- United States

- /

- Packaging

- /

- NYSE:SEE

Will Sealed Air’s (SEE) New CFO and Updated Guidance Reshape Its Long-Term Growth Strategy?

Reviewed by Simply Wall St

- Sealed Air Corporation recently announced its second quarter 2025 results, reporting net sales of US$1,335 million and issuing full-year sales guidance between US$5.10 billion and US$5.50 billion.

- An important development is the appointment of Kristen Actis-Grande as CFO, which marks a leadership change during a period of transition highlighted by updated earnings guidance and year-over-year performance comparisons.

- We'll now examine how Sealed Air's updated earnings guidance influences the company's investment narrative and long-term growth assumptions.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Sealed Air Investment Narrative Recap

Being a shareholder in Sealed Air means believing in its ability to counter volume and margin pressure from shifting consumer demand and industry cycles, particularly within its food packaging segment. The latest results and maintained full-year guidance suggest the immediate impact on the company's biggest catalyst, volume stabilization and margin support from innovation, appears limited, while the primary risk from weak protein market demand and persistent input cost challenges remains unchanged.

Among recent announcements, the appointment of Kristen Actis-Grande as CFO stands out. Her experience may offer stability during a period when Sealed Air needs disciplined financial execution to navigate ongoing margin compression and invest in growth initiatives, critical in a market where margin recovery is still uncertain.

By contrast, investors should be aware of ongoing risks to higher-margin food packaging volumes that may persist if...

Read the full narrative on Sealed Air (it's free!)

Sealed Air's outlook projects $5.7 billion in revenue and $540.5 million in earnings by 2028. This scenario is based on a 2.4% annual revenue growth rate, with earnings increasing by $241.1 million from the current $299.4 million.

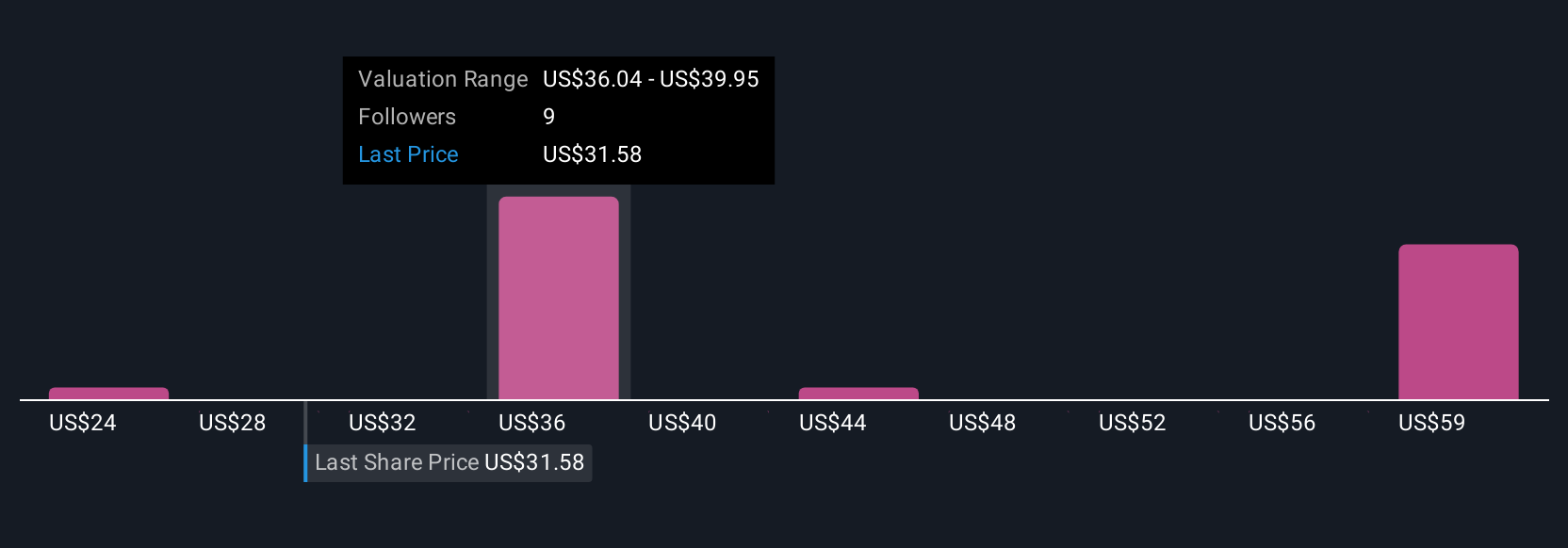

Uncover how Sealed Air's forecasts yield a $39.07 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Four individual fair value estimates from the Simply Wall St Community range from US$24.33 to US$64.72, highlighting sharply different expectations. With volume stabilization still uncertain due to industry headwinds, you can explore how varied investor views may impact sentiment and outcomes for Sealed Air stock.

Explore 4 other fair value estimates on Sealed Air - why the stock might be worth over 2x more than the current price!

Build Your Own Sealed Air Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sealed Air research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sealed Air research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sealed Air's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEE

Sealed Air

Provides packaging solutions in the United States and internationally, Europe, the Middle East, Africa, and Asia Pacific.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives