- United States

- /

- Metals and Mining

- /

- NYSE:MTUS

The Market Doesn't Like What It Sees From Metallus Inc.'s (NYSE:MTUS) Revenues Yet As Shares Tumble 29%

Metallus Inc. (NYSE:MTUS) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 27% share price drop.

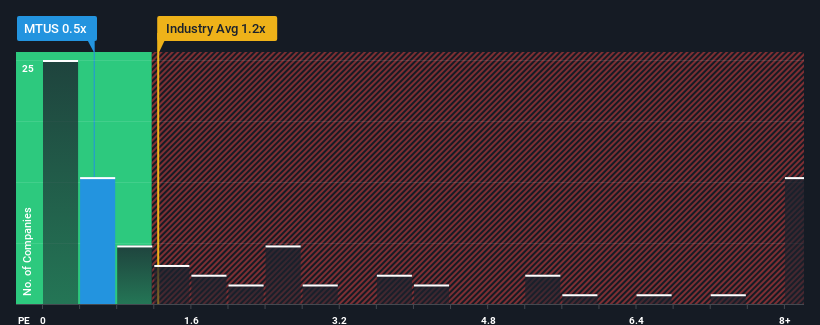

After such a large drop in price, Metallus may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.5x, since almost half of all companies in the Metals and Mining industry in the United States have P/S ratios greater than 1.2x and even P/S higher than 5x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Metallus

What Does Metallus' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Metallus has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Metallus will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Metallus?

The only time you'd be truly comfortable seeing a P/S as low as Metallus' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 4.5% gain to the company's revenues. Revenue has also lifted 28% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 5.4% as estimated by the three analysts watching the company. That's not great when the rest of the industry is expected to grow by 18%.

With this in consideration, we find it intriguing that Metallus' P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Metallus' P/S?

Metallus' recently weak share price has pulled its P/S back below other Metals and Mining companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's clear to see that Metallus maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Metallus' poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for Metallus that you should be aware of.

If these risks are making you reconsider your opinion on Metallus, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MTUS

Metallus

Manufactures and sells alloy steel, and carbon and micro-alloy steel products in the United States and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives