- United States

- /

- Metals and Mining

- /

- NYSE:MUX

How Do McEwen’s (MUX) New Windfall Drill Results Shape Its Resource Growth Narrative?

Reviewed by Sasha Jovanovic

- McEwen Inc. recently announced encouraging new results from its 2025 drilling program at the Windfall area of the Gold Bar Mine Complex, including high-grade near-surface gold intercepts and ongoing resource expansion potential in Nevada.

- The Windfall site, added through McEwen’s 2024 acquisition of Timberline Resources, continues to yield mineralized zones outside historical estimates, supporting the company’s efforts to increase gold resources and extend mine life.

- We’ll explore how these strong Windfall drill results could influence McEwen’s investment case, especially regarding resource growth and future production plans.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

McEwen Investment Narrative Recap

McEwen shareholders must believe that ongoing exploration success, especially at key sites like Windfall, will boost resources, extend mine life, and improve profitability. While the latest high-grade drill results support an optimistic outlook for resource growth, the most immediate catalyst remains consistent quarterly production delivery, and the biggest risk continues to be execution, especially timely integration of new assets and avoidance of operational disruptions. So far, the Windfall results do not materially change these core investment drivers in the short run.

A recent and relevant announcement is the September update from the Fox Complex's Grey Fox Project, where McEwen reported attractive gold grades and signaled forthcoming resource growth. This progress, when considered alongside strong Windfall drilling outcomes, highlights continued movement on the company's exploration-led catalyst, potentially supporting both near-term production targets and longer-term asset value. Yet, with production guidance reaffirmed and key results still coming in at Windfall, execution reliability remains closely watched ...

Read the full narrative on McEwen (it's free!)

McEwen's outlook anticipates $446.1 million in revenue and $201.4 million in earnings by 2028. Achieving this target would require annual revenue growth of 38.4% and an increase in earnings of $214.9 million from the current level of -$13.5 million.

Uncover how McEwen's forecasts yield a $23.30 fair value, a 22% upside to its current price.

Exploring Other Perspectives

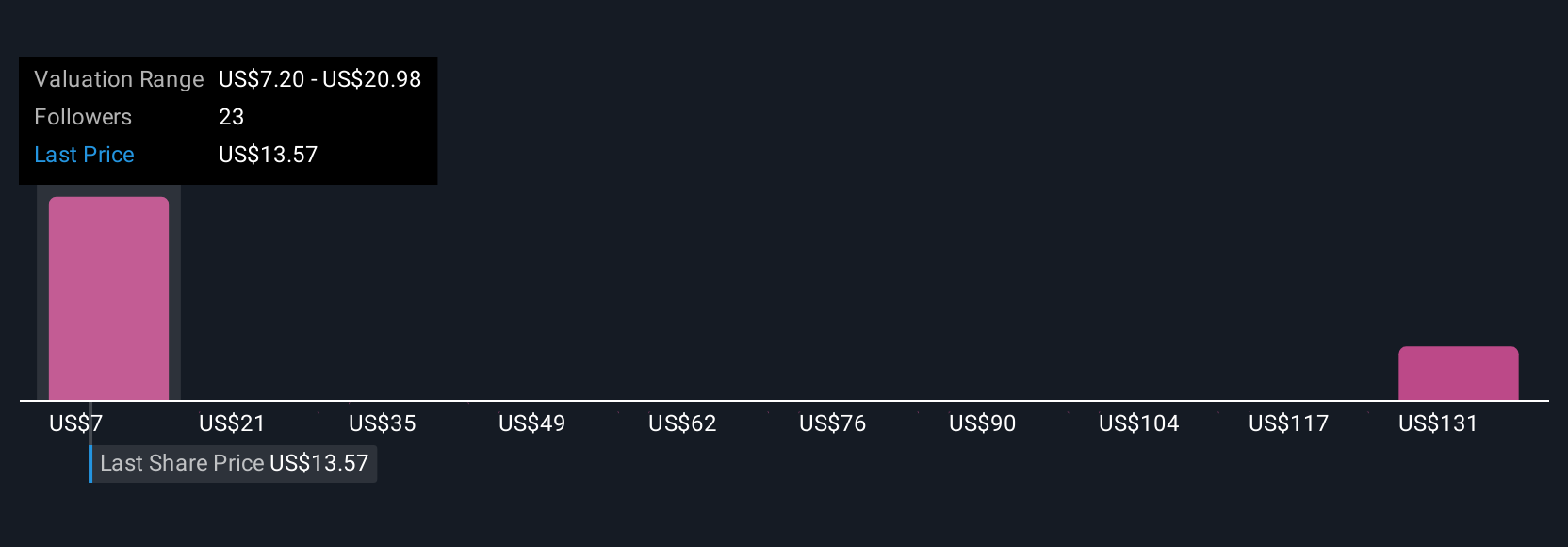

Fair value opinions from seven Simply Wall St Community members range between US$8.69 and US$172.09 per share. While resource growth momentum is encouraging, execution challenges could determine if McEwen fulfills this broad spectrum of investor expectations.

Explore 7 other fair value estimates on McEwen - why the stock might be worth less than half the current price!

Build Your Own McEwen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your McEwen research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free McEwen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate McEwen's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MUX

McEwen

Engages in the exploration, development, production, and sale of gold and silver deposits in the United States, Canada, Mexico, and Argentina.

High growth potential and good value.

Market Insights

Community Narratives