distribution, and sale of paint, coatings, and related products to professional, industrial, commercial and retail customers.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives