- United States

- /

- Chemicals

- /

- NYSE:MTX

How Rafinol Expansion and Dividend Growth at Minerals Technologies (MTX) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Minerals Technologies Inc. recently reported third-quarter 2025 results, showing net sales of US$532.4 million and basic earnings per share of US$1.37, alongside a 9% dividend increase and new investment in its Usak City, Turkey plant for the Rafinol™ product line.

- This expansion highlights the company's focus on high-growth sustainable markets, particularly in natural oil purification and renewable fuels, despite ongoing financial headwinds.

- We'll examine how the expansion of Rafinol™ in Turkey shapes Minerals Technologies' investment narrative through its commitment to sustainability.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Minerals Technologies Investment Narrative Recap

To be a Minerals Technologies shareholder, you need to believe in the company's ability to pivot toward high-growth, sustainable markets while managing near-term earnings headwinds and variable demand across its core segments. While the recent investment in the Usak City plant underscores the potential of the Rafinol™ line, current results suggest this expansion does not yet materially shift the most important short-term catalyst, margin recovery in Specialty Additives, or lessen the immediate risk from litigation and sluggish paper demand.

The most pertinent recent announcement is the expanded Usak City, Turkey facility for Rafinol™, aligning with Minerals Technologies’ focus on renewable fuels and natural oil purification. This investment is linked with the company’s efforts to grow higher-margin specialty businesses, a key catalyst as it seeks to mitigate ongoing pressures in legacy segments and support future earnings consistency.

However, investors should also be aware that legal and reputational risks related to unresolved talc litigation continue to loom, meaning...

Read the full narrative on Minerals Technologies (it's free!)

Minerals Technologies' narrative projects $2.3 billion revenue and $818.2 million earnings by 2028. This requires 3.3% yearly revenue growth and a $816.1 million increase in earnings from the current $2.1 million.

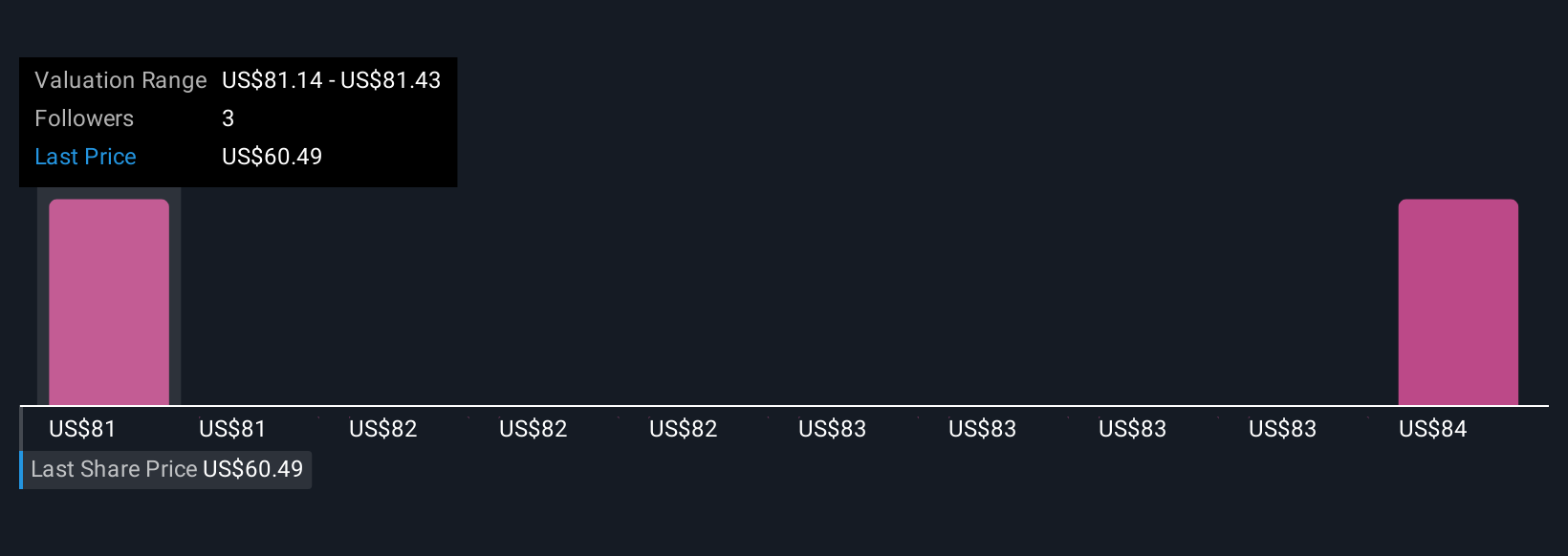

Uncover how Minerals Technologies' forecasts yield a $84.00 fair value, a 48% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members suggest fair values between US$84 and US$146.61, with two perspectives contributing to this broad span. While many see room for significant upside, persistent margin pressure in core segments could challenge Minerals Technologies’ route to recovery, so take time to compare several investor outlooks before forming your own assessment.

Explore 2 other fair value estimates on Minerals Technologies - why the stock might be worth over 2x more than the current price!

Build Your Own Minerals Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Minerals Technologies research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Minerals Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Minerals Technologies' overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTX

Minerals Technologies

Develops, produces, and markets various mineral, mineral-based, and related systems and services.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives