- United States

- /

- Metals and Mining

- /

- NYSE:MP

MP Materials (MP): Weighing the Valuation After Latest Earnings Disappoint Investors

Reviewed by Simply Wall St

See our latest analysis for MP Materials.

MP Materials' share price slipped sharply after results, with a 1-day share price return of -8.61% amplifying a recent loss of momentum. Despite these setbacks, long-term investors are still sitting on an impressive 5-year total shareholder return of 403%, which highlights both past growth and current volatility.

If this kind of swing in the materials sector has you looking for fresh ideas, consider using our resource to discover fast growing stocks with high insider ownership.

With strong historical gains but recent declines and a valuation that still sits below many analyst targets, the real question for investors is whether MP Materials is now undervalued or if the market has already priced in future growth.

Most Popular Narrative: 28.6% Undervalued

With MP Materials' last close at $57.66 and the most widely followed narrative pegging fair value at $80.71, the consensus sharply diverges from recent market pricing. That disconnect raises the stakes for upcoming milestones and big-picture developments.

MP Materials' recently secured long-term, government-backed offtake agreements, including a minimum price floor and guaranteed EBITDA for magnet output from the Department of Defense, as well as a $500M+ multi-year supply contract with Apple, ensure predictable and resilient revenue streams insulated from price volatility. These agreements directly enhance future revenue and earnings visibility.

Want to know the growth blueprint behind this high valuation? The narrative is built around eye-popping profit growth projections and a future profit multiple that usually only tech giants command. Ready to uncover the bold forecasts behind this fair value? Dive into the details. The driving assumptions might surprise you.

Result: Fair Value of $80.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ambitious expansion plans face execution risk, and heavy reliance on major customers could drive earnings volatility if key partnerships falter.

Find out about the key risks to this MP Materials narrative.

Another View: Market-Based Comparison

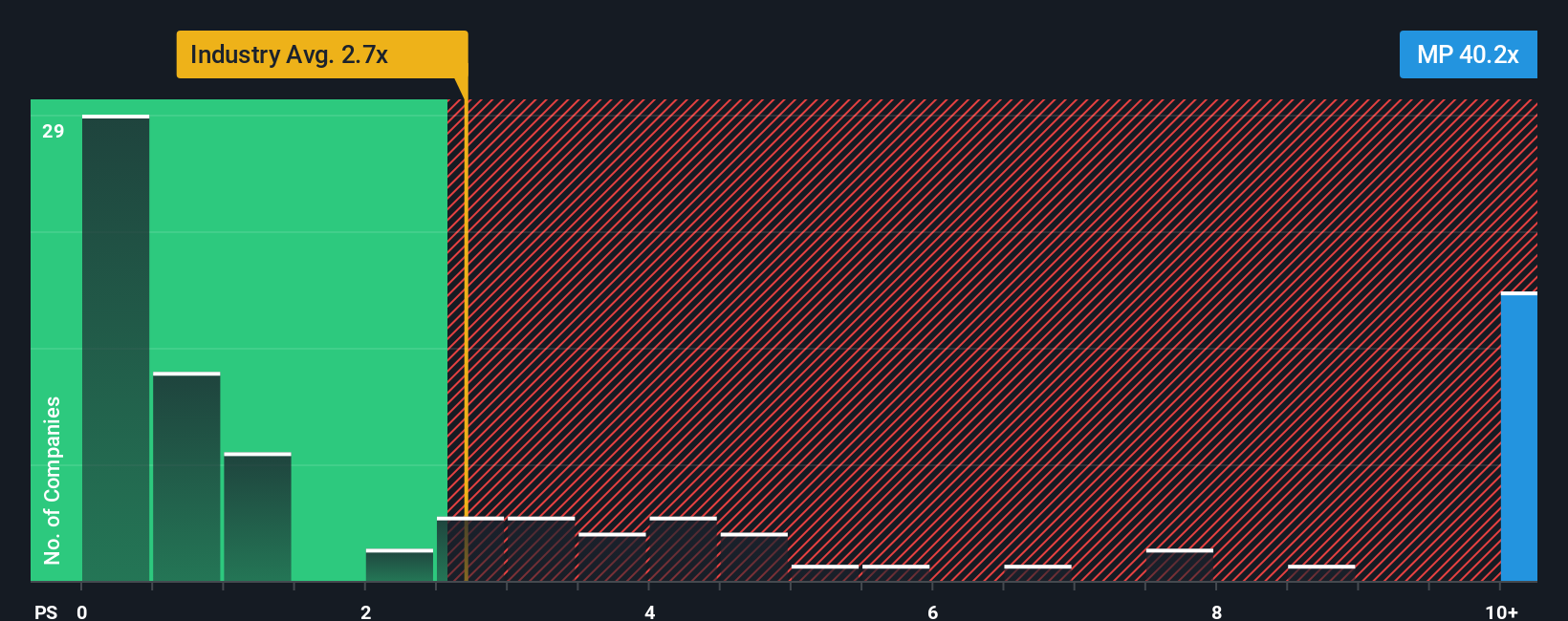

Looking at how the company is valued by traditional sales multiples reveals a different story. MP trades at a price-to-sales ratio of 42.2x, much higher than its peers in the US Metals and Mining industry, where the average is just 2.8x and the fair ratio is 2.4x. This wide gap suggests the market expects a lot of growth, but it also raises the stakes for meeting those expectations. Is the premium fully justified by future potential, or is there risk of a correction?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MP Materials Narrative

If you want to challenge the consensus or build your own perspective from the numbers, you can create your own view in under three minutes, and Do it your way.

A great starting point for your MP Materials research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let opportunity pass you by. These tailored screeners instantly put promising stocks at your fingertips, so you can move forward with confidence and clarity.

- Unearth growth potential by checking out these 843 undervalued stocks based on cash flows, which is packed with stocks the market might be mispricing right now.

- Accelerate your portfolio’s innovation edge and get ahead of tech trends with these 26 AI penny stocks, where you’ll find companies at the forefront of artificial intelligence.

- Lock in steady income streams by reviewing these 18 dividend stocks with yields > 3%, featuring stocks offering attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MP

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives