- United States

- /

- Chemicals

- /

- NYSE:OEC

Orion (OEC): $59.3M One-Off Loss Challenges Margin Recovery Narrative

Reviewed by Simply Wall St

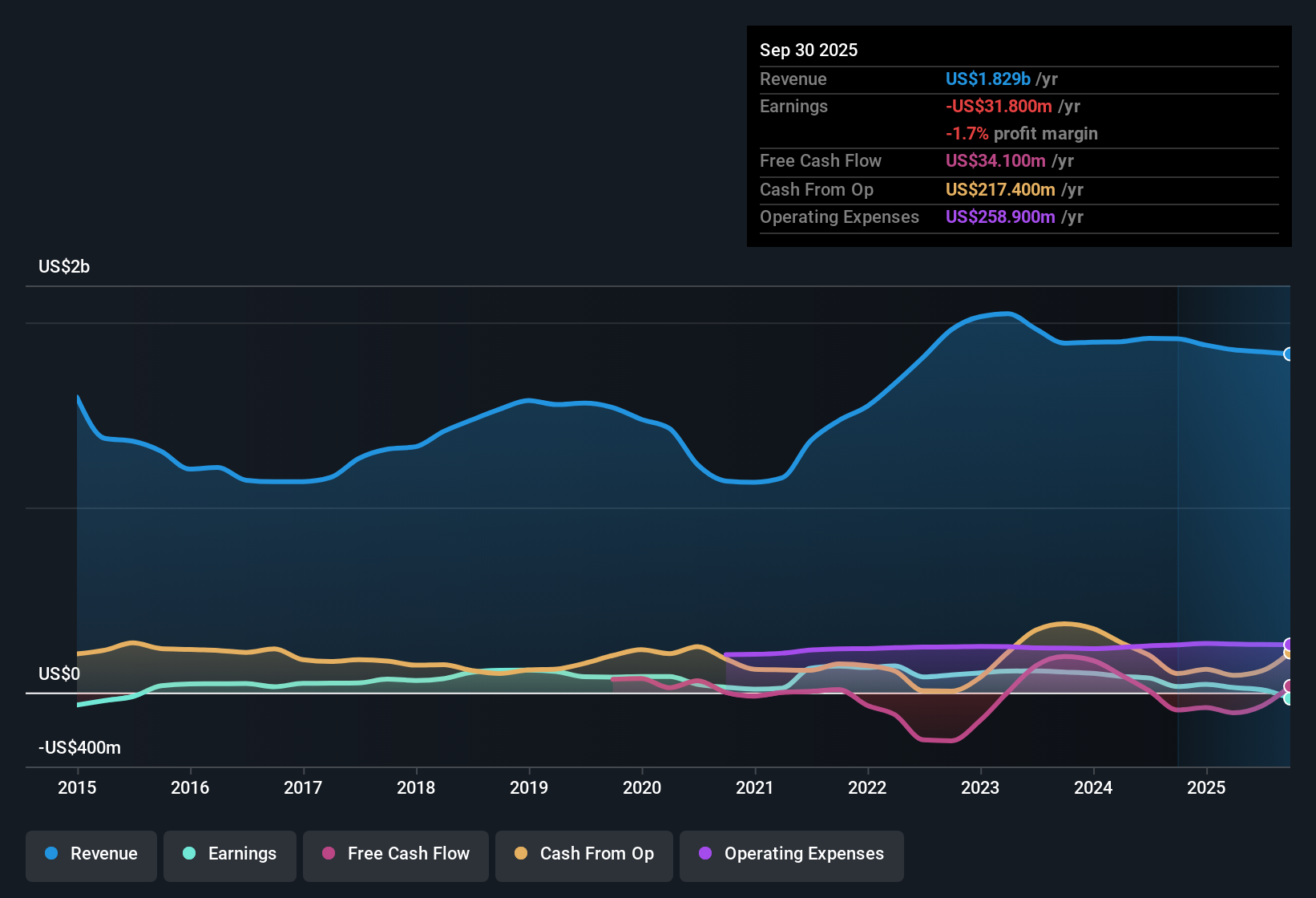

Orion (OEC) reported revenue growth forecasts of 3.5% per year, trailing well behind the US market’s anticipated 10.5% annual growth. Net profit margins have narrowed to 0.8%, down from 4.1% last year, while the company’s earnings have declined by an average of 8.4% per year over the past five years. The latest results were also hit by a significant one-off loss of $59.3 million, making it a tougher read for investors focused on underlying profitability.

See our full analysis for Orion.Next up, we will see how these headline numbers measure up against the dominant narratives shaping expectations for Orion. This will highlight where the data supports the story and where it pushes back.

See what the community is saying about Orion

P/E Sits Below Industry Averages

- Orion’s Price-To-Earnings Ratio stands at 16.7x, below both its peer average of 17.8x and the broader US Chemicals industry average of 26.4x.

- Analysts’ consensus view calls out Orion’s discounted valuation and expects future margin recovery, with

- a projected profit margin rise from 1.4% today to 7.8% in three years, and

- an anticipated earnings increase from $26.6 million to $155.2 million by August 2028.

- To align with the consensus price target of $9.10, Orion would need to achieve these growth benchmarks, a step up from recent trends.

Analysts think these value gaps could close sharply if margin expansion materializes as predicted. See how the consensus narrative unpacks the upside and debate. 📊 Read the full Orion Consensus Narrative.

One-Off Loss Distorts Underlying Profit

- The latest results include a $59.3 million one-off loss, which significantly outweighs ongoing net profits and muddies the picture for underlying earnings quality.

- Analysts’ consensus view highlights that, despite recent setbacks, completion of debottlenecking projects in the Specialty segment and operational improvements in China are expected to restore plant reliability and drive profit margins higher.

- This narrative leans on sustainability and innovation as differentiators in the carbon black market, projecting a competitive edge as cost efficiency improves by 2025.

- However, any repeat of similar non-recurring charges could postpone the anticipated recovery, suggesting that near-term results remain volatile even with longer-term optimism.

Dividends, Margins, and Risks Still in Focus

- Risks flagged include ongoing margin decline, unsustained dividends, and the challenge of delivering high-quality earnings in the face of non-recurring losses.

- Analysts’ consensus narrative stresses that weak demand in the Rubber segment and unfavorable currency exchanges could drag on performance, but expects capital expenditure to taper post-2025, freeing up cash flow for share buybacks.

- Any slippage in volume recovery or failure to move into higher-margin products would directly pressure these improvements.

- Shifts in supply chains and the trade-down effect among tire customers will also be key risks to monitor over the next cycle.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Orion on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot an opportunity or read the data another way? Turn that insight into your own story in just a few minutes. Do it your way.

A great starting point for your Orion research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

Explore Alternatives

Orion’s earnings face pressure from shrinking margins, volatile one-off charges, and challenges sustaining dividend payouts in a tough operating environment.

If you’re looking for steadier returns and fewer surprises, target companies with a track record of reliable payouts and healthier yields through these these 1969 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OEC

Moderate risk and good value.

Similar Companies

Market Insights

Community Narratives