- United States

- /

- Metals and Mining

- /

- NYSE:MP

A Look at MP Materials’s Valuation Following Major U.S.-Saudi Rare Earth Joint Venture Announcement

Reviewed by Simply Wall St

MP Materials (NYSE:MP) just announced a high-profile joint venture with the U.S. Department of War and Saudi Arabia’s Maaden to build a rare earth refinery in the Kingdom. This strategic move elevates MP’s role in diversifying and securing global rare earth supply chains.

See our latest analysis for MP Materials.

Momentum around MP Materials has accelerated with headline-grabbing partnerships and a surge in investor interest, including a fresh strategic stake from Gina Rinehart. The stock’s latest joint venture news has played straight into strong trends. A year-to-date share price return of 255% and a one-year total shareholder return of 187% reflect mounting optimism about MP’s expanding global role and growth prospects.

If you want to spot other companies expanding rapidly and catching institutional attention, now’s the perfect chance to discover fast growing stocks with high insider ownership

Yet with MP Materials’ rapid ascent and bullish forecasts, are investors facing an undervalued play on strategic minerals, or has the market already priced in every bit of future upside? Is this a fresh buying opportunity, or has optimism run ahead of fundamentals?

Most Popular Narrative: 27.9% Undervalued

With MP Materials trading at $58.21 at the last close, the most popular narrative sets a fair value notably higher, suggesting significant upside based on its anticipated growth and industry positioning.

The company is expanding its vertically integrated processing and magnet manufacturing capacity with the "10X" plant and a modular recycling facility. Along with significant CapEx support from Apple and the DoD, these initiatives are expected to capture more value-added margins and may improve net profit and operating leverage as downstream operations ramp up.

Curious how this fair value is calculated? There is one standout metric the narrative relies on, promising a rapid rise in profits and margins few expect. Want to find out which aggressive projections underpin these targets? Read the narrative in full to see what is driving such an optimistic view.

Result: Fair Value of $80.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid expansion plans and heavy reliance on a small number of major customers mean that unexpected delays or order changes could challenge MP's growth story.

Find out about the key risks to this MP Materials narrative.

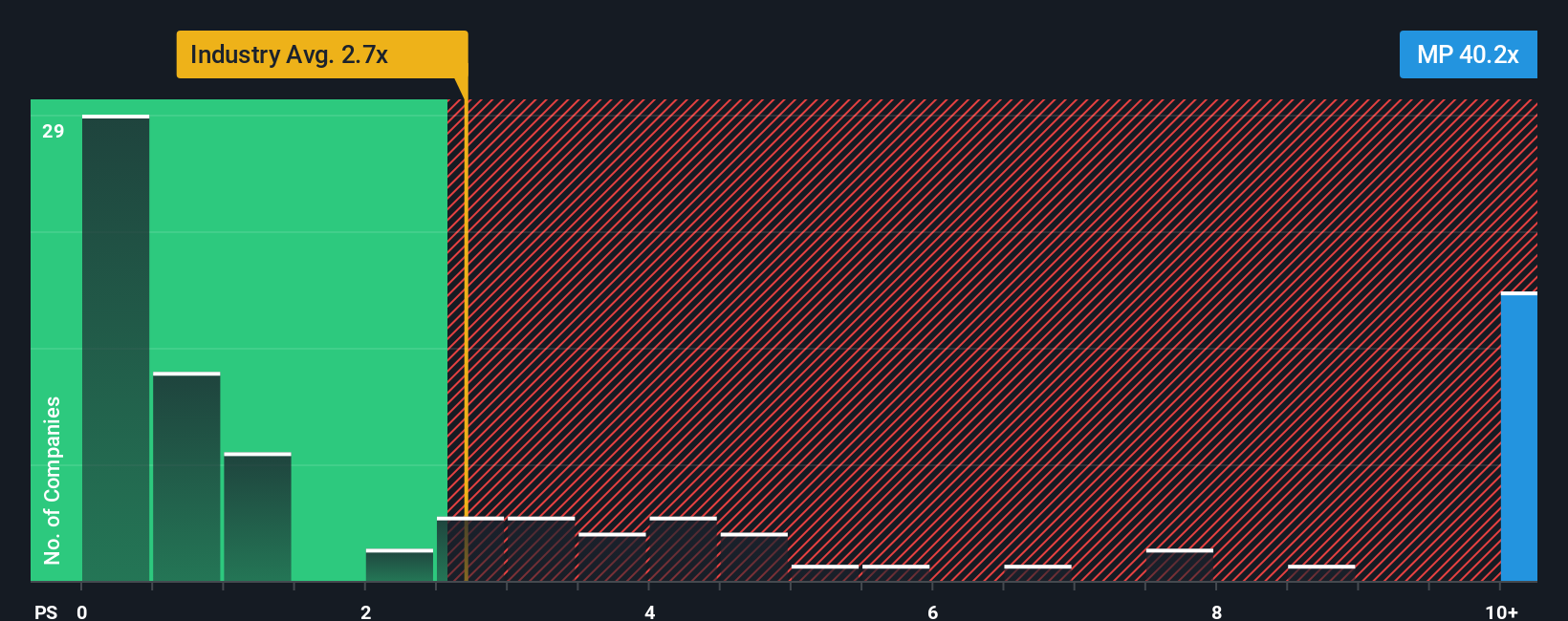

Another View: Looking at Market Comparisons

While analysts project major upside, market-based ratios tell a more cautious story. MP’s price-to-sales ratio sits at an eye-popping 44.3 times, significantly higher than both peers (0.7x) and the US mining industry average (2.1x). If the stock moves closer to its fair ratio of 2.5x, the current price may carry hefty valuation risk. Which side of the story will win out?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MP Materials Narrative

If you want a different perspective or prefer hands-on analysis, you can dive into the data and assemble your own view in just a few minutes. Do it your way

A great starting point for your MP Materials research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let opportunities pass you by. Expand your portfolio with high-potential stocks and untapped themes. Simple Wall Street’s screeners help you spot tomorrow’s winners today.

- Boost your returns with steady income by tapping into these 14 dividend stocks with yields > 3% that consistently deliver yields above 3% in dynamic markets.

- Stay ahead of emerging trends by following these 26 AI penny stocks that are pushing the boundaries of artificial intelligence and automation.

- Capitalize on upside potential by checking out these 924 undervalued stocks based on cash flows that the market is still overlooking based on real cash flow data.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MP

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success