- United States

- /

- Packaging

- /

- NYSE:PACK

Ranpak Holdings (PACK): Losses Deepen, Undermining Value Narrative Despite Low Price-to-Sales Ratio

Reviewed by Simply Wall St

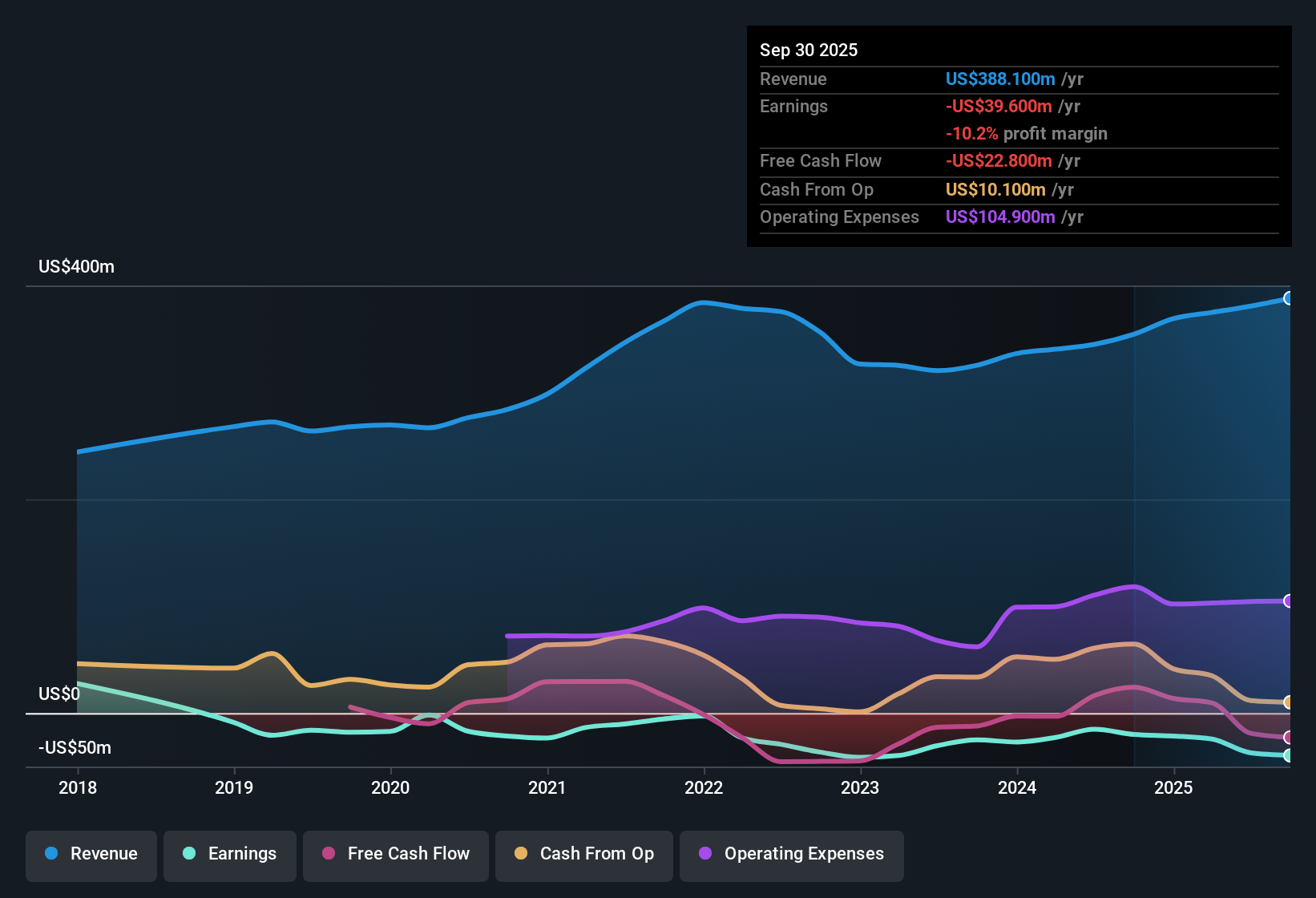

Ranpak Holdings (PACK) remains in the red, posting losses that have grown at an annual rate of 10.8% over the past five years. Looking ahead, the company is expected to stay unprofitable for at least three more years, while revenue is forecast to rise at a modest 8.3% annually. This is slower than the US market’s 10.3% pace. Despite trading at a strong value versus peers by Price-To-Sales Ratio (1x compared to 5.2x), profitability continues to lag and net margins have shown no improvement over the past year, leaving investors grappling with ongoing operational losses.

See our full analysis for Ranpak Holdings.The next section takes these headline results and puts them head-to-head with the most widely debated narratives about Ranpak, highlighting where the numbers reinforce or challenge what investors believe.

See what the community is saying about Ranpak Holdings

Margin Compression: 540 Basis Points Down in Q2

- Gross margin fell by 540 basis points year over year in Q2, reflecting headwinds from higher input costs and inefficient operations. These factors are not being offset by pricing or mix benefits.

- Consensus narrative raises concerns that these margin pressures, if persistent, could become structural and impact the long-term profit outlook.

- Ongoing North American inefficiencies and Asia-Pacific demand uncertainty increase the risk that margins may not recover as automation ramps up.

- Analysts agree that failure to stabilize margins could undermine recurring sales benefits from recent automation investments.

Heavily Leveraged at 4.6x Net Leverage

- With net leverage at 4.6x on a last twelve months basis, Ranpak faces elevated debt levels that restrict financial flexibility for investment and growth.

- Consensus narrative points out that if leverage stays high, Ranpak may struggle to fund new contracts or navigate disruptions.

- Carrying higher-than-expected inventory ties up cash and increases sensitivity to market or supply chain shocks. This compounds the impact of leverage.

- In the long term, the company will need to improve cash flow to reduce debt and unlock capital for strategic initiatives.

Price-to-Sales: Value Standout or Industry Premium?

- Ranpak trades at a Price-To-Sales ratio of 1x, a significant discount to the peer average of 5.2x, but actually a premium to the broader US packaging industry's average.

- Analysts' consensus view is that the current share price of $4.63 sits notably below the $7.17 target. However, persistent operating losses and slower-than-market revenue growth could delay the expected rerating.

- The attractive peer-relative valuation is tempered by ongoing unprofitability and margin challenges, which may limit upside until trends reverse.

- Consensus acknowledges the value case but signals that patience is needed as investors wait for tangible improvement in core metrics.

See how new contract wins and industry shifts could reshape Ranpak's story according to Wall Street analysts. 📊 Read the full Ranpak Holdings Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ranpak Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot an opportunity or view the data in a new light? Share your unique take and build your own narrative in just minutes. Do it your way

A great starting point for your Ranpak Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Ranpak’s high leverage, shrinking margins, and persistent losses highlight serious balance sheet constraints and limited financial flexibility.

If you’re concerned about these vulnerabilities, consider strengthening your portfolio with solid balance sheet and fundamentals stocks screener (1986 results) offering companies built on stronger fundamentals and lower debt.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PACK

Ranpak Holdings

Provides product protection solutions and end-of-line automation solutions for e-commerce and industrial supply chains in North America, Europe, and Asia.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives