- United States

- /

- Metals and Mining

- /

- NYSE:MUX

Top Growth Stocks With Significant Insider Ownership In November 2025

Reviewed by Simply Wall St

As the U.S. stock market faces a downturn with the S&P 500 closing lower for four consecutive sessions and tech stocks under pressure, investors are keenly observing how major earnings reports, like Nvidia's, might influence broader market sentiment. In such volatile conditions, growth companies with high insider ownership can be particularly appealing as they often demonstrate strong alignment between management and shareholder interests, potentially offering resilience amid market fluctuations.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 21.9% | 73.4% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 26.3% | 204.4% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| FTC Solar (FTCI) | 23% | 78.8% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Atour Lifestyle Holdings (ATAT) | 18.1% | 24.2% |

| Astera Labs (ALAB) | 12.5% | 27.1% |

| AppLovin (APP) | 27.5% | 26.6% |

Underneath we present a selection of stocks filtered out by our screen.

American Resources (AREC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: American Resources Corporation focuses on producing rare earth and critical mineral concentrates for the infrastructure and electrification markets, with a market cap of $315.72 million.

Operations: Revenue segments for American Resources Corporation are not provided in the available text.

Insider Ownership: 11.4%

Revenue Growth Forecast: 73.6% p.a.

American Resources Corporation, with high insider ownership, is poised for substantial growth despite recent volatility and dilution. The company anticipates impressive revenue growth of 73.6% annually, outpacing the market significantly. However, it currently generates minimal revenue and has negative equity. Recent financial activities include a shelf registration of US$67 million and private placements totaling approximately US$40 million to bolster capital for future initiatives, reflecting strategic positioning amidst ongoing financial challenges.

- Delve into the full analysis future growth report here for a deeper understanding of American Resources.

- The valuation report we've compiled suggests that American Resources' current price could be inflated.

ImmunityBio (IBRX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ImmunityBio, Inc. is a commercial-stage biotechnology company focused on developing next-generation therapies to enhance natural immune systems against cancers and infectious diseases, with a market cap of approximately $2 billion.

Operations: The company's revenue segment is primarily derived from its focus on developing next-generation therapies, totaling $82.56 million.

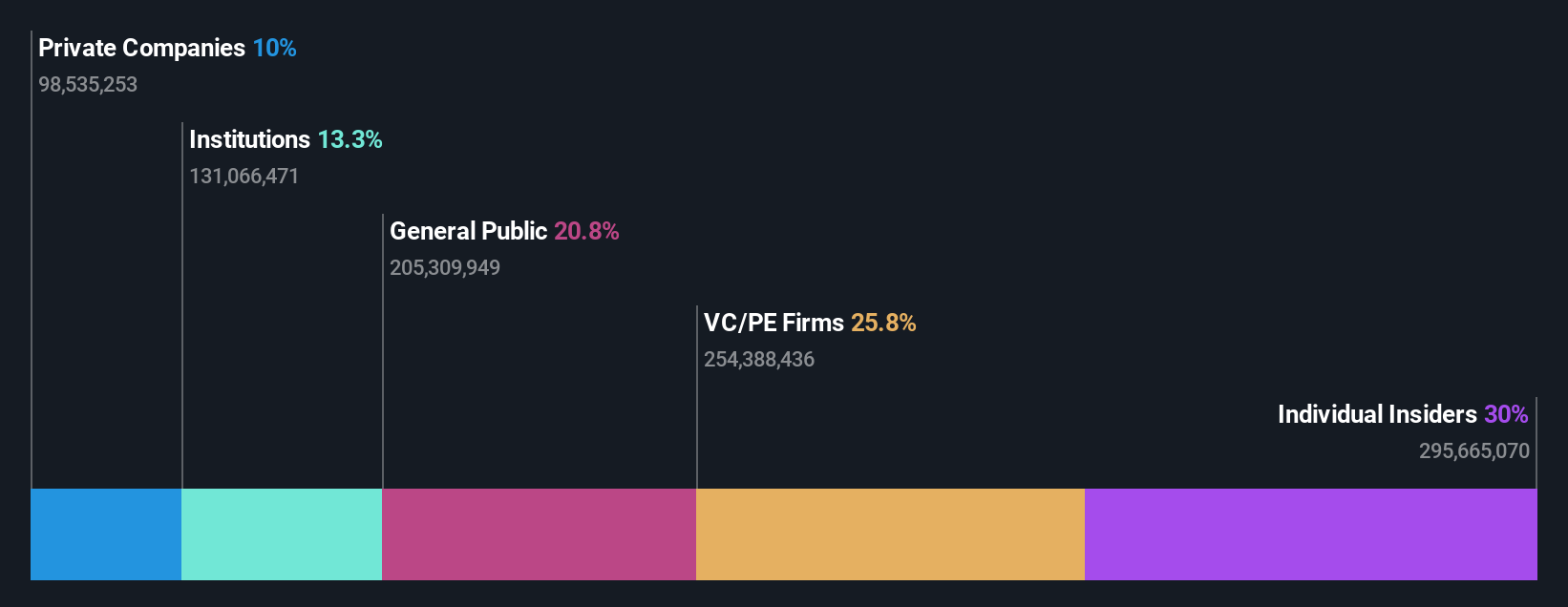

Insider Ownership: 30%

Revenue Growth Forecast: 58.4% p.a.

ImmunityBio, known for high insider ownership, is set for significant growth with a forecasted 58.4% annual revenue increase, surpassing the US market's average. Despite recent shareholder dilution and negative equity, the company reported substantial revenue growth to US$32.06 million in Q3 2025 from US$6.11 million a year ago. Their investigational therapy ANKTIVA shows promise in treating advanced cancers and long COVID, potentially enhancing its market position amidst financial challenges and a limited cash runway.

- Navigate through the intricacies of ImmunityBio with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that ImmunityBio's share price might be on the cheaper side.

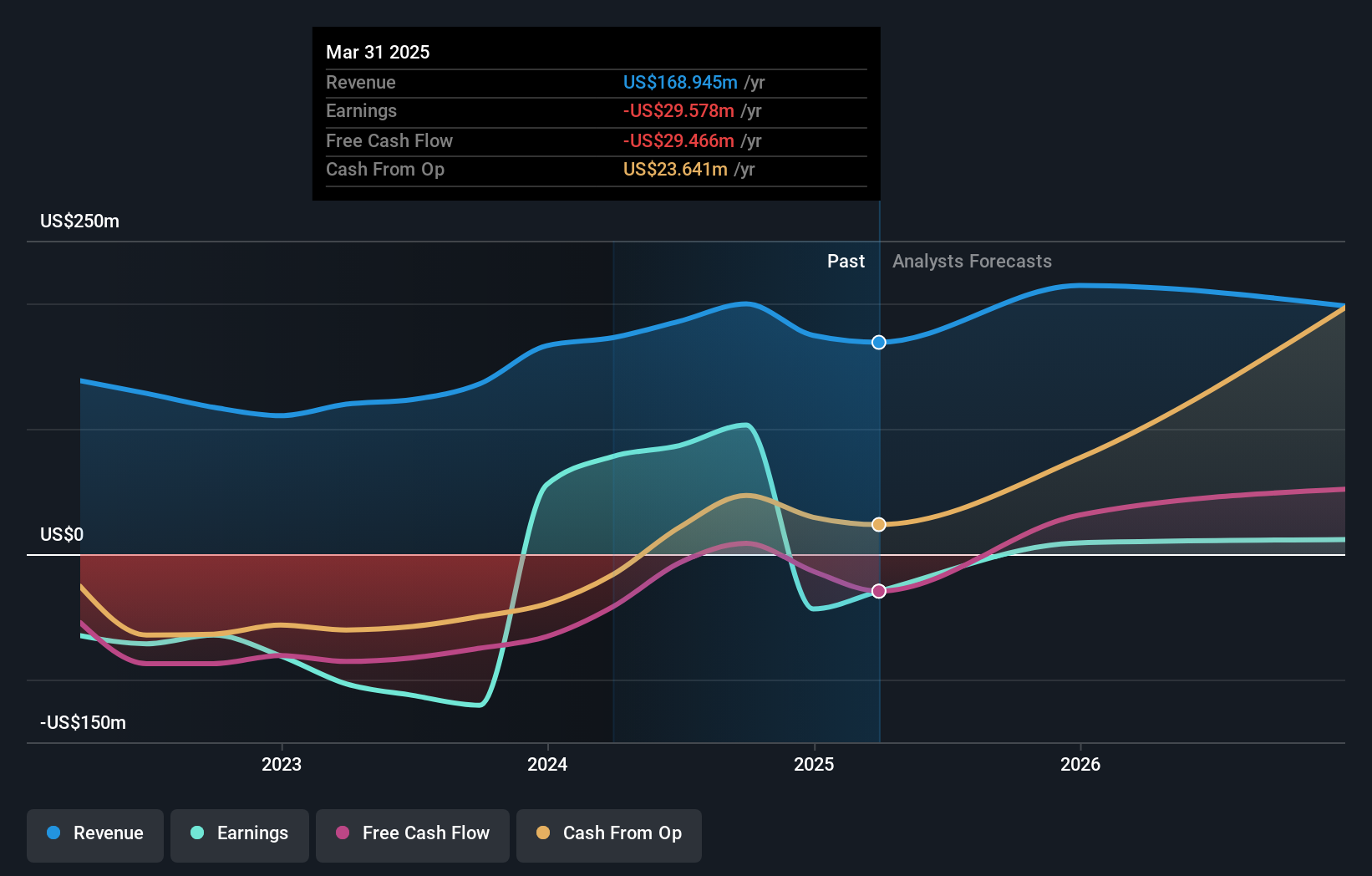

McEwen (MUX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: McEwen Inc. is involved in the exploration, development, production, and sale of gold and silver deposits across the United States, Canada, Mexico, and Argentina with a market cap of $922.35 million.

Operations: The company's revenue segments are comprised of $69.53 million from Canada, $0.65 million from Mexico, and $96.27 million from the United States of America (USA).

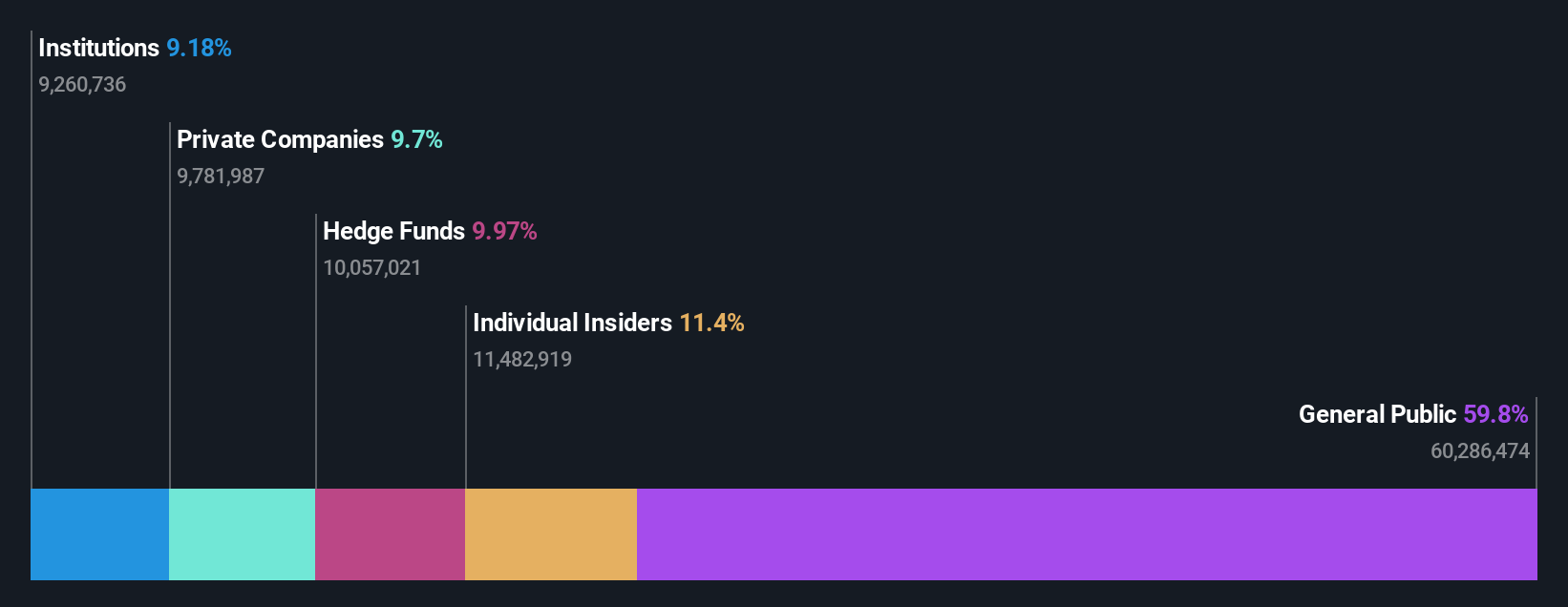

Insider Ownership: 15.7%

Revenue Growth Forecast: 42.7% p.a.

McEwen, with substantial insider ownership, is poised for growth as its revenue is forecasted to increase by 42.7% annually, outpacing the US market. Despite a revised production guidance and recent losses narrowing significantly from the previous year, McEwen's strategic drilling at Windfall and Grey Fox projects shows promising results for resource expansion. The company's focus on enhancing production efficiency and advancing exploration initiatives positions it well to leverage higher gold prices while pursuing long-term profitability goals.

- Get an in-depth perspective on McEwen's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report McEwen implies its share price may be lower than expected.

Seize The Opportunity

- Explore the 194 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MUX

McEwen

Engages in the exploration, development, production, and sale of gold and silver deposits in the United States, Canada, Mexico, and Argentina.

High growth potential and good value.

Market Insights

Community Narratives