- United States

- /

- Metals and Mining

- /

- NYSE:SCCO

Will Upbeat Analyst Forecasts for Southern Copper (SCCO) Reshape Its Growth Narrative?

Reviewed by Sasha Jovanovic

- In recent days, Southern Copper has attracted heightened investor attention after analysts raised earnings estimates for the current quarter and coming years, following a streak of outperformance versus consensus expectations.

- This trend of upward revisions and consistent results has shone a spotlight on the company's operational momentum and growth outlook.

- We'll explore how strong analyst optimism and increased investor interest might influence Southern Copper's broader investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Southern Copper Investment Narrative Recap

To be a Southern Copper shareholder, you would typically need to believe in the company's ability to capitalize on global copper demand, execute its multi-billion dollar expansion plans, and sustain cost controls to protect margins. While recent upward earnings estimate revisions reflect operational momentum, they do not alter the main near-term catalyst: execution of growth projects and production increases. The principal risk remains external, macroeconomic factors like tariffs or trade tensions with China could weigh on copper demand and pricing; the immediate impact from the latest news is not material to that risk.

Of the recent company announcements, the October 2025 earnings report stands out as most relevant. The company posted increased year-over-year sales and net income for the third quarter, reinforcing analyst optimism about ongoing strong performance. This supports the case for continued earnings growth if copper market conditions remain favorable, but does not shift the central catalysts or risks around major project execution or exposure to trade policies.

Yet, despite the momentum, investors should be mindful that if trade tensions escalate and tariffs on U.S. imports are implemented, Southern Copper’s revenue could face significant pressure due to...

Read the full narrative on Southern Copper (it's free!)

Southern Copper is projected to reach $13.0 billion in revenue and $4.3 billion in earnings by 2028. This outlook assumes a 3.1% annual revenue growth and an increase in earnings of $0.7 billion from the current $3.6 billion.

Uncover how Southern Copper's forecasts yield a $117.76 fair value, in line with its current price.

Exploring Other Perspectives

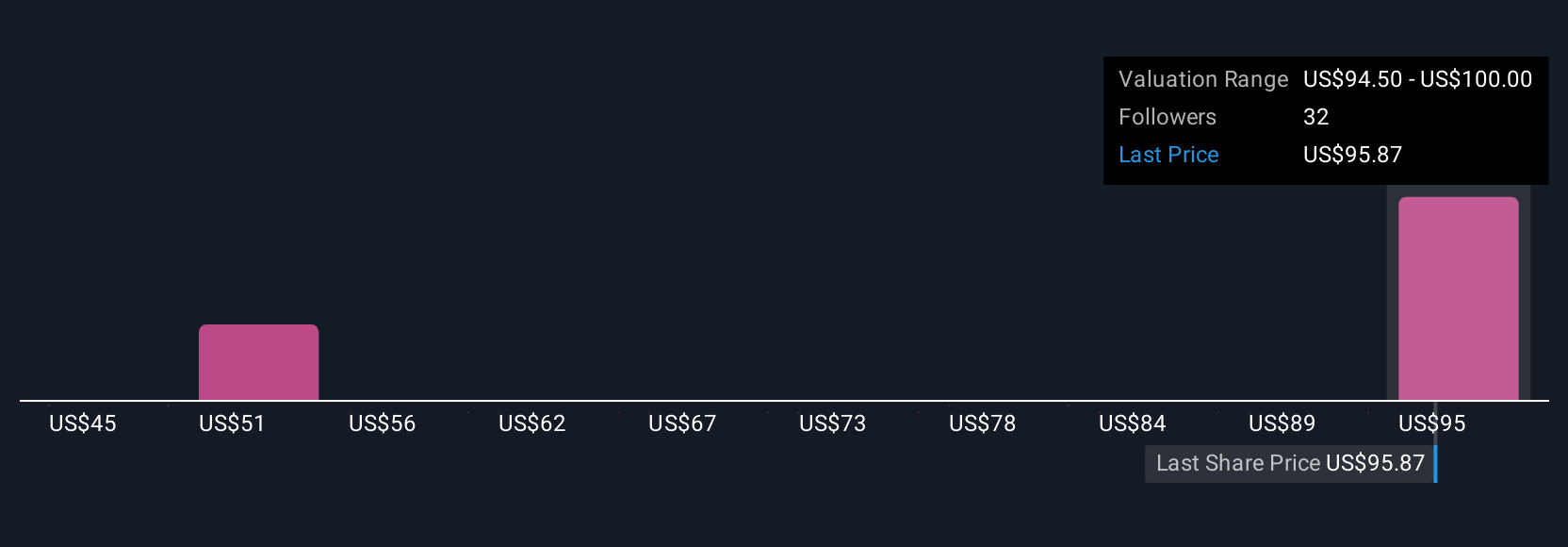

Four members of the Simply Wall St Community offered fair value estimates for Southern Copper, ranging from US$100 to US$126.80 per share. Investor sentiment is split, while external risks tied to tariffs and global trade tensions could play a key role in shaping business results, explore the range of viewpoints and see how your perspective measures up.

Explore 4 other fair value estimates on Southern Copper - why the stock might be worth as much as 6% more than the current price!

Build Your Own Southern Copper Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southern Copper research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Southern Copper research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southern Copper's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCCO

Southern Copper

Engages in mining, exploring, smelting, and refining copper and other minerals in Peru, Mexico, Argentina, Ecuador, and Chile.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives