- United States

- /

- Packaging

- /

- NYSE:PKG

Is Packaging Corporation of America Poised for a Rebound After Recent Share Price Drop?

Reviewed by Bailey Pemberton

- Wondering if Packaging Corporation of America is a bargain or priced for perfection? Let’s dive into what really matters when it comes to valuing the stock.

- The stock has seen a 1.3% bump in the last week, but it is still down 6.5% over the past month and 11.6% year to date, so there has been plenty of action for investors to digest.

- Recent headlines have focused on supply chain improvements across the packaging industry, along with reports of steadily rising demand in e-commerce packaging. These factors have fueled speculation about the company’s potential to bounce back from recent share price declines.

- To summarize, Packaging Corporation of America scores a 4 out of 6 on our valuation checks. We will walk through the usual valuation models next, but stick around, as we will finish with an even more insightful way to size up the company’s value.

Approach 1: Packaging Corporation of America Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting them back to today's dollars, reflecting the time value of money. This approach is widely used because it focuses on the fundamental earnings power of a business over time.

For Packaging Corporation of America, the current Free Cash Flow stands at $634.5 Million. Analyst forecasts predict steady growth, with cash flows projected to rise to $1.4 Billion by 2029. Beyond that period, Simply Wall St extrapolates ten-year forecasts and shows consistent increases and a positive trajectory for the company's future earnings potential. All cash flow figures are reported in USD.

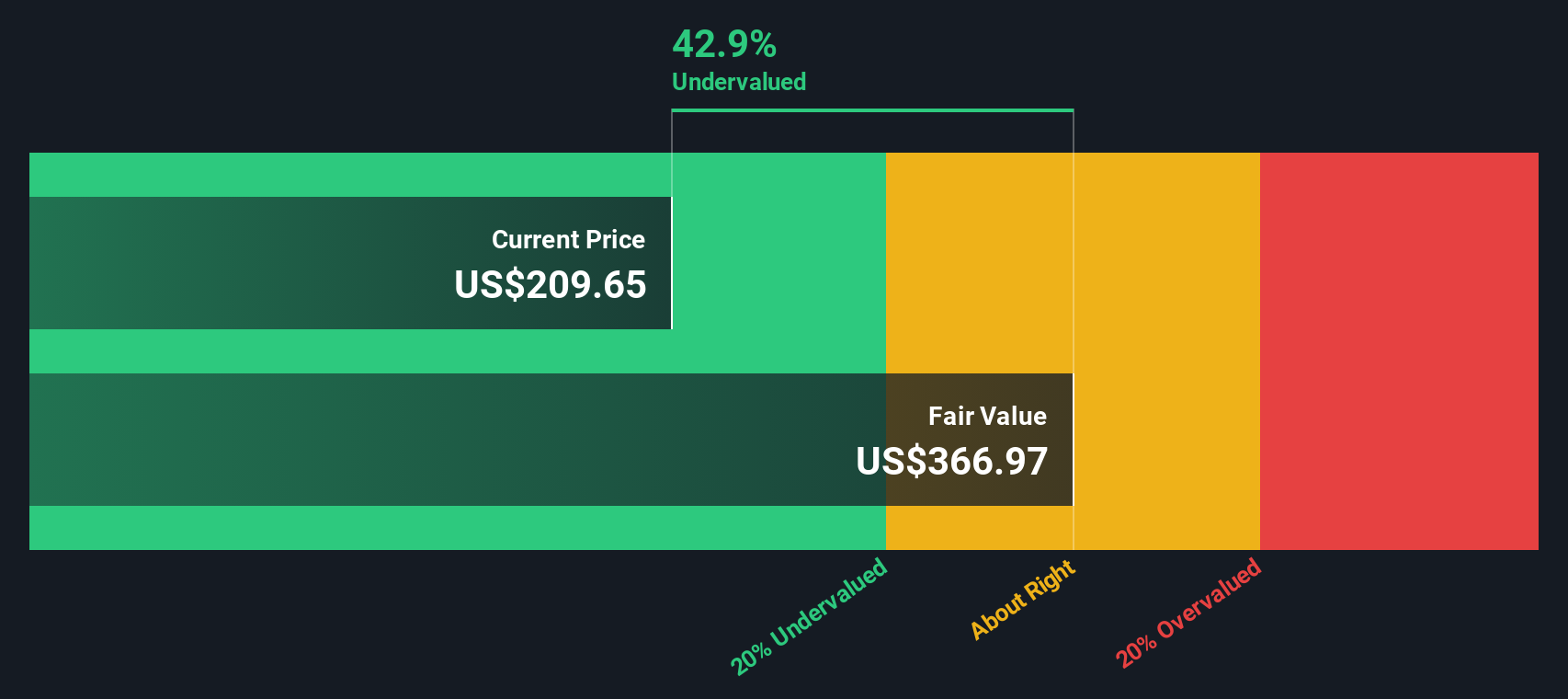

The DCF analysis assigns Packaging Corporation of America an intrinsic value of $408.93 per share. Given the current share price, this implies the stock is trading at a 51.3% discount to its estimated fair value, which indicates it is significantly undervalued according to this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Packaging Corporation of America is undervalued by 51.3%. Track this in your watchlist or portfolio, or discover 849 more undervalued stocks based on cash flows.

Approach 2: Packaging Corporation of America Price vs Earnings

The Price-to-Earnings (PE) ratio is a commonly used valuation tool for profitable companies like Packaging Corporation of America. This metric shows how much investors are willing to pay for each dollar of current earnings, helping to assess whether a stock is reasonably valued in light of its profit performance.

The right PE ratio for a company is influenced by expectations for future growth and the perceived risks in its business. Companies with higher forecasted earnings growth or lower risk typically justify higher PE multiples, while more mature or riskier businesses may trade at a discount.

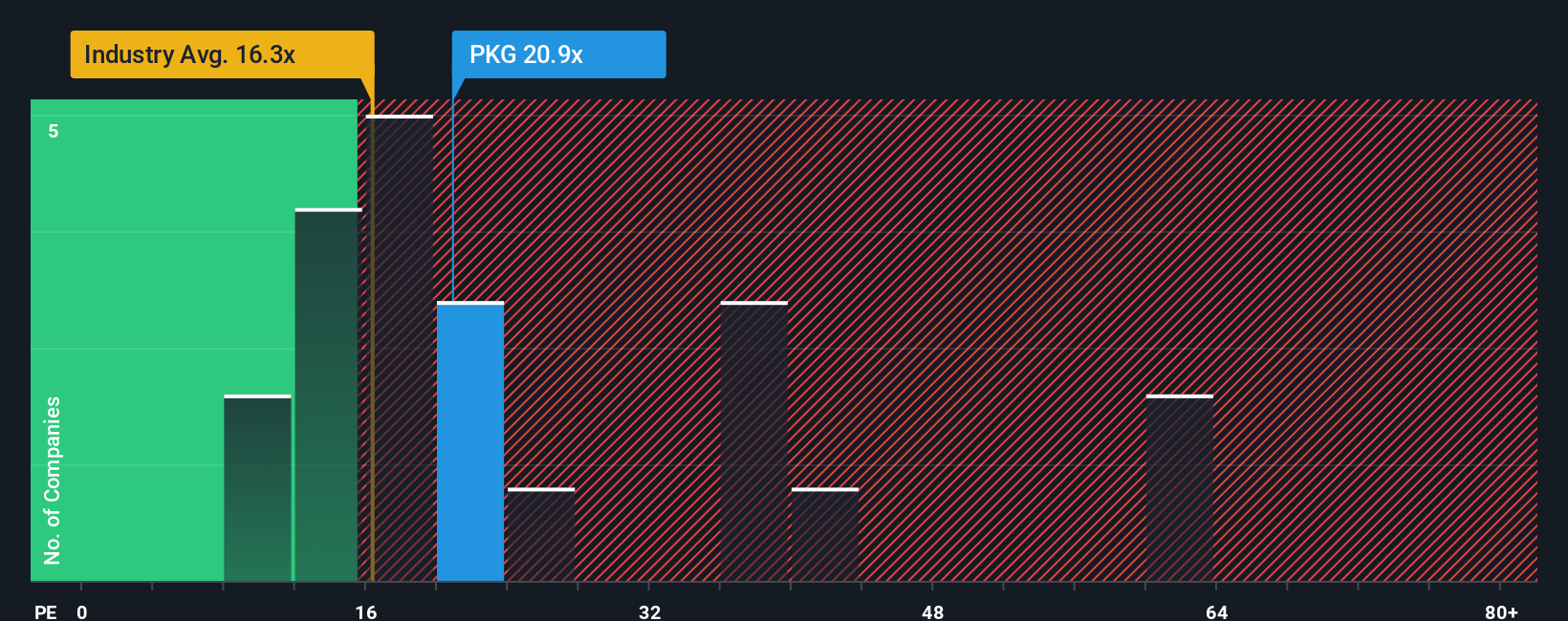

Packaging Corporation of America currently trades at a PE ratio of 20.05x. This is higher than the Packaging industry average of 16.27x but lower than the average of its direct peers, which sits at 23.65x. This suggests investors expect the company to outperform the broader industry but perhaps trail behind some closest rivals in earnings growth.

Simply Wall St's proprietary “Fair Ratio” method takes a broader view, estimating that a fair PE for the company should be 21.33x. Unlike industry or peer averages, the Fair Ratio accounts for Packaging Corporation of America’s specific earnings growth prospects, industry positioning, profit margins, company size and risks. This provides a more tailored benchmark for whether the stock is attractively valued.

With its actual PE ratio of 20.05x just below the Fair Ratio, Packaging Corporation of America appears to be valued about right by the market based on this multiple.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Packaging Corporation of America Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal investment story that connects what you believe about a company, such as its future revenue, earnings, and margins, with a clear financial forecast and ultimately, an estimated fair value.

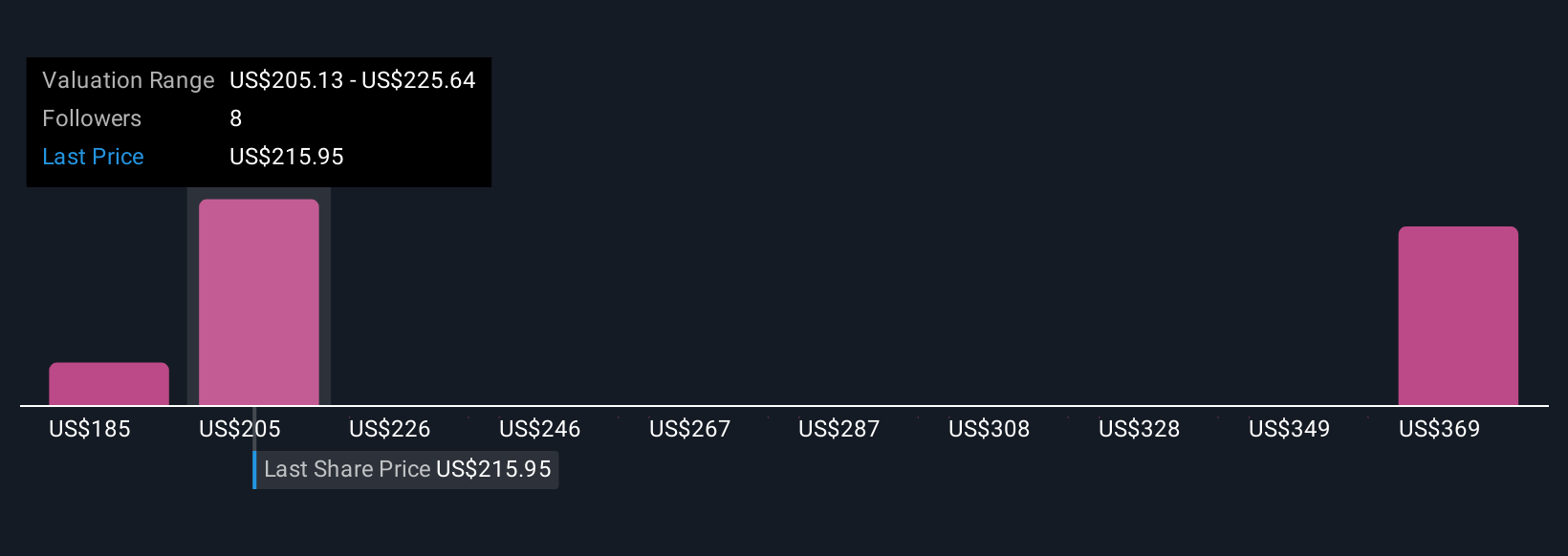

Narratives bridge the gap between the numbers and your unique perspective, making it much easier to see how your expectations might play out against current share prices. On Simply Wall St’s Community page, millions of investors create and share Narratives, updating them live as new company results or industry news arrives. This way, your view is always current with market events.

Using Narratives, you can quickly see if your fair value suggests it is time to buy, hold, or sell, because you are comparing your outlook with the market in real time. For example, some Packaging Corporation of America investors see strong execution on new plant efficiency and price increases as supporting a bullish $244 per share target. Others may worry about industry uncertainty and set a more conservative target around $152 per share. By creating your own Narrative, you decide which story and numbers make sense for your investment approach.

Do you think there's more to the story for Packaging Corporation of America? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PKG

Packaging Corporation of America

Manufactures and sells containerboard and uncoated freesheet (UFS) paper products in North America.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives