- United States

- /

- Metals and Mining

- /

- NYSE:NEM

Is There Still an Opportunity in Newmont After Recent 13.4% Price Surge?

Reviewed by Bailey Pemberton

- Wondering if Newmont stock is still a bargain or if you have already missed out on the best returns? You are not alone. Many investors are asking whether its current price really reflects the company's long-term value.

- Newmont's share price has surged, up 6.4% in the past week and 13.4% for the past month. Those who invested at the start of the year have seen gains of 139.3%.

- Recent market excitement has been fueled by several key developments. Big headlines this quarter have included Newmont's strategic progress on new mining projects and growing optimism around gold prices. Both factors have caught the attention of investors seeking strong returns and stability.

- The company's value score comes in at 5 out of 6 based on our fundamental checks. This indicates that many metrics point to undervaluation. We will break down some common valuation approaches next, but stick around to discover an even more insightful perspective on Newmont’s worth at the end of this article.

Approach 1: Newmont Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's value. This approach is widely used to gauge whether a stock’s current price reflects its underlying potential.

For Newmont, analysts currently estimate Free Cash Flow (FCF) at $5.34 Billion. These cash flows are projected to grow steadily, reaching $7.98 Billion in 2029, as supported by both analyst forecasts and extrapolations for further years. In fact, estimates for the coming decade suggest that Newmont's FCF could continue rising, with a consistent upward trend seen in the projections. This sustained growth reflects strong fundamentals and operational progress within the company.

Based on these discounted cash flows, the DCF model estimates Newmont’s intrinsic value at $125.74 per share. Compared to the recent share price, this implies that Newmont stock is trading at a 27.0% discount according to this analysis. The model therefore positions the stock as notably undervalued at this time.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Newmont is undervalued by 27.0%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

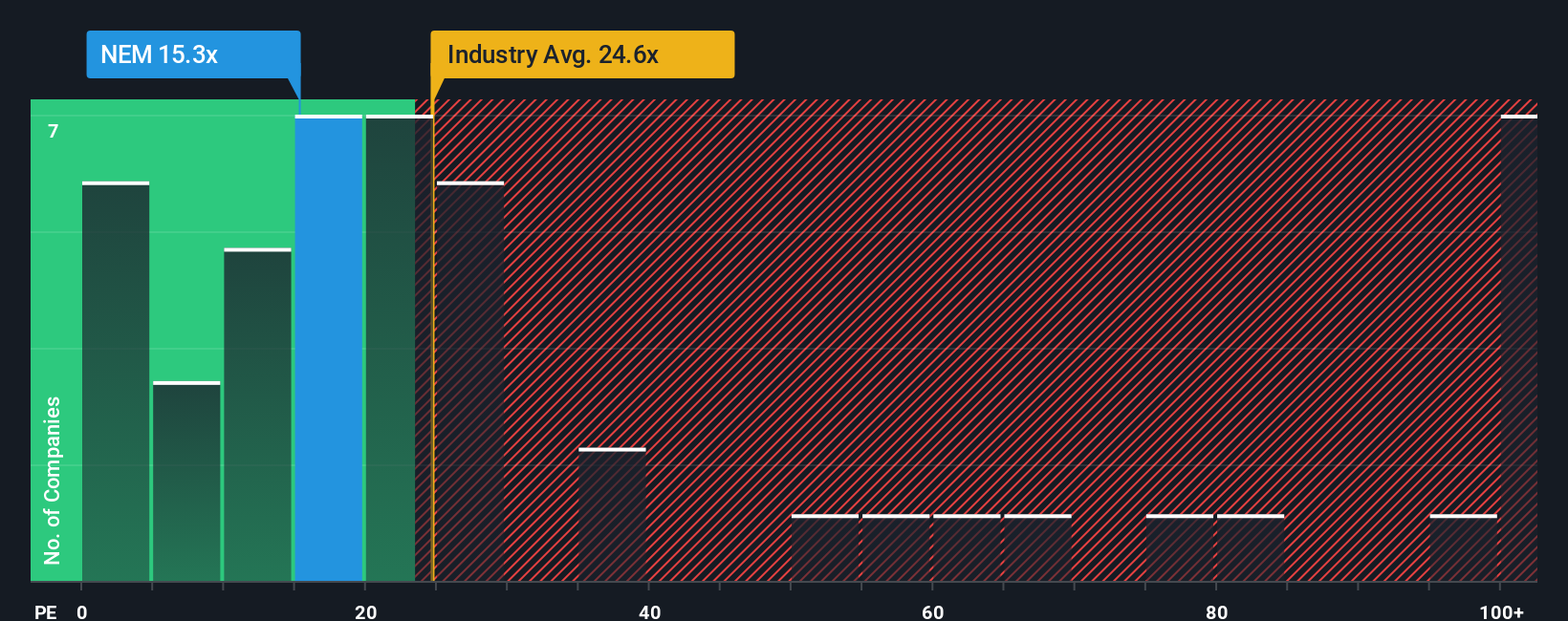

Approach 2: Newmont Price vs Earnings

For profitable companies like Newmont, the Price-to-Earnings (PE) ratio is a widely used valuation multiple. It offers investors a snapshot of how much they are paying for each dollar of current earnings, making it especially relevant for established, income-generating firms.

The right or “normal” PE ratio largely depends on expectations for future growth and the risks facing the business. Higher anticipated growth and lower risks can justify a higher PE, while more modest growth or elevated risks usually mean a lower fair PE ratio.

Newmont currently trades at a PE ratio of 13.9x. When compared to the Metals and Mining industry average of 22.3x and the peer group average of 26.6x, Newmont appears attractively valued on this traditional basis. However, relying solely on industry or peer group averages can overlook company-specific features that impact what multiple is truly fair.

This is where Simply Wall St’s Fair Ratio comes in. By considering Newmont’s earnings growth, industry, profit margins, market cap, and unique risk profile, the Fair Ratio represents a well-rounded benchmark. Here, it is calculated at 23.7x. This approach goes beyond basic peer or industry comparisons and provides a more tailored and reliable standard for valuation assessment.

Since Newmont’s actual PE is well below the Fair Ratio, the stock stands out as undervalued using this method.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Newmont Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful way to bring your own perspective to investing. It's the story you believe about a company, connected directly to your assumptions about its future revenue, earnings, and margins, all the way through to your idea of its fair value.

This approach goes beyond the numbers, helping you link Newmont’s business story, such as gold market trends, acquisitions, or operational changes, to a personalized financial forecast and a clear estimate of what the shares are worth. Narratives are easy to use and instantly accessible within the Community page on Simply Wall St, where millions of investors track and refine their views.

With Narratives, you can see exactly how your outlook stacks up against the market, making smarter decisions about buying or selling by comparing your fair value to the current price. These forecasts stay up to date and adapt in real time whenever new earnings reports or news are released.

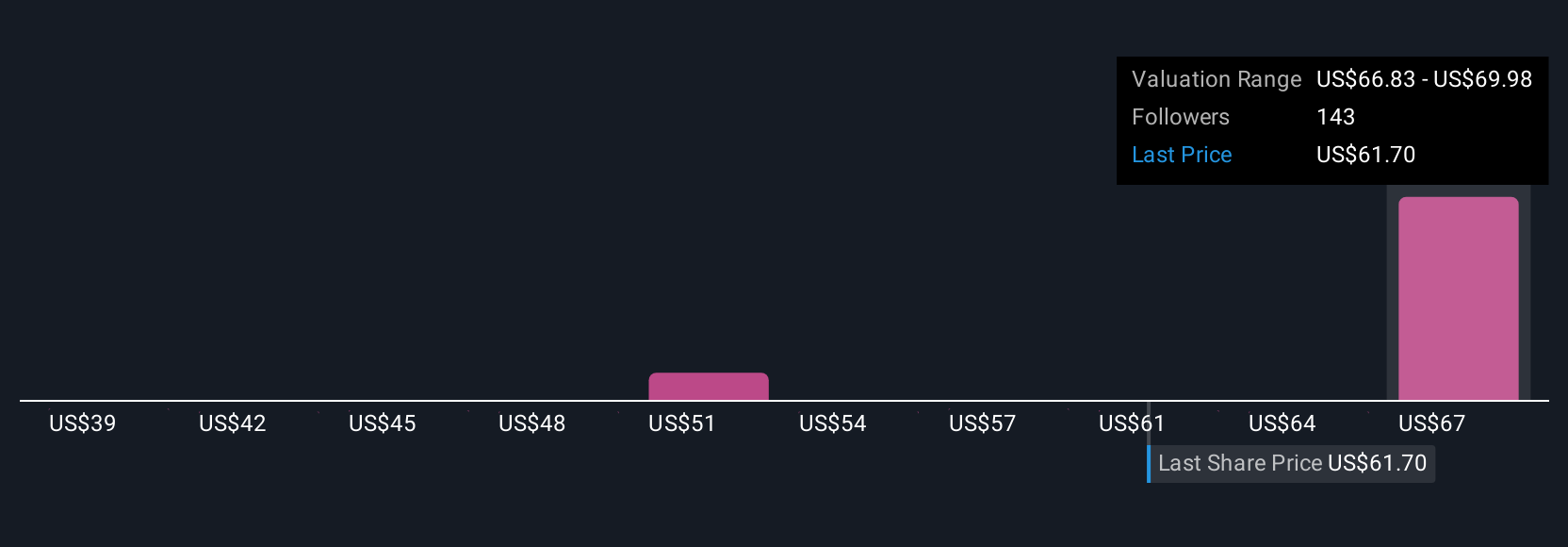

For example, some Newmont Narratives foresee upside from strong gold demand and efficiency improvements, projecting fair values as high as $104 per share. Others highlight operational risks and assign much lower values around $58, reminding us there are always multiple views and empowering you to choose the Narrative that matches your own convictions.

Do you think there's more to the story for Newmont? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newmont might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEM

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026