- United States

- /

- Basic Materials

- /

- NYSE:MLM

Martin Marietta Materials (MLM): Exploring Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Martin Marietta Materials.

Martin Marietta Materials has kept up its positive momentum, with the share price up more than 22% year-to-date and its three-year total shareholder return reaching an impressive 73%. Recent gains reflect ongoing optimism about long-term infrastructure spending and stable industry demand.

If materials sector strength has your attention, it could be a perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares rising steadily and performance figures impressing analysts, the key question remains: is Martin Marietta Materials undervalued at current levels, or has the market already accounted for its growth potential? Could this be a buying opportunity, or is future momentum priced in?

Most Popular Narrative: 6.5% Undervalued

The current narrative suggests Martin Marietta Materials may be trading below its fair value, as the narrative's fair value calculation outpaces the latest closing price. This difference is driven by strong forward growth projections and an expectation of expanding margins.

Ongoing adoption of advanced cost management, digital tools, and operational efficiency measures, evidenced by record improvements in gross and EBITDA margins, are likely to deliver sustained net margin expansion and higher profitability, even through cyclical slowdowns.

Want a peek behind the curtain? This narrative leans on bold expectations: accelerating earnings growth and margin expansion typically reserved for leaders in faster-moving industries. Hungry to find out which future forecasts give this company its valuation edge? Tap through to see what is setting the price target just above the current share price.

Result: Fair Value of $666.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent affordability issues in residential construction or reduced government infrastructure spending could quickly challenge the positive outlook and growth assumptions for Martin Marietta Materials.

Find out about the key risks to this Martin Marietta Materials narrative.

Another View: Do Multiples Tell a Different Story?

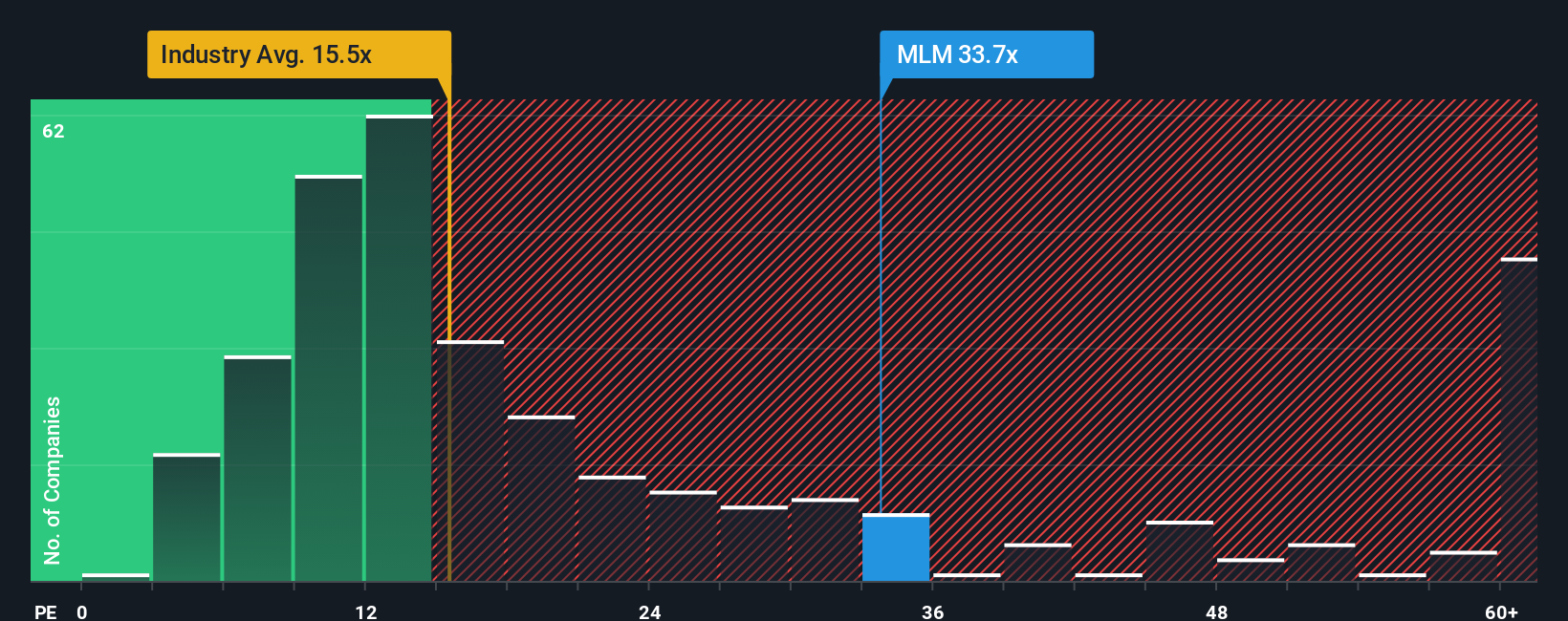

While the fair value model points to potential upside, looking at the company’s price-to-earnings multiple paints a less optimistic picture. Martin Marietta trades at 31.7x earnings, which is much higher than both the US Basic Materials industry average of 15x and peers at 25.8x, and well above its fair ratio of 22.9x. This premium suggests investors are pricing in a lot of growth, which might create valuation risk if expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Martin Marietta Materials Narrative

If you have a different take or want to dig deeper into the numbers yourself, crafting your own perspective is quick and straightforward. Make your own in just a few minutes with Do it your way.

A great starting point for your Martin Marietta Materials research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't limit your portfolio to just one opportunity. The market is full of promising stocks across innovative growth themes, and you’ll want to catch the best right now.

- Supercharge your search by spotting tomorrow's disruptors among these 25 AI penny stocks as they ride the AI wave into new industries and applications.

- Unlock steady dividend income from companies with reliable yields using these 15 dividend stocks with yields > 3% as your starting point.

- Catch the next wave in digital finance by exploring growth stories in blockchain with these 81 cryptocurrency and blockchain stocks before they make headlines.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MLM

Martin Marietta Materials

A natural resource-based building materials company, supplies aggregates and heavy-side building materials to the construction industry in the United States and internationally.

Mediocre balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026