- United States

- /

- Metals and Mining

- /

- NYSE:MP

MP Materials (MP): Examining Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

MP Materials (MP) recently saw its stock take a step back, with share prices sliding nearly 3% in the past day. Investors are keeping an eye on recent market moves to gauge whether this pullback creates a compelling opportunity, especially considering the performance over the past month.

See our latest analysis for MP Materials.

Despite the recent dip, MP Materials’ share price is still up an impressive 247.65% year-to-date. The pullback over the past month comes after a long run, as investors reassess growth prospects. However, total shareholder return over the past year remains a remarkable 210.52%, which are clear signs that momentum has cooled a bit in the short term even as long-term gains stand out.

If today’s shifts have you rethinking your strategy, now could be the right time to broaden your search and discover fast growing stocks with high insider ownership

With robust long-term returns but a recent cooldown in momentum, the question remains: is MP Materials now trading below its true value, or is the market already taking future growth into account?

Most Popular Narrative: 29.5% Undervalued

Compared to MP Materials’ last close at $56.98, the most popular narrative sets a fair value much higher, fueling active debate over long-term growth assumptions and upside.

MP Materials' recently secured long-term, government-backed offtake agreements, including a minimum price floor and guaranteed EBITDA for magnet output from the Department of Defense, as well as a $500M+ multi-year supply contract with Apple, ensure predictable and resilient revenue streams insulated from price volatility. This directly enhances future revenue and earnings visibility.

What is the secret behind this bullish outlook? The narrative hinges on a combination of massive revenue acceleration, a swing in profit margins, and a future valuation multiple that leaves traditional industry benchmarks far behind. Wondering what dramatic shifts and bold financial projections justify such a premium? The numbers may surprise even the most seasoned investors—see for yourself inside the full narrative.

Result: Fair Value of $80.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ambitious expansion plans could stumble if new facilities face delays or if heavy reliance on key customers leads to sudden revenue swings.

Find out about the key risks to this MP Materials narrative.

Another View: The Multiples Approach

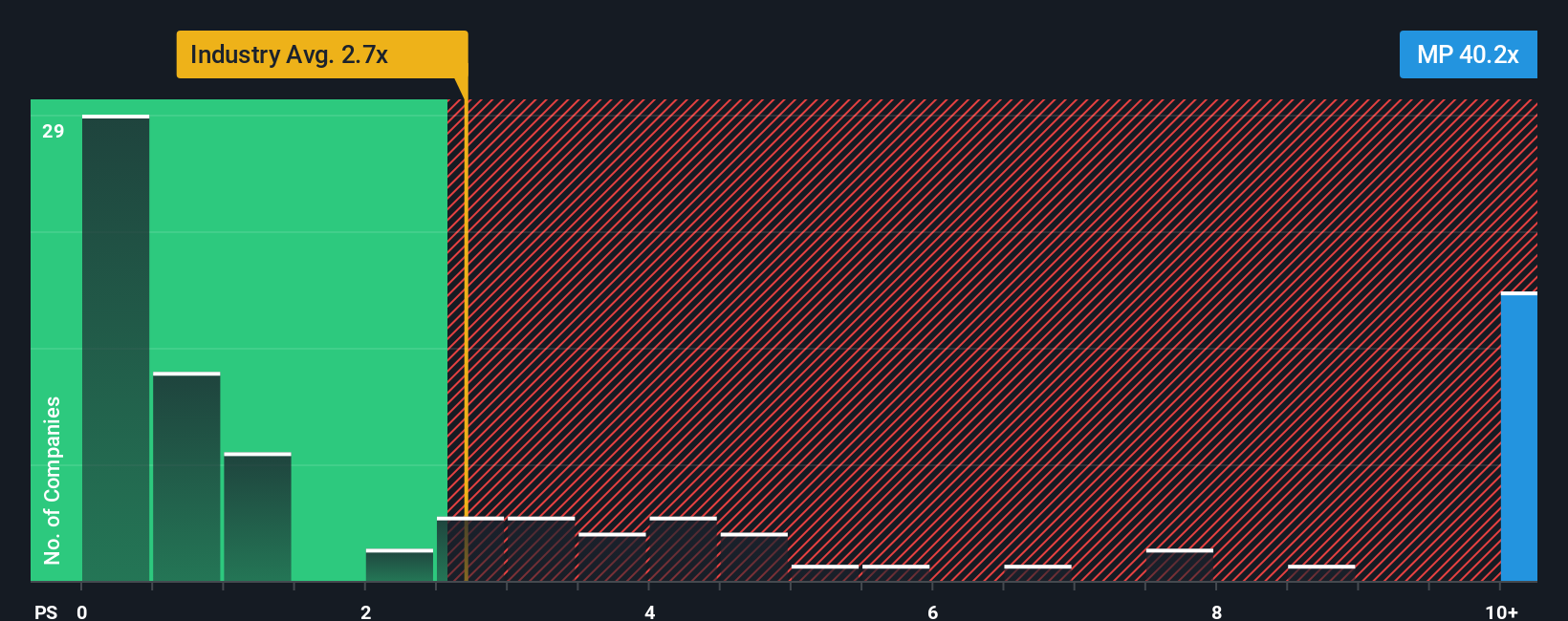

Looking from another angle, MP Materials is trading at a price-to-sales ratio of 43.4x, which is dramatically higher than both the US metals and mining industry average of 2.6x and its peer average of just 0.7x. Even when compared to the fair ratio of 2.5x, where the market could eventually settle, MP’s current level suggests the stock is richly valued on this measure. Does this significant gap signal potential for a sharp correction if sentiment turns, or does it simply reflect unique long-term growth prospects that investors are betting on?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MP Materials Narrative

If you see things differently or want to dig into the details yourself, you can build your own perspective in just a few minutes. Do it your way

A great starting point for your MP Materials research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t wait on the sidelines while others seize emerging opportunities. See what else you might be missing in today’s markets with these powerful, curated ideas:

- Boost your passive income potential when you tap into these 18 dividend stocks with yields > 3% with proven yields and solid fundamentals.

- Capitalize on tomorrow’s tech revolution by snapping up growth potential with these 27 AI penny stocks powering advances in artificial intelligence.

- Secure a great entry point with these 894 undervalued stocks based on cash flows that the market may have overlooked, giving you a head start on value plays before the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MP

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives