- United States

- /

- Packaging

- /

- NYSE:PKG

Will PKG’s Mixed Earnings Signal a Shift in Its Long-Term Profitability Narrative?

Reviewed by Sasha Jovanovic

- Packaging Corporation of America recently reported its third quarter 2025 results, posting sales of US$2,313.4 million and basic earnings per share from continuing operations of US$2.52, alongside issuing fourth quarter earnings guidance of US$2.40 per share, excluding special items.

- While quarterly sales increased over the prior year, net income saw a slight decrease, offering a nuanced view of profitability that adds context to the company's forward-looking guidance.

- Given this new guidance and earnings update, we'll explore how the company's forward outlook may influence its ongoing earnings growth narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Packaging Corporation of America Investment Narrative Recap

For someone considering Packaging Corporation of America, it's important to believe in the resilience of its packaging business amid economic uncertainty and fluctuating demand. The latest third quarter results and conservative fourth quarter guidance reflect ongoing operational execution, but do not materially change the key short-term catalyst: the ability to maintain shipment volumes and pricing power. The biggest risk remains the potential impact of rising operational costs and inflationary pressures on net margins, a factor that this quarter’s flat-to-lower profitability brings to the forefront.

The company's recent declaration of a quarterly US$1.25 per share dividend stands out, maintaining a consistent payout despite evolving market challenges. With profit margins and earnings growth facing pressure from higher costs, such announcements may assure shareholders seeking income stability, even as the business works to offset cost headwinds and support earnings performance. But with cost pressures persisting, there’s an important detail that’s often overlooked…

Read the full narrative on Packaging Corporation of America (it's free!)

Packaging Corporation of America's outlook anticipates $9.5 billion in revenue and $1.1 billion in earnings by 2028. This scenario is based on analysts' assumptions of 3.2% annual revenue growth and an earnings increase of approximately $200 million from the current $898.4 million.

Uncover how Packaging Corporation of America's forecasts yield a $224.90 fair value, a 14% upside to its current price.

Exploring Other Perspectives

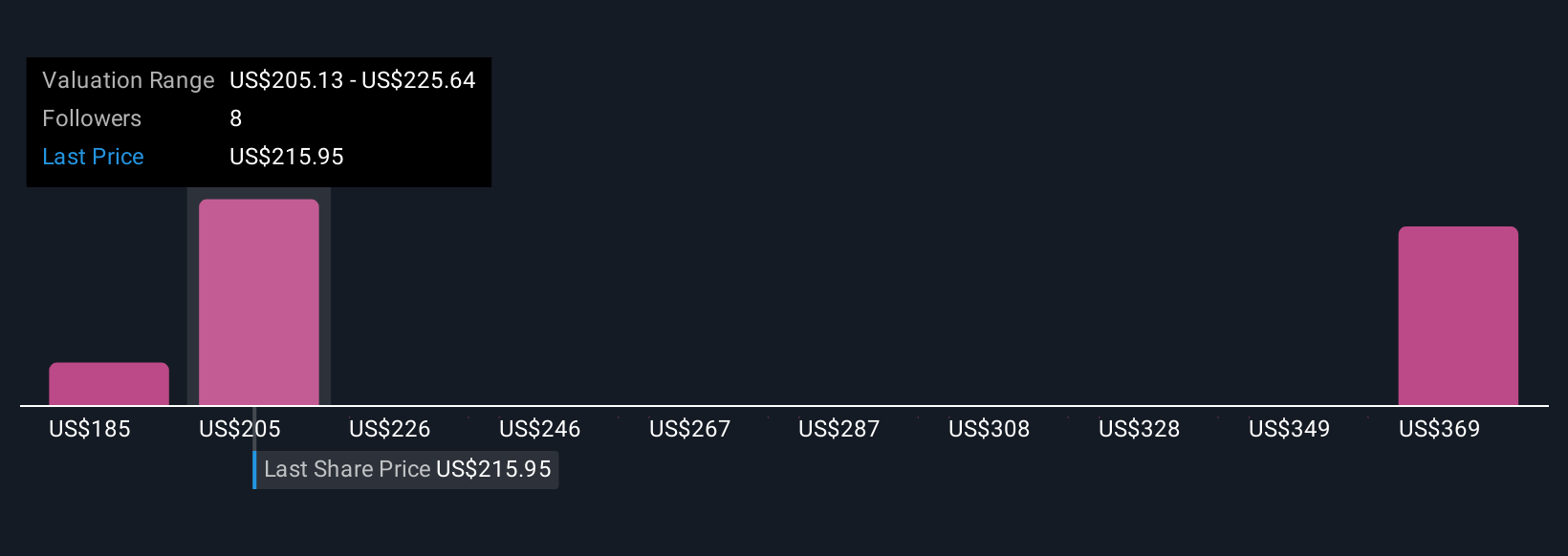

Four member fair value estimates from the Simply Wall St Community range widely from US$184.63 to US$409.35 per share. While many see possible upside, ongoing cost inflation and margin pressure remain crucial for you to consider when assessing long-term potential, see how these factors weigh into differing outlooks.

Explore 4 other fair value estimates on Packaging Corporation of America - why the stock might be worth over 2x more than the current price!

Build Your Own Packaging Corporation of America Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Packaging Corporation of America research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Packaging Corporation of America research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Packaging Corporation of America's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PKG

Packaging Corporation of America

Manufactures and sells containerboard and uncoated freesheet (UFS) paper products in North America.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives