- United States

- /

- Basic Materials

- /

- NYSE:MLM

Martin Marietta Materials (MLM): Evaluating Valuation After a Steady Three-Year Share Price Climb

Reviewed by Simply Wall St

Martin Marietta Materials (MLM) has quietly kept climbing, with shares up about 5% over the past month and nearly 24% this year, as investors focus on steady infrastructure and construction demand.

See our latest analysis for Martin Marietta Materials.

At around $633.94 a share, that solid year to date share price return of roughly 24% and a three year total shareholder return near 91% suggest investors are steadily pricing in durable infrastructure growth rather than a one quarter story.

If Martin Marietta’s steady climb has you thinking about what else could benefit from long term spending cycles, it might be worth exploring aerospace and defense stocks as another pocket of potential opportunity.

Yet with shares hovering just below analyst targets and trading at a premium to some peers, the key question now is whether Martin Marietta still offers upside or if the market has already priced in years of growth.

Most Popular Narrative: 4.9% Undervalued

With Martin Marietta last closing at $633.94 versus a narrative fair value of about $666, the story being priced in is one of steady, compounding strength rather than a quick trade.

The exchange of cement and ready mix assets for high quality aggregate operations in Virginia, Missouri, Kansas, and Vancouver, BC, strategically increases Martin Marietta's exposure to advantaged geographies with strong barriers to entry and pricing power, expected to enhance margins and support stable earnings growth over time.

Want to see how this margin story scales over time? The narrative focuses on disciplined growth, a richer business mix, and a future earnings multiple usually reserved for market darlings. Curious which specific assumptions are carrying most of that valuation weight, and how long they need to hold for the math to work in full? Dive into the details behind that fair value calculation.

Result: Fair Value of $666.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on continued infrastructure funding and stable construction demand. At the same time, tighter regulation or a slower housing recovery could quickly undermine those margin and growth assumptions.

Find out about the key risks to this Martin Marietta Materials narrative.

Another View: Market Ratios Flash a Different Signal

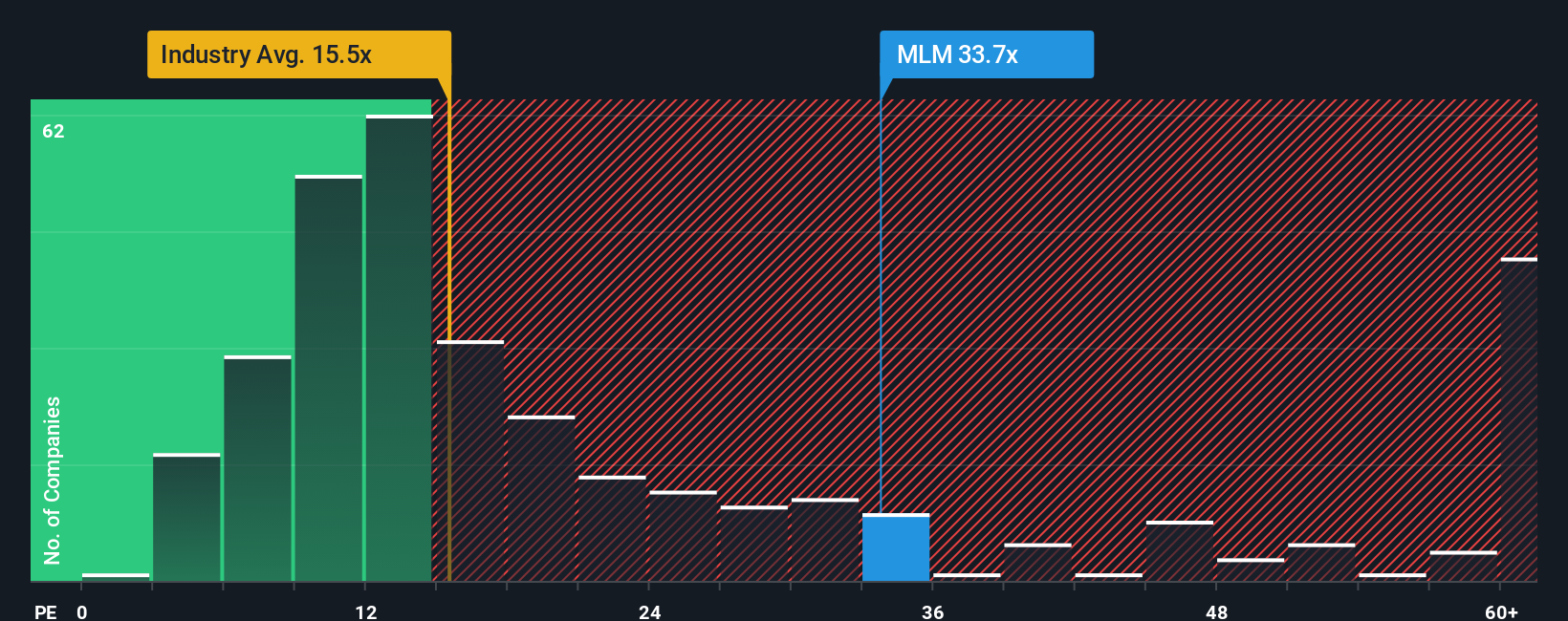

While the narrative fair value suggests Martin Marietta is about 4.9% undervalued, the market is paying a far richer price tag on earnings. At 32.3 times earnings versus a fair ratio of 23.2 times, and above both peer and global industry averages, the stock looks stretched rather than cheap. Is this simply confidence in the story, or optimism running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Martin Marietta Materials Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can build a customized narrative in under three minutes, Do it your way.

A great starting point for your Martin Marietta Materials research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take the next step now and broaden your opportunity set with focused stock ideas that match your strategy before the market moves on without you.

- Capture potential mispricings by targeting companies flagged as undervalued through these 913 undervalued stocks based on cash flows and position yourself early in the re rating story.

- Focus on powerful technology trends by identifying innovation driven names using these 24 AI penny stocks.

- Strengthen your income stream by filtering for reliable payers via these 12 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MLM

Martin Marietta Materials

A natural resource-based building materials company, supplies aggregates and heavy-side building materials to the construction industry in the United States and internationally.

Mediocre balance sheet with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion