- United States

- /

- Metals and Mining

- /

- NYSE:MP

MP Materials (NYSE:MP) Surges 41% In One Month Following Saudi Partnership

Reviewed by Simply Wall St

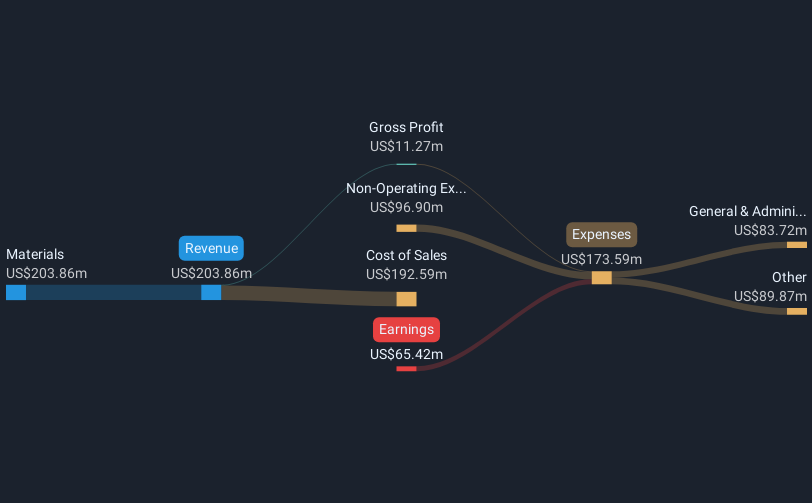

MP Materials (NYSE:MP) recently gained market attention as Saudi Arabian Mining Company (Maaden) formed a partnership with the company to establish an integrated rare earth supply chain in Saudi Arabia. This collaboration, signed at the U.S.-Saudi Investment Forum, aligns with growing global demand for rare earth materials critical in advanced technologies. Such positive developments likely contributed to the notable 41% rise in MP’s stock value over the past month. Meanwhile, global markets saw mixed performance amid geopolitical tensions impacting oil and travel sectors, but these broader fluctuations did not substantially affect MP’s upward move, further highlighting the significance of its recent strategic initiatives.

MP Materials has 1 warning sign we think you should know about.

The recent collaboration between MP Materials and Saudi Arabian Mining Company seeks to create a robust rare earth supply chain in Saudi Arabia, potentially amplifying the company's revenue opportunities. As demand for rare earth materials grows, this partnership could further drive MP Materials' efforts to enhance production and efficiency, contributing positively to future earnings projections.

Over the last year, MP Materials' total return, including dividends, surged very significantly, reflecting strong performance. When evaluated against the previous 12 months, MP surpassed both the US market, which saw an 11.7% return, and the US Metals and Mining industry, with a 9.7% return over the same period. This outperformance underscores investor confidence in MP Materials' future growth potential and strategic direction.

Regarding revenue and earnings forecasts, the new partnership could positively influence analysts' expectations by opening new markets and stabilizing production outputs. With shares currently trading at US$24.58, the analyst consensus price target of US$26.69 presents an opportunity for further appreciation, though modest given the close proximity. Careful consideration of these factors will be essential in assessing MP Materials' future trajectory.

Understand MP Materials' track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MP

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives