- United States

- /

- Chemicals

- /

- NYSE:PRM

Will Lower Revenue Forecasts Reveal Deeper Challenges in Perimeter Solutions' (PRM) Growth Outlook?

Reviewed by Sasha Jovanovic

- Perimeter Solutions Inc is expected to report a 17.4% decrease in revenue to US$238.27 million for the quarter ending September 30, 2025, with forecasted earnings of 68 cents per share.

- This projection points to a significant year-over-year earnings decline that has drawn particular attention from investors ahead of the results.

- Next, we'll explore how the anticipated decline in quarterly revenue informs Perimeter Solutions' investment narrative moving forward.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Perimeter Solutions' Investment Narrative?

For anyone considering a position in Perimeter Solutions, the big-picture investment thesis centers on the company's ability to expand in the wildfire safety and suppression market through strategic contracts, operational upgrades, and specialized product launches. The recently projected 17.4% revenue drop and sharper earnings decline for the September quarter mark a departure from prior momentum and may temper enthusiasm around short-term catalysts like the new USDA partnership and the expanded share buyback program. If these one-off results are tied to timing issues or temporary market factors, they may not heavily disrupt the longer-term growth story, which still benefits from increased government focus on firefighting capabilities. However, this setback raises questions about earnings volatility and whether Perimeter’s position in a slower-growing sector could leave it more vulnerable to demand shifts, cost pressures, or contract-driven lulls. Investors will likely focus on management’s commentary this quarter for signals about whether the risks to near-term results have become more pronounced.

Yet, beyond the headline revenue drop, potential cost pressures are also shaping up as a key concern for shareholders.

Exploring Other Perspectives

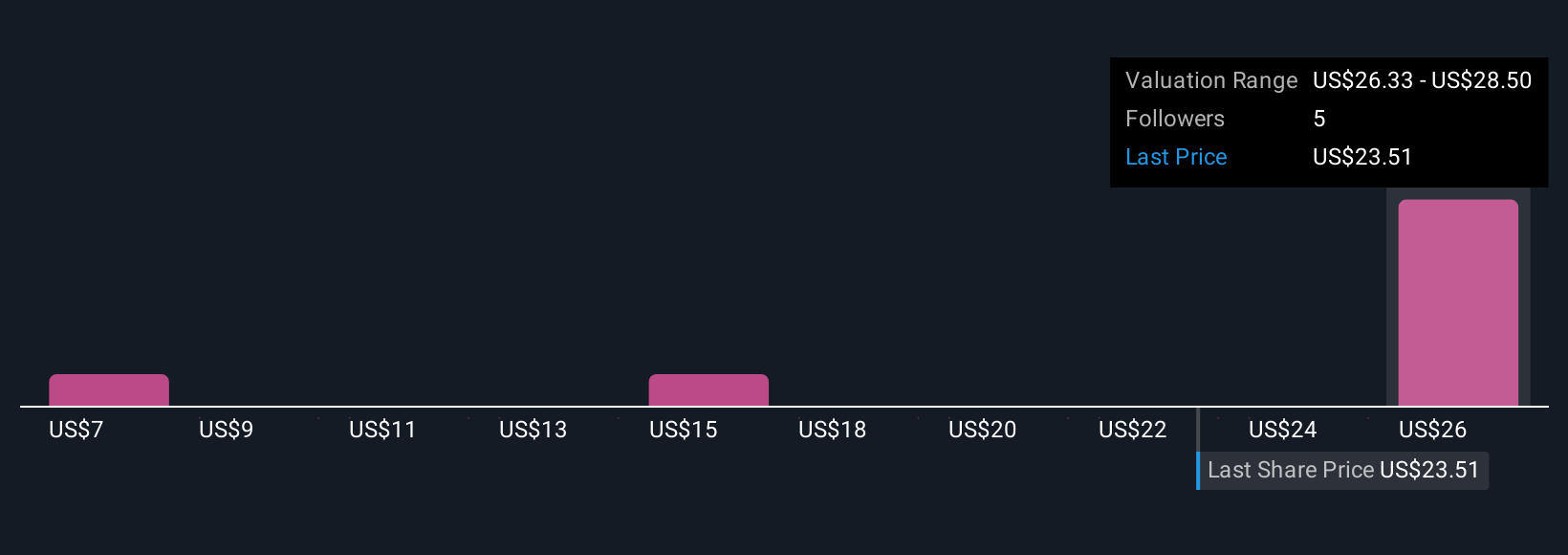

Explore 4 other fair value estimates on Perimeter Solutions - why the stock might be worth over 4x more than the current price!

Build Your Own Perimeter Solutions Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Perimeter Solutions research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Perimeter Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Perimeter Solutions' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRM

Perimeter Solutions

Manufactures and supplies firefighting products and lubricant additives in the United States, Germany, and internationally.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives