- United States

- /

- Metals and Mining

- /

- NYSE:MP

MP Materials (MP): Examining Valuation After Major US Defense Backing and Apple Deal Reshapes Rare Earths Landscape

Reviewed by Kshitija Bhandaru

MP Materials, the leading US producer of rare earths, has drawn fresh attention after the Department of Defense made a sizable investment and signed a landmark partnership with the company. This comes as US-China tensions highlight America’s push to secure key minerals independently.

See our latest analysis for MP Materials.

MP Materials has seen its share price rocket nearly 393% since the start of the year, propelled by a wave of strategic wins and surging demand for reliable U.S. rare earths. Recent headlines, such as its $400 million Department of Defense partnership and a major supply deal with Apple, sparked an energetic rally, even as some investors paused to lock in profits after a swift multi-day jump. Momentum looks strong, with a 21% share price gain in the past month and a five-year total shareholder return of 505% illustrating just how transformative this run has been for longer-term holders.

If MP Materials’ unique position has caught your attention, it might be the perfect moment to discover fast growing stocks with high insider ownership.

After such a meteoric rise, investors are now left to wonder: does MP Materials’ sky-high valuation reflect years of future growth already, or is there still room for another leg higher?

Most Popular Narrative: 3.5% Overvalued

With analysts now assigning a $78.05 fair value for MP Materials, the last close at $80.79 sits a touch above the consensus, sparking renewed debate over its future trajectory. Let’s look at the strategic themes driving this view.

MP Materials’ recently secured long-term, government-backed offtake agreements, including a minimum price floor and guaranteed EBITDA for magnet output from the Department of Defense, as well as a $500M+ multi-year supply contract with Apple, ensure predictable and resilient revenue streams insulated from price volatility. These agreements directly enhance future revenue and earnings visibility.

Want to understand the math behind such a premium price? The key to this narrative lies in ambitious growth projections fueled by bold operating margin targets and blockbuster deals. Curious which assumptions are powering this market-challenging valuation? The full narrative breaks down the financial forecasts and the logic pushing the price target beyond what historical norms might suggest. Dive in and see if your expectations align with theirs.

Result: Fair Value of $78.05 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected delays in MP Materials’ downstream expansion or reliance on a small group of strategic customers could threaten the company's ambitious profit growth targets.

Find out about the key risks to this MP Materials narrative.

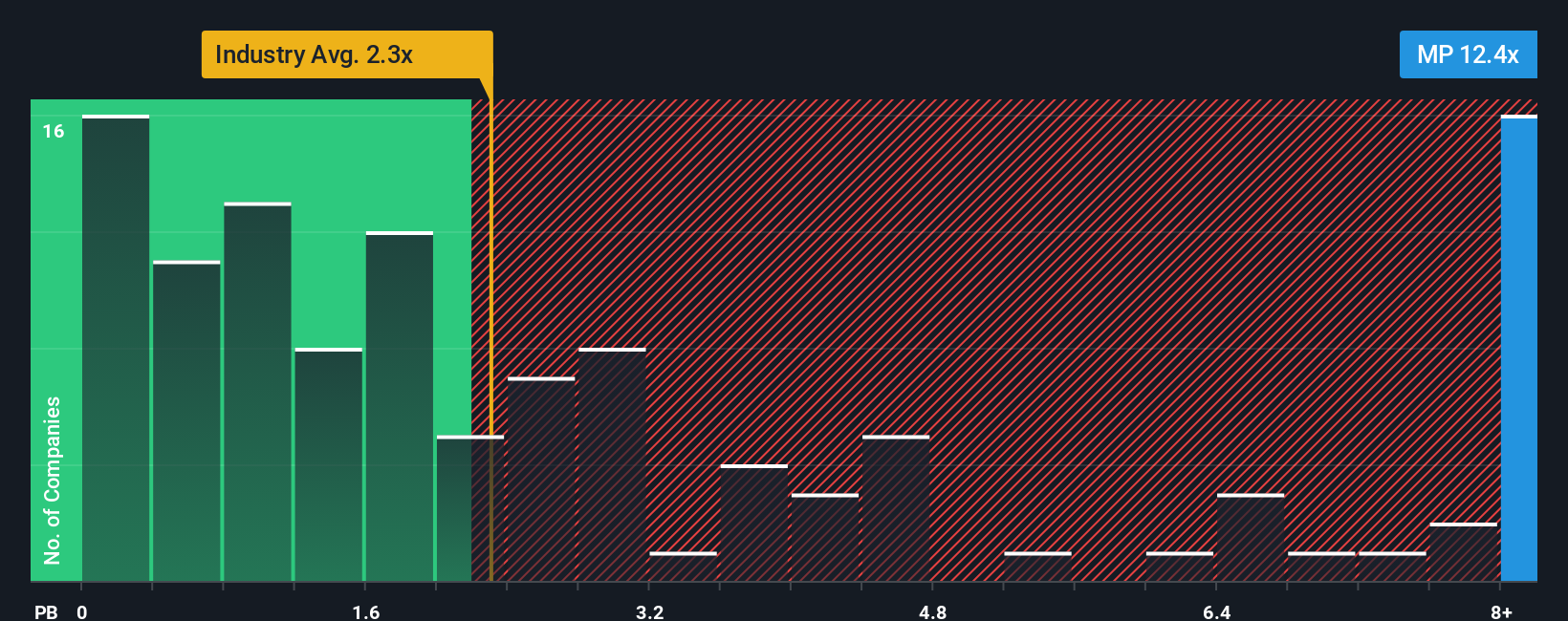

Another View: Book Value Comparison Paints a Different Picture

Looking at MP Materials through the lens of its price-to-book ratio reveals a striking contrast. The company trades at 14.2x book value, far above the US Metals and Mining industry average of 2.4x. While this suggests strong investor confidence, it also signals a hefty premium and higher valuation risk if expectations shift. Is this premium justified, or does it leave shares vulnerable to sharp corrections?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MP Materials Narrative

If you think the story should be told differently, or want to dive into the numbers yourself, you can easily craft your own analysis in just minutes. Do it your way.

A great starting point for your MP Materials research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Unlock even more potential for your portfolio by targeting today’s fastest-moving themes. Don’t let standout opportunities pass you by. See what’s gaining momentum now.

- Capture opportunities in transformative medicine and scalable biotech breakthroughs with these 33 healthcare AI stocks.

- Seize the edge in next-generation technology by tapping into these 26 quantum computing stocks, where innovation meets exponential growth.

- Secure compelling returns from assets trading below their value by checking out these 875 undervalued stocks based on cash flows before others catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MP

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives