- United States

- /

- Chemicals

- /

- NYSE:OLN

Olin (OLN): Evaluating Valuation After Q3 Profit Rebound and Renewed Share Buybacks

Reviewed by Simply Wall St

Olin (OLN) grabbed market attention after swinging to a net profit in its third quarter, reversing last year's loss. The company also continued share buybacks, which signals operational and capital allocation changes in recent months.

See our latest analysis for Olin.

Olin’s turnaround story has attracted attention after the company returned to profit and continued its share buyback strategy, but the market’s enthusiasm has tempered. The latest 1-day share price return of 1.46% offered a brief bounce; yet even with the recent earnings beat, Olin’s share price remains down 42% year-to-date and its 1-year total shareholder return has slumped nearly 55%. Momentum is still shaky as the longer-term performance has yet to recover, despite isolated positive sessions.

If you’re weighing your next investment move, this could be the perfect moment to widen your search and discover fast growing stocks with high insider ownership

With Olin’s shares trading at a sizable discount to analyst targets despite the recent earnings rebound, investors are left to wonder if the stock is truly undervalued or if the market is already reflecting all the future growth prospects.

Most Popular Narrative: 21.6% Undervalued

Compared to Olin’s last close at $19.40, the most widely followed narrative assigns a much higher fair value. This gap sets up a debate around whether the market is missing key future catalysts.

Structural cost reduction initiatives (Beyond250 and Epoxy cost optimization) are expected to deliver significant operational savings, yielding an estimated $70 to $90 million run-rate benefit by the end of 2025 and additional structural cost reductions from the Stade, Germany facility in 2026. This should improve net margins and boost earnings quality.

Want to know what’s powering this bold valuation call? The narrative hinges on an aggressive shift in profit margins, steady revenue growth, and a transformation in Olin’s core business mix. Curious about which numbers tip the scales so far above today’s market price? Find out what ambitious projections support this valuation and see if you agree with the optimism.

Result: Fair Value of $24.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent global overcapacity and intense international competition could quickly undermine Olin’s margin recovery and put long-term earnings growth at risk.

Find out about the key risks to this Olin narrative.

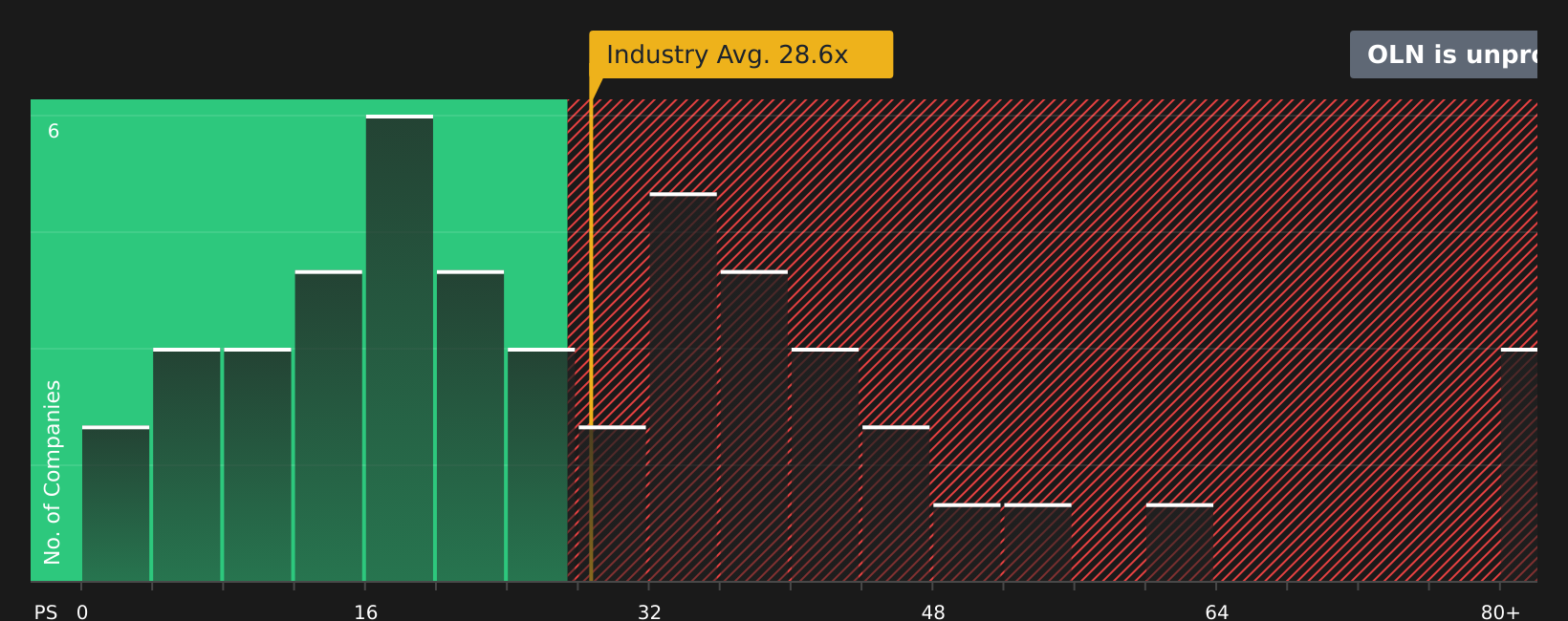

Another View: Market Multiples Tell a Different Story

While the narrative-supported fair value suggests Olin is undervalued, a quick check against market ratios tells a more cautious tale. Olin’s price-to-earnings ratio sits at 41.3x, which is much pricier than the US Chemicals industry average of 23x, and even higher than its peer average of 15.2x. For context, the market’s fair ratio for Olin could be closer to 53.6x, but the current gap implies a valuation risk if results fall short or market sentiment turns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Olin Narrative

If you think there’s more to the story or want to see the numbers for yourself, it only takes a few minutes to craft your own perspective. Do it your way

A great starting point for your Olin research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take control of your next market move and make sure you’re not missing out on fresh opportunities beyond Olin. Get inspired with these handpicked stock ideas:

- Get ahead of the curve as artificial intelligence changes every sector. Tap into potential with these 24 AI penny stocks that are shaping tomorrow's innovations now.

- Secure your portfolio with powerful income plays and reliable yields. Start with these 16 dividend stocks with yields > 3% designed for long-term stability and growth.

- Step into the future of finance and technology by checking out these 82 cryptocurrency and blockchain stocks leading the charge in digital transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OLN

Olin

Manufactures and distributes chemical products in the United States, Europe, Asia Pacific, Latin America, and Canada.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives