- United States

- /

- Chemicals

- /

- NYSE:SHW

Analyzing Sherwin-Williams After Global Expansion Headlines and Recent Price Surge

Reviewed by Bailey Pemberton

Thinking about what to do with your Sherwin-Williams shares or considering jumping in for the first time? You are definitely not alone. Over the past year, investors have watched this paint giant’s stock move in ways that spark plenty of debate about its next big direction. The numbers provide a clear snapshot: Sherwin-Williams closed most recently at $354.45, posting a 4.7% return over the past week and a steady 3.7% rise in the last month. That performance is even more impressive when you consider its multi-year climb, with a gain of 62.0% in the past three years and 56.5% over five. However, there has been some turbulence, with the one-year return dipping slightly into the red at -1.2%.

So what is shaping the market’s view? Recent headlines have touched on the company’s strategy for global expansion and ongoing adjustments within the construction and housing sectors. While these stories have helped paint a fuller picture, there is also a growing sense among investors that the risk profile for Sherwin-Williams is evolving, especially as competitive pressures and shifting building demand create new questions around valuation.

With that in mind, let us dig into the heart of the matter: valuation. Based on a six-point checklist, Sherwin-Williams scores a 0, meaning the company does not currently appear undervalued on any of the major metrics we typically use. But numbers do not always tell the whole story. In the next section, we will break down each approach to valuation, and at the end, I have an even better way to cut through the noise and see what Sherwin-Williams might be truly worth.

Sherwin-Williams scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Sherwin-Williams Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the worth of a business by projecting how much cash it will generate in the future and then discounting those expected cash flows back to present value. In other words, it tries to answer the question, "How much is all of Sherwin-Williams’ future cash flow worth right now?"

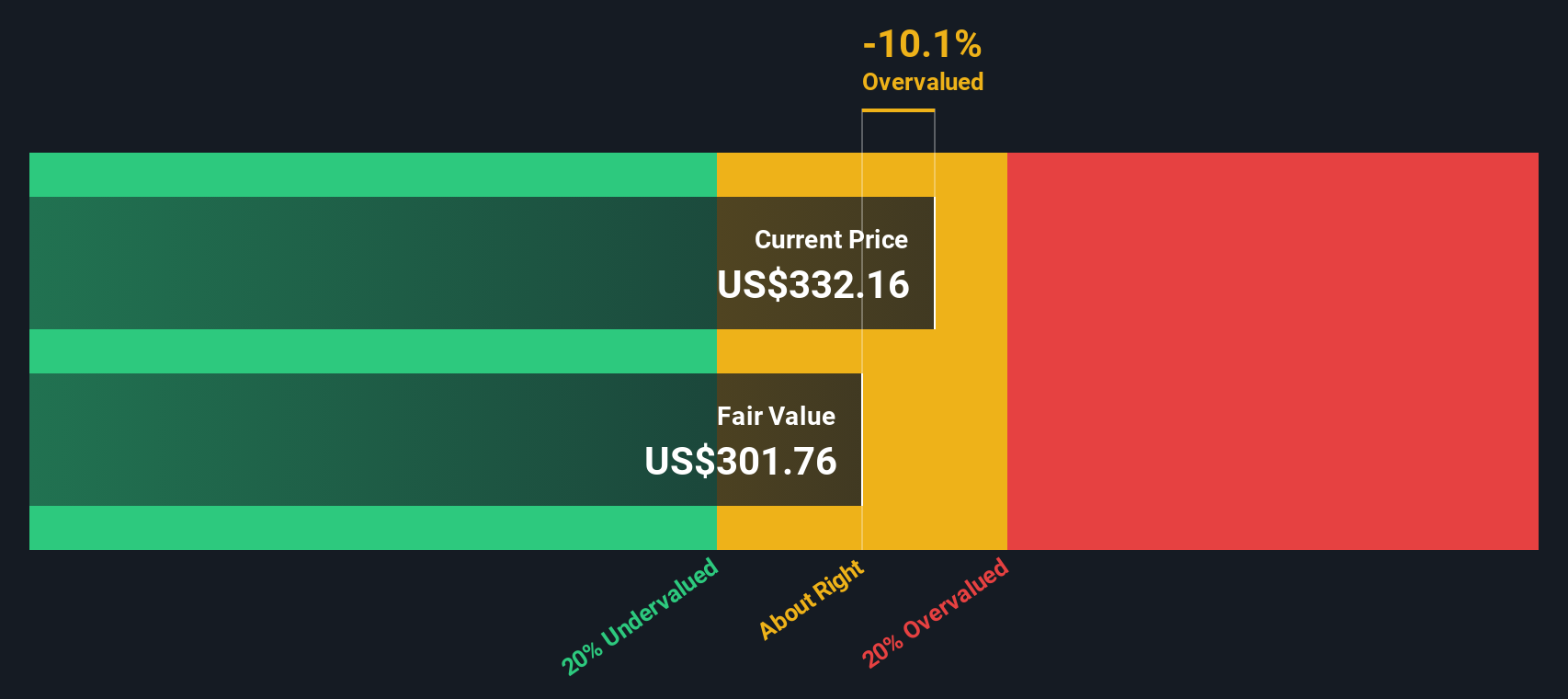

Based on the DCF model, Sherwin-Williams generated $2.15 billion in free cash flow (FCF) over the last twelve months. Analyst estimates project FCF to grow steadily, reaching $3.32 billion by 2028, with extended projections indicating FCF could surpass $3.79 billion ten years from now. These forecasts combine insights from several analysts for the first five years, and Simply Wall St’s gradual, data-driven extrapolations for the years after that.

The final result is that the model pegs Sherwin-Williams’ intrinsic value at $259.61 per share, which is roughly 36.5% below its current price of $354.45. This suggests that, at least by cash flow fundamentals, the stock appears overvalued rather than a bargain.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sherwin-Williams may be overvalued by 36.5%. Find undervalued stocks or create your own screener to find better value opportunities.

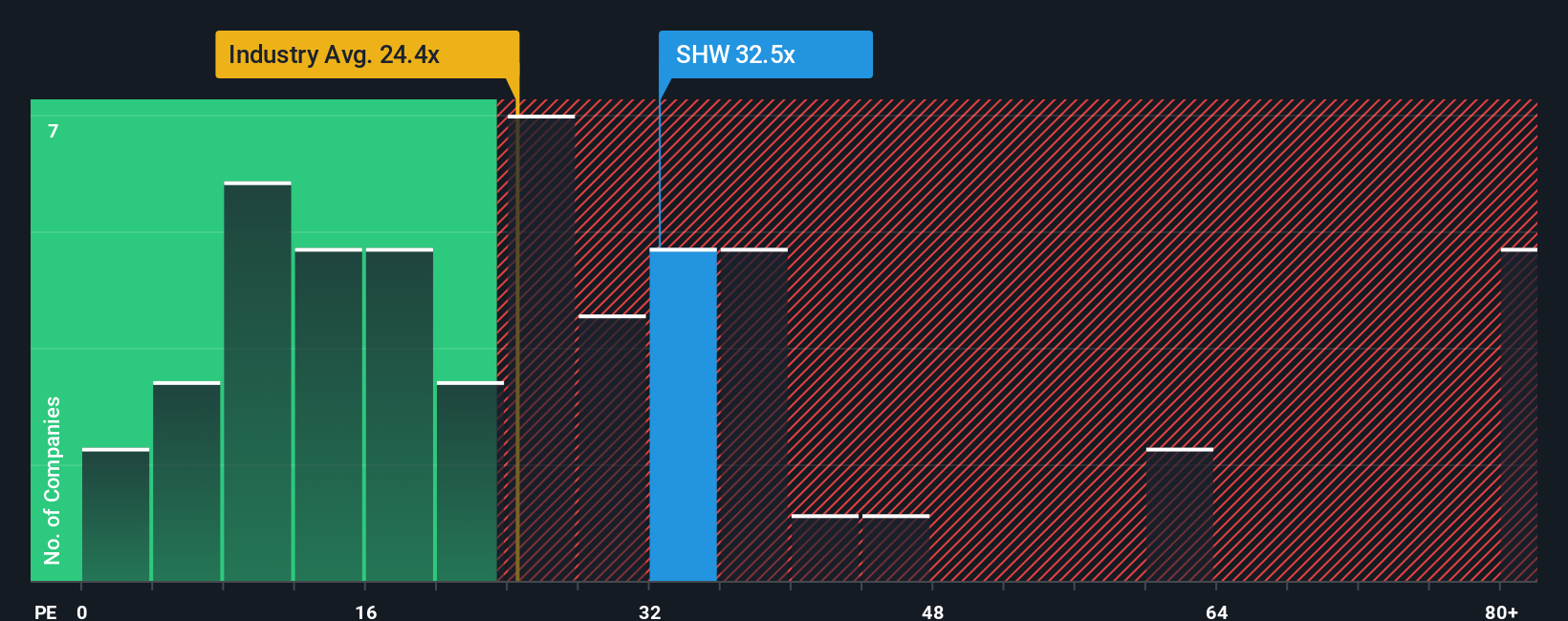

Approach 2: Sherwin-Williams Price vs Earnings (PE)

Among the many ways to value a profitable business, the price-to-earnings (PE) ratio remains one of the most popular metrics. It is straightforward; investors can see how much they are paying for each dollar of earnings, making it especially useful for established, consistently profitable companies like Sherwin-Williams.

However, not all PE ratios are created equal. Whether a PE ratio is high or low compared to "normal" depends on factors like future earnings growth, business risks, and how steady those earnings are. In general, faster growth or lower risk justifies a higher PE, while slow growth or more uncertainty pulls it lower.

Right now, Sherwin-Williams trades at a PE of 34.6x. That is noticeably higher than the chemicals industry average of 26.4x and the average across its peers at 22.5x. But what really matters is how all of Sherwin-Williams’ unique features—its growth prospects, profit margins, industry, risk profile, and size—stack up. This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio, in this case 24.3x, provides a more tailored benchmark, weighing all those critical factors together rather than just industry averages or peer groupings.

Comparing Sherwin-Williams’ actual PE to its Fair Ratio, we see a significant gap: the current PE of 34.6x is well above the 24.3x level modeled as fair. This suggests that, by earnings multiples, the stock is overvalued at the moment.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sherwin-Williams Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative brings the story you believe about Sherwin-Williams, whether it is bullish, cautious, or somewhere in between, directly into your investing by letting you pair your perspective on things like future revenue growth and profit margins with concrete financial forecasts and a fair value calculation.

Instead of relying just on past numbers or analyst targets, Narratives empower you to connect what you think is most likely to happen for this company with easy financial modeling. This approach shows how your assumptions translate into a fair value that can be directly compared to the current share price. Narratives are available on Simply Wall St's Community page, where millions of investors quickly draft, update, and share their views. This allows you to see a range of possibilities at a glance.

The best part is that Narratives automatically adapt when new financial results or news headlines are released, offering you a living, up-to-date outlook that helps you decide whether to buy, hold, or sell. For example, one Sherwin-Williams Narrative might forecast a fair value of $420 if you expect strong global growth and higher margins, while a more cautious view could see the fair value as low as $258. Whatever your outlook, Narratives help you act with greater confidence by tying your story directly to real investment signals.

Do you think there's more to the story for Sherwin-Williams? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SHW

Sherwin-Williams

Engages in the development, manufacture, distribution, and sale of paint, coatings, and related products to professional, industrial, commercial and retail customers.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives