- United States

- /

- Metals and Mining

- /

- NYSE:SCCO

Southern Copper (SCCO): Margin Expansion Reinforces Bullish Narrative Despite Slower Growth Outlook

Reviewed by Simply Wall St

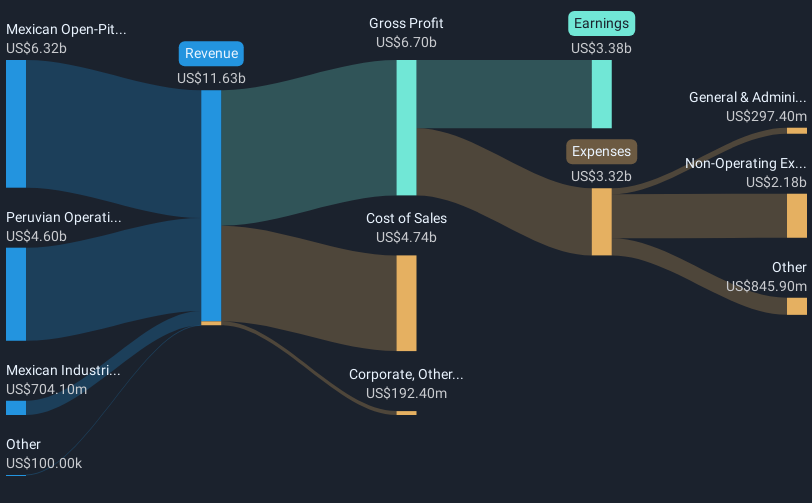

Southern Copper (SCCO) posted a net profit margin of 31% for the most recent period, up from last year's 27.7%, with annual earnings growth hitting 26.2% and outpacing the firm’s five-year average of 9.3%. Looking forward, earnings are projected to grow by 5.74% per year while revenue is expected to rise at 4.7% annually, both trailing the broader US market’s forecasts. This latest report underscores sustained high profitability, a steady upward margin trend, and a proven track record of profit growth.

See our full analysis for Southern Copper.The next section takes these results and puts them head-to-head with the current narratives, highlighting where the new numbers confirm expectations and where they push back against market assumptions.

See what the community is saying about Southern Copper

Capital Investments Set Stage for Growth

- Southern Copper has committed over $15 billion in capital investments, including projects across Mexico and Peru. These initiatives are positioning the company for material production gains in coming years.

- Analysts' consensus view indicates that these investments, together with operational efficiencies and tight copper market conditions, are expected to drive sustained margin and revenue improvement.

- With the Buenavista zinc concentrator now at full capacity, zinc production is anticipated to jump 31% in 2025, adding a significant boost to total revenues and margin expansion.

- Projects such as Tia Maria and Los Chancas are set to further raise production capacity beginning in 2027 and beyond, which is a key validation for those expecting continued top-line and bottom-line growth.

Consensus narrative highlights room for upside if these expansion projects deliver on schedule and market conditions remain favorable. 📊 Read the full Southern Copper Consensus Narrative.

Margin Expansion Outpaces Peers

- The company’s net profit margin rose to 31%, up from 27.7% last year, and is forecast to climb further to 33.3% in the next three years, exceeding typical industry gains.

- Consensus narrative underscores that while the broader US market expects stronger revenue and earnings growth rates at 10.4% and 16.1% annually, respectively, Southern Copper's ability to grow profit margins amid these slower top-line gains is a key competitive advantage.

- Operational efficiencies and controlled cash costs, projected between $0.75 and $0.80 per pound of copper by 2025, help support these wider margins even if revenue growth lags.

- This combination makes Southern Copper stand out for investors focused on profitability over absolute growth, especially when compared to industry peers.

Premium Valuation Limits Upside

- At a share price of $138.80, Southern Copper trades above both the consensus analyst price target of $118.88 and its DCF fair value of $137.76. This suggests a premium to even optimistic future earnings trajectories.

- Consensus narrative notes that this gap is meaningful, given that the company’s price-to-earnings ratio is higher than both industry and peer averages. This indicates that current profitability and anticipated margin expansion are largely priced in.

- The narrow difference between the current price and fair value indicates potential for limited upside unless new catalysts emerge, which could temper expectations for near-term returns.

- Nevertheless, persistent high margins continue to support a fundamental premium over peers, even as future price appreciation appears more constrained.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Southern Copper on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? In just a few minutes, you can shape your insights into your own narrative. Do it your way.

A great starting point for your Southern Copper research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Southern Copper’s premium valuation means that future share price gains could be limited if new catalysts do not emerge or if growth does not accelerate beyond market expectations.

If you’re looking for more attractive entry points, check out these 840 undervalued stocks based on cash flows to find companies the market may have overlooked and where upside potential still exists.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCCO

Southern Copper

Engages in mining, exploring, smelting, and refining copper and other minerals in Peru, Mexico, Argentina, Ecuador, and Chile.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives