- United States

- /

- Metals and Mining

- /

- NYSE:MUX

Market Participants Recognise McEwen Inc.'s (NYSE:MUX) Revenues Pushing Shares 26% Higher

McEwen Inc. (NYSE:MUX) shares have continued their recent momentum with a 26% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 28% in the last year.

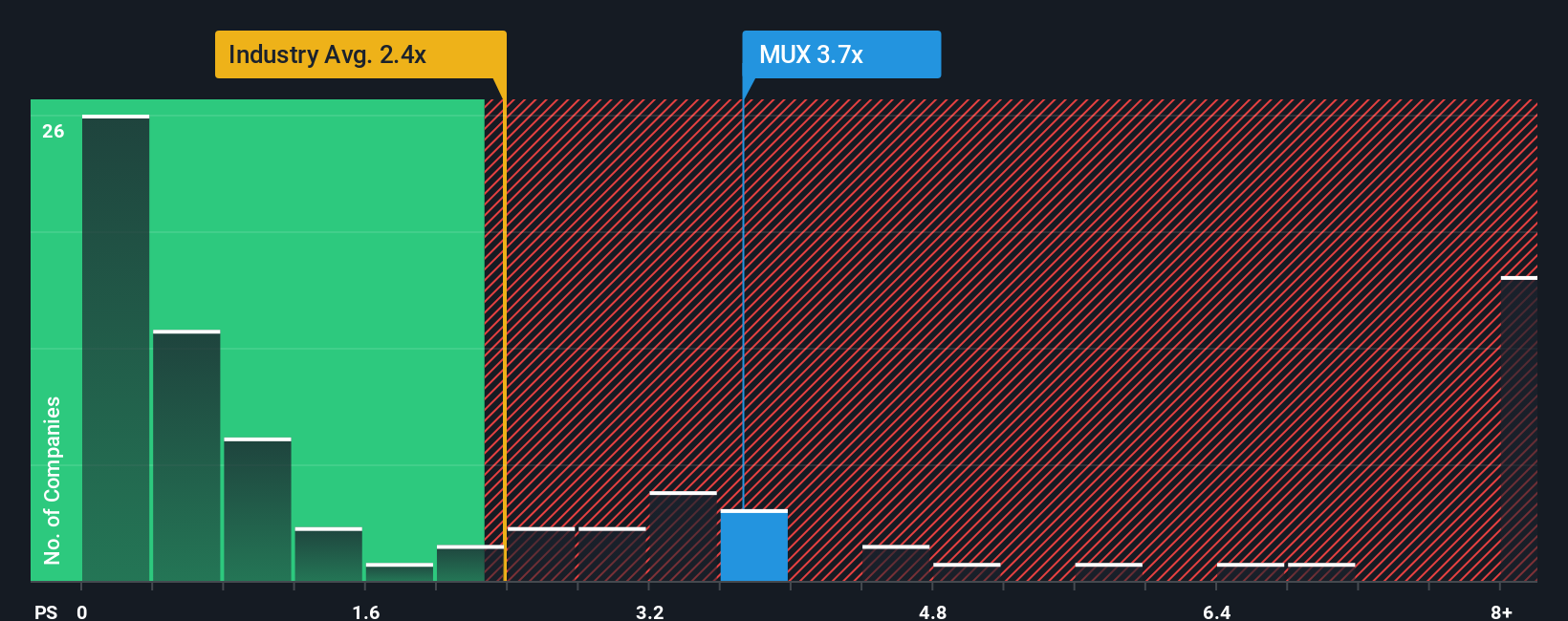

Following the firm bounce in price, when almost half of the companies in the United States' Metals and Mining industry have price-to-sales ratios (or "P/S") below 2.4x, you may consider McEwen as a stock probably not worth researching with its 3.7x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for McEwen

How Has McEwen Performed Recently?

McEwen hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on McEwen will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For McEwen?

In order to justify its P/S ratio, McEwen would need to produce impressive growth in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.2%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 22% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next year should generate growth of 24% as estimated by the three analysts watching the company. With the industry only predicted to deliver 12%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that McEwen's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On McEwen's P/S

The large bounce in McEwen's shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of McEwen's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for McEwen with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MUX

McEwen

Engages in the exploration, development, production, and sale of gold and silver deposits in the United States, Canada, Mexico, and Argentina.

High growth potential and good value.

Market Insights

Community Narratives