- United States

- /

- Paper and Forestry Products

- /

- NYSE:MAGN

Magnera (MAGN): Loss Narrows to -$1.63 EPS, Challenging Bearish Narratives on Profitability Path

Reviewed by Simply Wall St

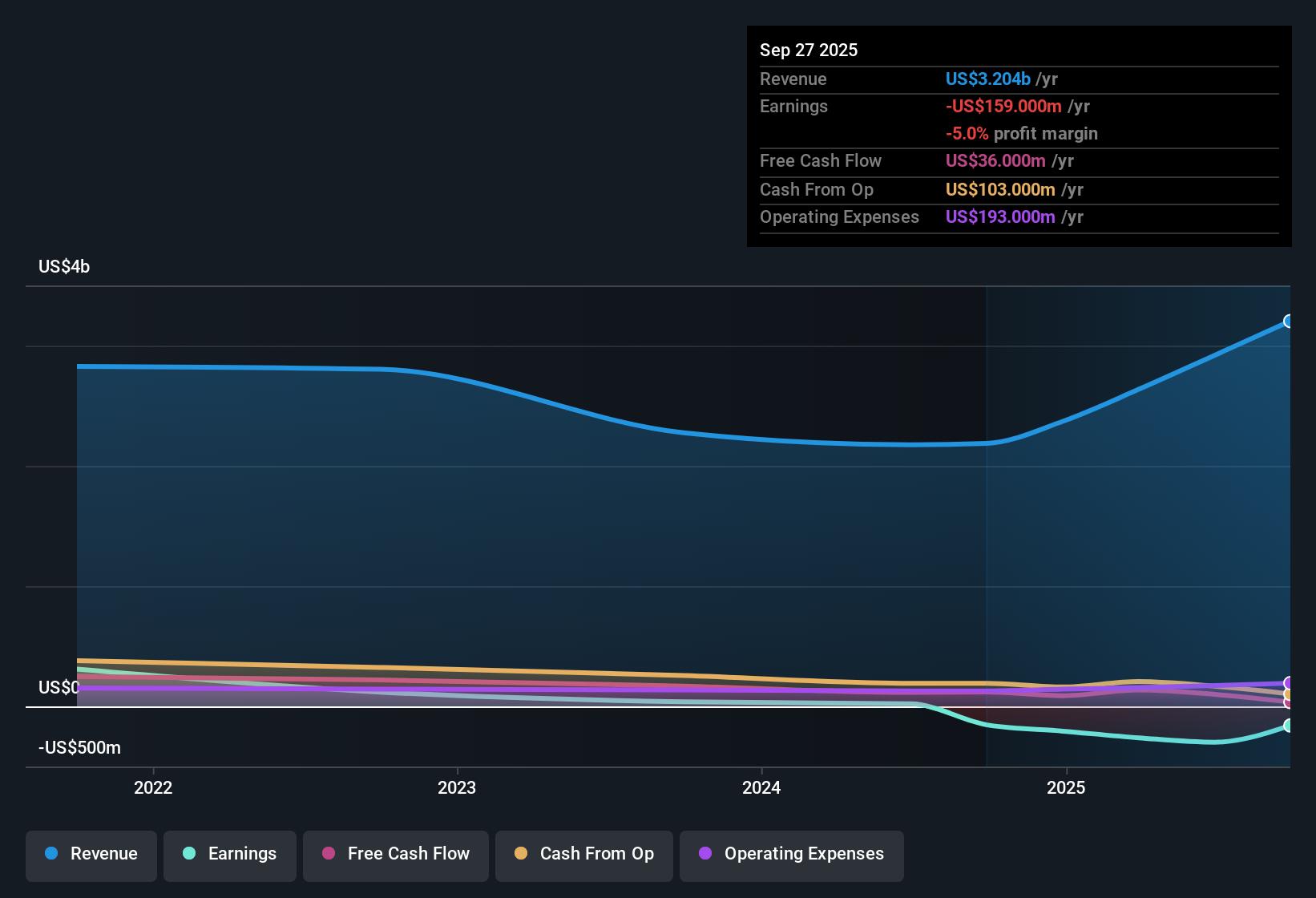

Magnera (MAGN) just posted its FY 2025 results, reporting revenue of $1.7 billion and a basic EPS of -$1.63. Net income stood at -$58 million for the second half of the year. Looking back, the company has seen revenue climb from $1.1 billion in the second half of FY 2024 to $1.7 billion in the latest half, as basic EPS improved from -$5.03 to -$1.63 during the same period. Margins remain under pressure, but investors are watching for signs of a turnaround in the numbers.

See our full analysis for Magnera.Next up, we will see how these figures stack up against the dominant community narratives and the expectations shaping Magnera’s outlook.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profitability Gap Still Widening

- Trailing-twelve-month net income stood at -$159 million, with losses rising at an 81.1% rate annually over the past five years.

- While revenue climbed to $3.2 billion, Magnera’s forecasted 103% earnings growth per year is expected to push the company toward profitability within three years. This strongly supports the claim that bulls see long-term upside despite ongoing unprofitability.

- Earnings remain negative now, but bullish investors argue this pace of growth outstrips most sector peers.

- Consensus expects profit margins to turn positive before most value competitors, based on these annualized growth rates.

Shares Trade at Deep Discount

- Magnera’s share price of $13.78 is about 32% below its DCF fair value estimate of $20.30. Its price-to-sales ratio of 0.2x is lower than both peer (0.5x) and industry (0.3x) averages.

- Investors focusing on the bearish side emphasize that, despite trading at a discount, Magnera's continued unprofitability and a five-year track record of losses challenge the thesis that cheap valuation alone signals a bargain.

- Even as the stock screens as undervalued, sustained negative earnings mean value traps pose real risk for holders.

- Bears highlight that price-to-sales alone cannot compensate if profit margins fail to recover in line with expectations.

Revenue Growth Lags Industry Trend

- Annual revenue is forecast to grow at just 3% per year, trailing the broader US market’s 10.5% revenue growth rate.

- The prevailing market view ties Magnera’s value to defensive sector positioning and product diversity, but notes that limited top-line expansion could cap upside.

- Consensus underscores that slower growth makes future profit targets more dependent on margin improvement rather than raw sales expansion.

- Context for new investors: enduring market presence is not the same as high growth, so expectations should be set accordingly.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Magnera's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Magnera’s ongoing unprofitability, sluggish top-line growth, and reliance on future margin improvements leave its outlook less stable than market leaders.

If you’re looking for steadier performers that have proven their ability to deliver consistent results, check out stable growth stocks screener (2075 results) for reliable companies with a strong track record through changing cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MAGN

Undervalued with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success