- United States

- /

- Chemicals

- /

- NYSE:NEU

NewMarket (NEU): Assessing Valuation After $100 Million Boost to Aerospace and Defense Capabilities

Reviewed by Simply Wall St

NewMarket’s $100 million investment to grow its subsidiary AMPAC’s ammonium perchlorate production marks a strategic move that underscores the company’s confidence in demand from aerospace and defense. This development could reshape competitive dynamics in a tightly regulated sector.

See our latest analysis for NewMarket.

The news lands after a remarkable year for NewMarket, with the stock gaining over 47% year-to-date and delivering a total shareholder return of 42% over the past twelve months. While there has been some recent cooling, such as a 9% 30-day share price pullback, the long-term uptrend remains strong. This suggests that investors are still optimistic about the company’s growth story in aerospace and defense.

With the defense sector in the spotlight, this could be the ideal moment to check out what’s happening across the industry via our curated See the full list for free..

The key question now is whether NewMarket’s rapid rise leaves room for further upside, or if today’s price already reflects expectations for sustained industry growth and market share gains from this bold expansion.

Price-to-Earnings of 14.8: Is it justified?

NewMarket’s shares trade at a price-to-earnings (P/E) ratio of 14.8, putting them well below the US Chemicals industry average of 25.7. This signals a notable valuation gap, especially following a strong rally in the stock price.

The price-to-earnings ratio shows how much investors are willing to pay for each dollar of profit. For a mature company in a high-barrier-to-entry industry like chemicals, a low P/E might hint at either lower expected growth or overlooked potential by the market.

NewMarket’s P/E of 14.8 looks modest compared to both its sector and peers. With notable outperformance in returns and above-average earnings growth, the market may be underappreciating the company’s potential, especially following significant investment and margin gains. If the market adjusts to industry averages, there could be room for the valuation multiple to expand.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 14.8 (UNDERVALUED)

However, sustained share price momentum is not guaranteed if market expectations shift or if sector headwinds affect NewMarket’s margin and growth outlook.

Find out about the key risks to this NewMarket narrative.

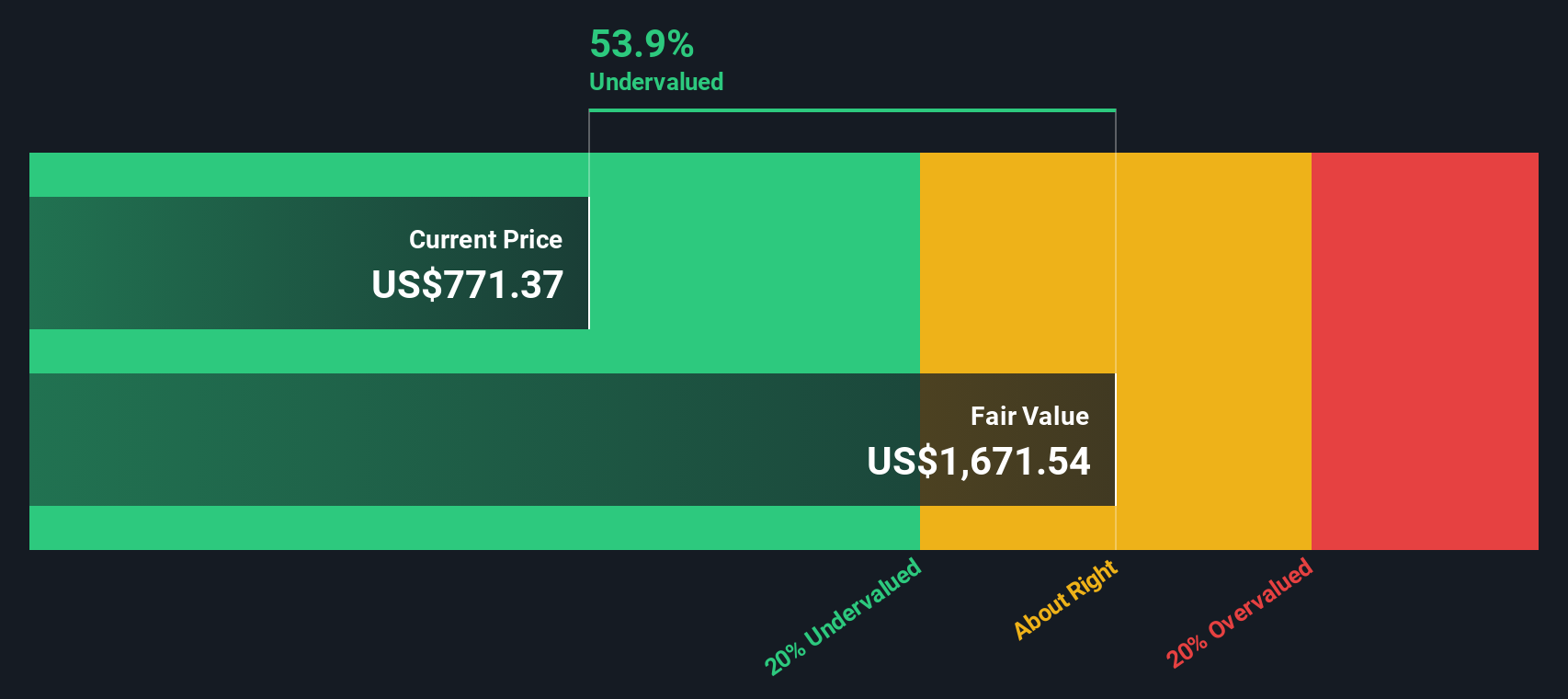

Another View: Discounted Cash Flow Says Undervalued

While NewMarket’s price-to-earnings ratio looks attractive compared to the industry, our DCF model presents an even starker picture. The current share price trades nearly 49% below our estimate of fair value, signaling deep undervaluation from a different perspective. Could this suggest even more upside ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NewMarket for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NewMarket Narrative

If you have a different perspective or enjoy digging into the numbers yourself, you can assemble your own narrative quickly and see how the story unfolds: Do it your way.

A great starting point for your NewMarket research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors look beyond the obvious winners. Catch your next opportunity by tapping into unique stock selections before others catch on. Start building your edge now:

- Boost your portfolio with steady income by exploring these 17 dividend stocks with yields > 3% that consistently offer yields above 3%.

- Ride the high-growth wave in artificial intelligence by targeting these 27 AI penny stocks making headlines with innovation and bold ambition.

- Position yourself ahead of the curve by scanning these 3559 penny stocks with strong financials showing real financial strength and untapped potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NewMarket might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEU

NewMarket

Through its subsidiaries, primarily engages in the manufacture and sale of petroleum additives.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives