- United States

- /

- Basic Materials

- /

- NYSE:MLM

Martin Marietta Materials (MLM): Assessing Valuation After Upbeat Earnings and Raised 2025 Outlook

Reviewed by Simply Wall St

Martin Marietta Materials (MLM) just posted third quarter results that topped forecasts, with both revenue and net income rising compared to last year. The company also raised its outlook for 2025, which signals momentum heading into next year.

See our latest analysis for Martin Marietta Materials.

It’s been an eventful stretch for Martin Marietta Materials, with upbeat earnings and a newly raised dividend giving investors reasons for optimism. While the stock recently pulled back alongside the broader market, reflected in a 1-month share price return of -8.33%, momentum over the longer term remains positive. This is highlighted by a year-to-date share price gain of nearly 18% and a healthy 3-year total shareholder return of about 75%. These steady gains suggest the market is rewarding Martin Marietta’s strong results and upbeat guidance, even if short-term volatility persists.

If recent results have you curious about other potential market leaders, it’s a great time to broaden your scope and discover fast growing stocks with high insider ownership

With shares still trading below analyst targets and upbeat outlooks energizing the stock, investors now face a key question: is this a rare window to buy at a relative value, or has the market already priced in future gains?

Most Popular Narrative: 9.6% Undervalued

With Martin Marietta Materials closing at $602.13, the current consensus narrative estimates fair value at $666.29. This price target could suggest significant upside if its projections play out. The real intrigue lies in the specific business drivers behind this calculation, especially as analysts balance robust infrastructure spending with pockets of macro uncertainty.

Sustained infrastructure investment, demographic shifts, and strategic asset swaps position the company for stable earnings growth and increased pricing power in key markets. Operational efficiencies, digital initiatives, and targeted acquisitions support margin expansion, revenue diversification, and greater resilience through economic cycles.

Want to know what’s fueling this potential upside? There’s a bold set of expectations for future profits and the company’s margin power, driven by some eye-catching quantitative targets. Which assumptions truly move the needle for Martin Marietta’s projected value? Dig into the full narrative to see the numbers and reasoning that set this fair value apart.

Result: Fair Value of $666.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, particularly if infrastructure spending slows or if persistent affordability issues weaken residential construction demand. These factors could temper Martin Marietta’s growth prospects.

Find out about the key risks to this Martin Marietta Materials narrative.

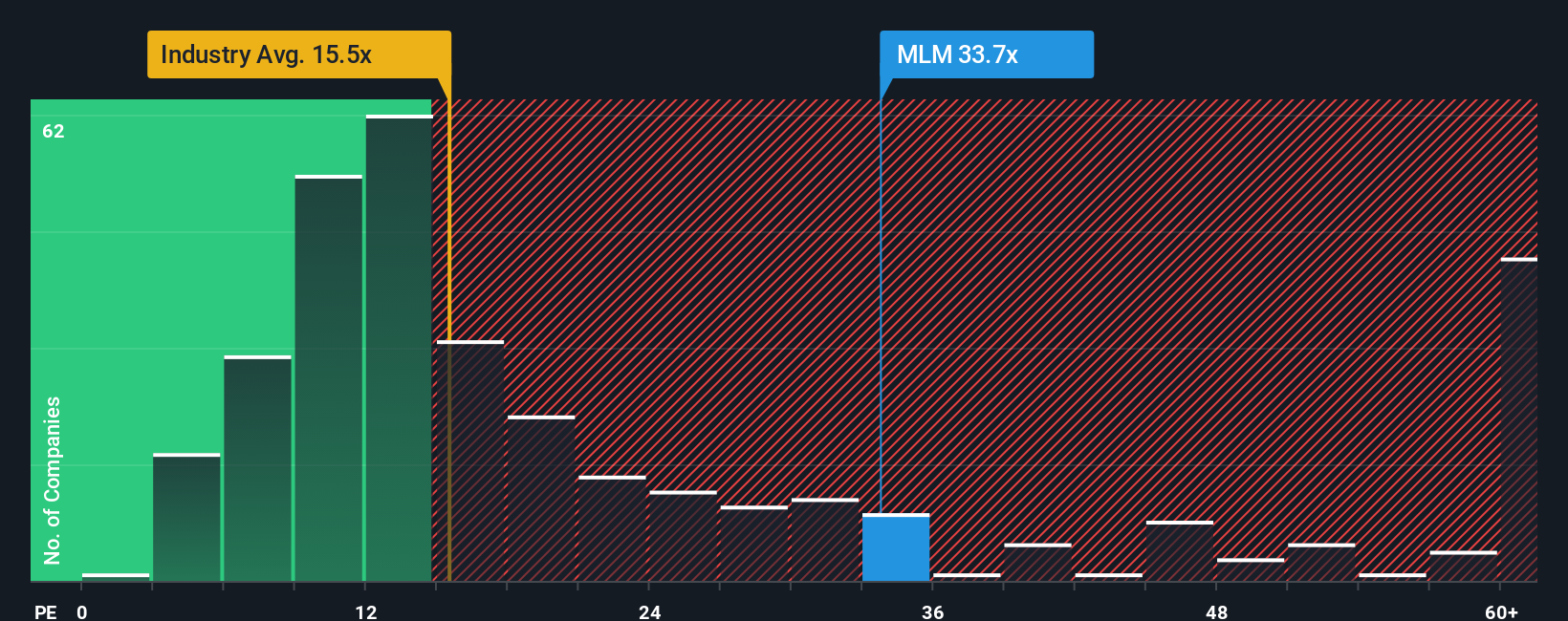

Another View: The Price-to-Earnings Perspective

While analysts argue Martin Marietta's stock looks undervalued based on projected growth, the actual market valuation tells a more expensive story. Its price-to-earnings ratio stands at 30.7x, which is well above both the global industry average of 15.1x and a fair ratio of 22.9x. This gap suggests investors are paying a steep premium for expected future gains. Is the optimism warranted, or could risks weigh on those high hopes?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Martin Marietta Materials Narrative

If you want to dive deeper or see things differently, you can quickly craft your own view using the data in just a few minutes. Do it your way

A great starting point for your Martin Marietta Materials research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Give yourself a real advantage by acting now, not later. The Simply Wall Street Screener unlocks opportunities you might otherwise overlook. Seize your edge today.

- Capture market growth through these 882 undervalued stocks based on cash flows offering strong fundamentals and attractive value right now.

- Access income potential by reviewing these 15 dividend stocks with yields > 3% with robust yields and healthy payout consistency.

- Stay ahead of financial innovation by monitoring these 82 cryptocurrency and blockchain stocks focused on blockchain, digital assets, and tomorrow’s payment trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MLM

Martin Marietta Materials

A natural resource-based building materials company, supplies aggregates and heavy-side building materials to the construction industry in the United States and internationally.

Mediocre balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives