- United States

- /

- Metals and Mining

- /

- NYSE:NUE

GuruFocus’s High Score for Nucor (NUE) Might Change the Case for Investing in the Steel Giant

Reviewed by Sasha Jovanovic

- GuruFocus recently assigned Nucor Corp a GF Score of 94 out of 100, highlighting the company’s strong financial health, robust balance sheet, and high interest coverage ratio.

- An interesting detail is that Nucor’s 3-year revenue growth rate outpaces more than half of its steel industry competitors, supporting its reputation for stable expansion.

- To assess how this strong financial endorsement reshapes Nucor’s outlook, we’ll explore its effect on the company’s ongoing earnings growth narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Nucor Investment Narrative Recap

To have conviction in Nucor, shareholders need to believe in the company's ability to consistently deliver solid earnings growth and navigate the cyclical steel sector, while benefiting from internal efficiencies and strong financial discipline. The recent GuruFocus score reaffirms Nucor’s financial strength, but it does not materially change the critical short-term catalyst, timely execution and ramp-up of new production projects, and leaves the most pressing risk, exposure to steel demand swings, largely intact.

Among Nucor’s recent announcements, the Q3 2025 earnings release stands out for its relevance: sales and net income both climbed year over year, signaling resilience despite industry challenges. Still, company guidance points to softer volumes and margin compression ahead, tying directly to the themes of operational performance and sector volatility that underpin the outlook for future catalysts.

In contrast, it’s crucial for investors to be aware of the latest trends in end-market steel demand given that...

Read the full narrative on Nucor (it's free!)

Nucor's forecast suggests revenues of $37.2 billion and earnings of $3.7 billion by 2028. This outlook is based on an annual revenue growth rate of 6.5% and represents a $2.4 billion increase in earnings from the current $1.3 billion level.

Uncover how Nucor's forecasts yield a $167.42 fair value, a 10% upside to its current price.

Exploring Other Perspectives

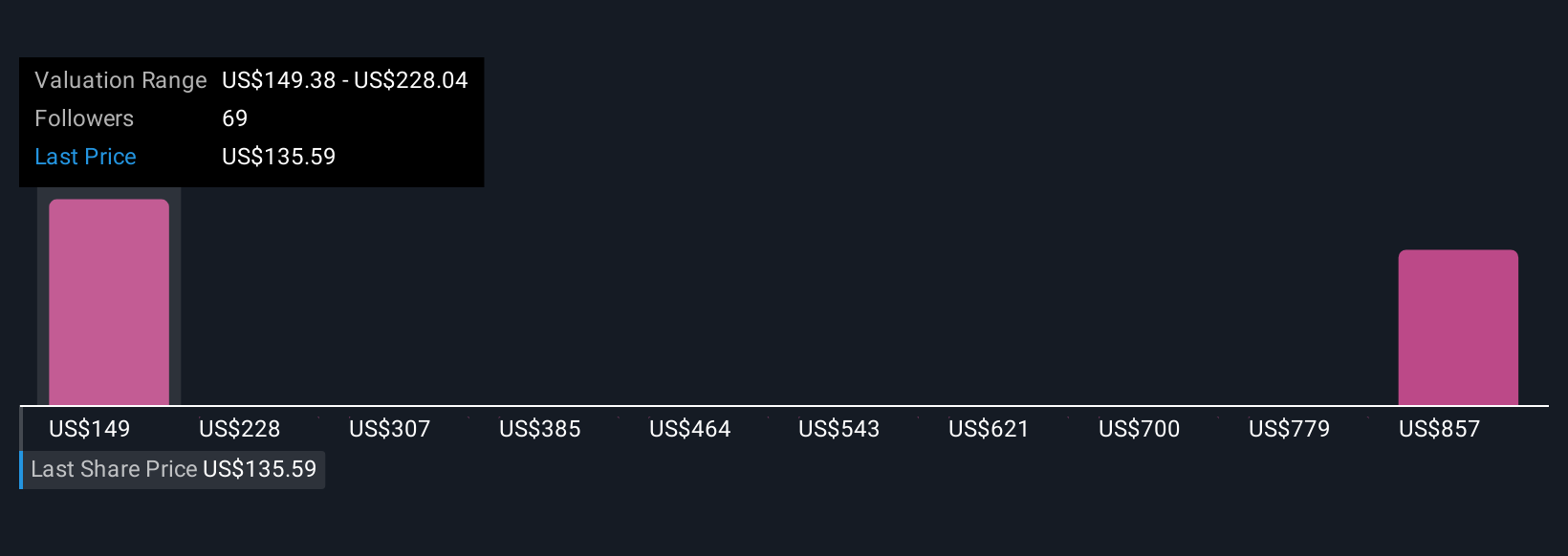

Seven community fair value estimates for Nucor range sharply from US$140.34 to US$594.68 per share on Simply Wall St. While these private forecasts reflect wide opinion gaps, the company’s need to deliver on incoming capacity projects may be the variable that most separates enduring optimism from caution.

Explore 7 other fair value estimates on Nucor - why the stock might be worth 8% less than the current price!

Build Your Own Nucor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nucor research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nucor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nucor's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nucor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NUE

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives