- United States

- /

- Chemicals

- /

- NYSE:NEU

NewMarket (NEU) Net Margin Rises to 17.2%, Reinforcing Defensive Value Narrative

Reviewed by Simply Wall St

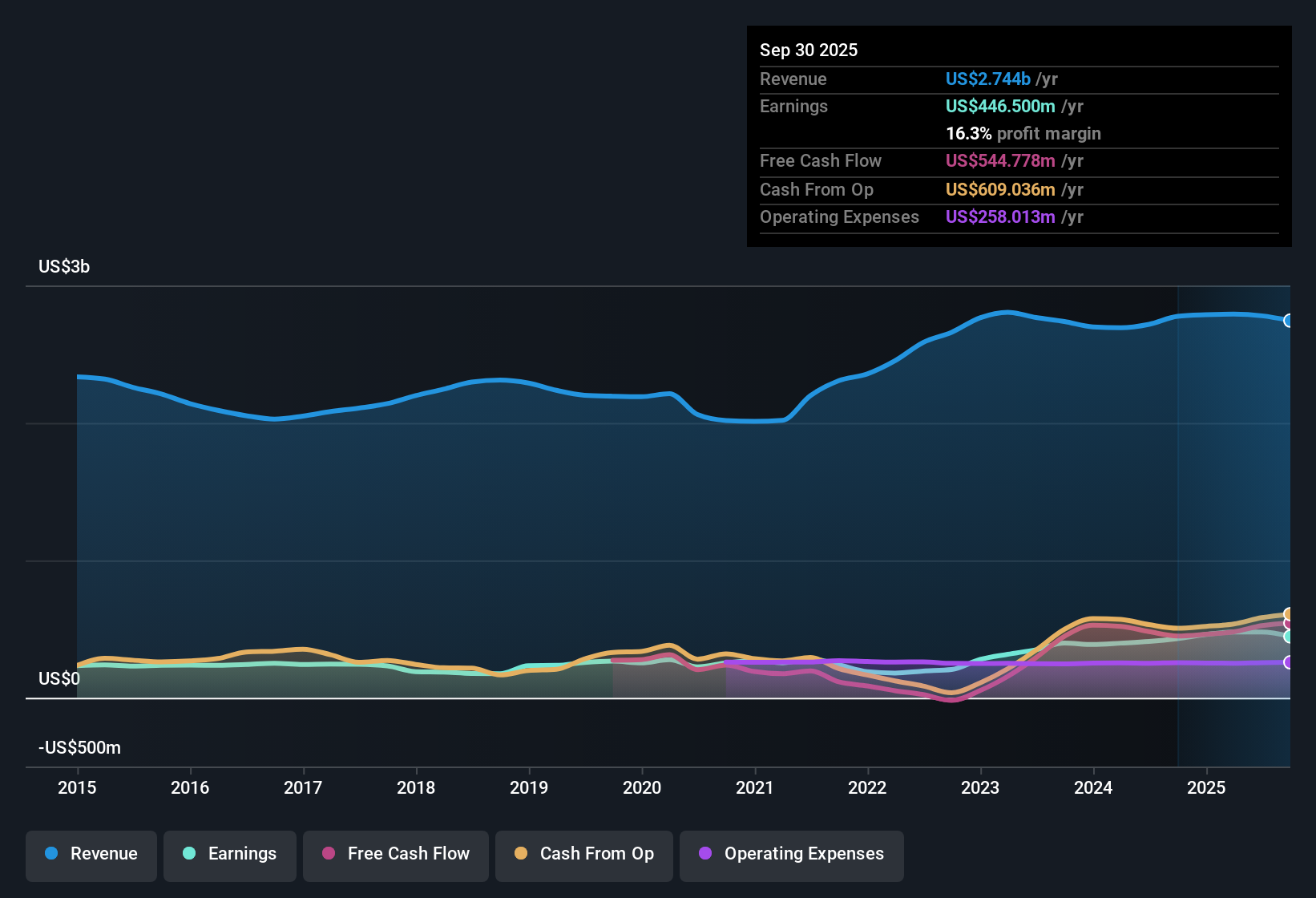

NewMarket (NEU) posted another strong earnings report, with net profit margins rising to 17.2% compared to 15.1% a year earlier. Annual earnings have grown by 18.2% over five years, and while the latest year saw a 16.8% increase, that pace is just a touch below the longer-term trend. With shares trading at $767.9, well below the estimated fair value of $1,339.76, and profit margins continuing to improve, investors have plenty to consider as valuation and profitability both look compelling.

See our full analysis for NewMarket.Next, we will see how the latest results stand up when set against the most popular investor narratives. This is where the numbers meet the story and expectations are put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Margins Climb to 17.2%

- Net profit margins expanded to 17.2%, up from 15.1% last year, highlighting the company’s operational efficiency and favorable cost management.

- Sustained margin gains strongly support the view that reliable performance makes NewMarket appealing as a "sleep well at night" choice.

- Even as annual earnings growth of 16.8% came in just below the five-year average, this steady improvement in margins supports the idea that income-focused investors may be right to consider NEU a defensive value play.

- Operating improvements indicate a resilience that may set NEU apart from more volatile chemical stocks, which bullish investors see as a reason to hold through broader market swings.

P/E Ratio Sits Below Industry

- NewMarket’s price-to-earnings ratio is 15.1x, noticeably lower than both the US Chemicals industry average of 25.3x and peers’ average of 15.6x, flagging the stock as attractively priced relative to its sector.

- An appealing valuation addresses concerns about overpaying for steady but unspectacular growth.

- The current share price of $767.90 is also well below the DCF fair value of $1,339.76, which has not gone unnoticed by investors searching for bargains among profit-makers.

- Even though recent annual growth is slightly softer than the longer trend, these valuation indicators reinforce the argument that NEU’s reliability is offered at a discount, adding further appeal for value-focused buyers.

Strong Earnings Growth Trend

- Earnings have grown at an average rate of 18.2% annually over the past five years, showing that NewMarket’s profitability expansion is a long-standing trend.

- Long-term earnings momentum supports the idea that NEU remains a steady operator with room for upside if sector demand increases.

- The most recent annual increase of 16.8%, though slightly below trend, maintains a high baseline of earnings progress, supporting holders waiting for a sector tailwind.

- This pattern of steady growth, combined with a manageable risk profile, appeals to those who view NEU as a practical "hold" with potential for further gains if industry conditions improve.

What else do analysts flag about NewMarket and its industry? Hear the range of bull and bear narratives in our deep dive.

See what the community is saying about NewMarketNext Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on NewMarket's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite NewMarket’s impressive profit margins and solid valuation, its most recent earnings growth has slipped slightly below the company’s longer-term average pace.

If you want to focus on businesses that consistently deliver strong earnings gains year after year, check out stable growth stocks screener (2103 results) for companies with dependable growth through any market condition.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NewMarket might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEU

NewMarket

Through its subsidiaries, primarily engages in the manufacture and sale of petroleum additives.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives