- United States

- /

- Basic Materials

- /

- NYSE:MLM

Assessing Martin Marietta Materials (MLM): Is the Current Valuation Justified?

Reviewed by Simply Wall St

See our latest analysis for Martin Marietta Materials.

Martin Marietta Materials has delivered a 21.7% share price return so far this year, with momentum boosted by optimism around growth in construction demand and ongoing infrastructure investments. While the one-year total shareholder return of 9.6% is steady, the three-year and five-year total returns of 87% and 141% show why long-term holders have stayed confident as the stock rides the recent upward trend.

If you’re wondering what other stocks have been capturing attention lately, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading near recent highs and analyst targets only modestly above current levels, investors are left to ask: Is Martin Marietta Materials undervalued, or is the market already pricing in the company’s next leg of growth?

Most Popular Narrative: 5.6% Undervalued

Martin Marietta Materials’ current share price is only slightly below the most popular narrative’s estimate of fair value, highlighting a narrow margin between market and narrative expectations.

Sustained, multi-year demand for aggregates is expected due to ongoing U.S. federal and state infrastructure investment. State and local highway, bridge, and tunnel contract awards have recently hit record highs. Anticipated extensions to federal spending packages would further increase revenue visibility and support continued top-line and EBITDA growth.

Want to know what’s driving this rare valuation premium for a construction materials stock? The secret ingredient is bold assumptions about future profit expansion and margin gains. Curious how high analysts see earnings climbing, or what kind of revenue growth is baked in? Find out which numbers have analysts betting on an above-average multiple and discover why this fair value might surprise you.

Result: Fair Value of $658 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

Still, any slowdown in housing construction or delays in future infrastructure funding could quickly challenge the bullish narrative and change market expectations for Martin Marietta Materials.

Find out about the key risks to this Martin Marietta Materials narrative.

Another View: Is the Market Getting Ahead of Itself?

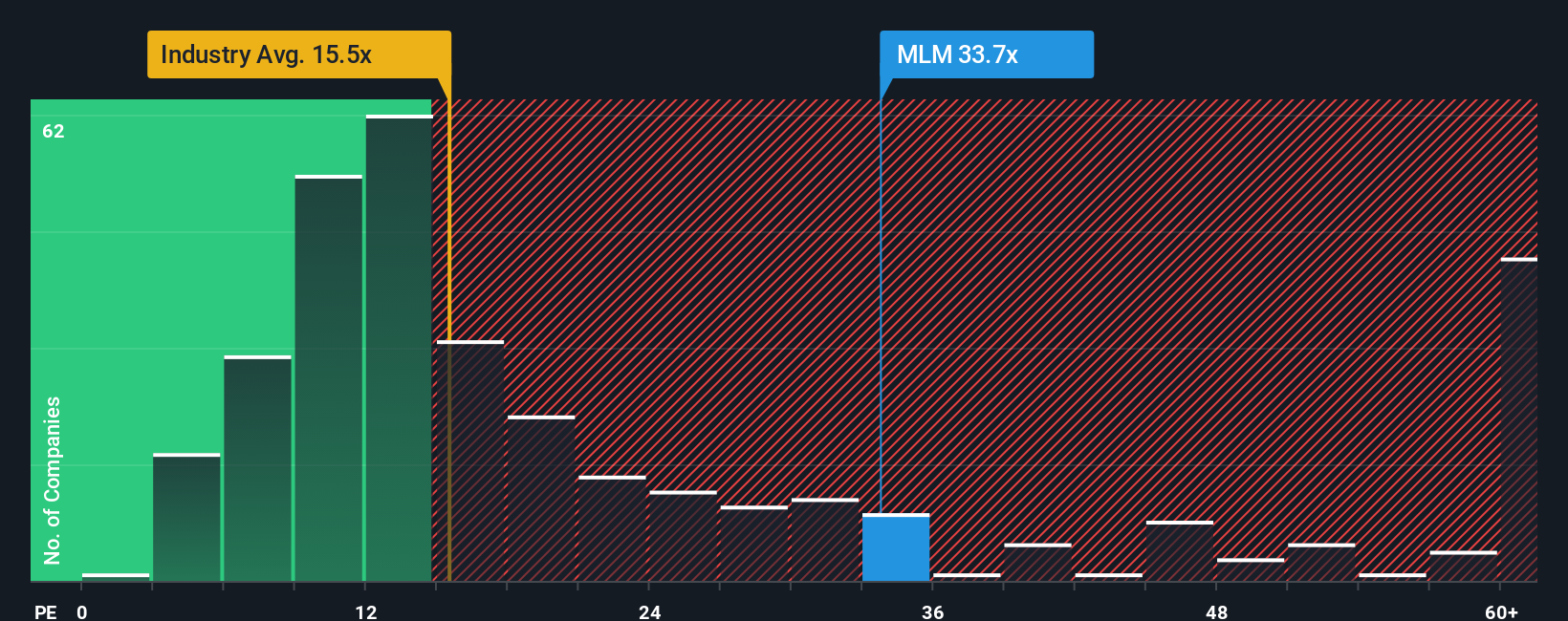

Looking at how Martin Marietta Materials is priced compared to its industry, the company trades at a price-to-earnings ratio of 34.1x. This is meaningfully higher than both industry peers at 26.2x and the broader global sector at 15.4x. The ratio is also well above the fair ratio of 22.9x, suggesting the market may be pricing in a lot of optimism already. With such a gap, could this premium signal opportunity or just risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Martin Marietta Materials Narrative

If you see the story differently or want to dig into the numbers for yourself, you can craft your own Martin Marietta Materials outlook in just a few minutes with Do it your way.

A great starting point for your Martin Marietta Materials research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investing is about seizing timely opportunities across different sectors and themes. Don't wait on the sidelines; use these handpicked screeners to uncover stocks that could fit your strategy before the crowd catches on.

- Capture reliable income potential by checking out these 17 dividend stocks with yields > 3% offering yields above 3% and steady returns.

- Tap into technological breakthroughs and stay ahead of market trends with these 27 AI penny stocks powering tomorrow’s innovations.

- Strengthen your portfolio with value by seeking out these 877 undervalued stocks based on cash flows trading below their intrinsic worth based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MLM

Martin Marietta Materials

A natural resource-based building materials company, supplies aggregates and heavy-side building materials to the construction industry in the United States and internationally.

Mediocre balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives