- United States

- /

- Chemicals

- /

- NYSE:LXU

LSB Industries (LXU) Losses Narrow 31.1% Annually, Testing Investor Optimism on Turnaround

Reviewed by Simply Wall St

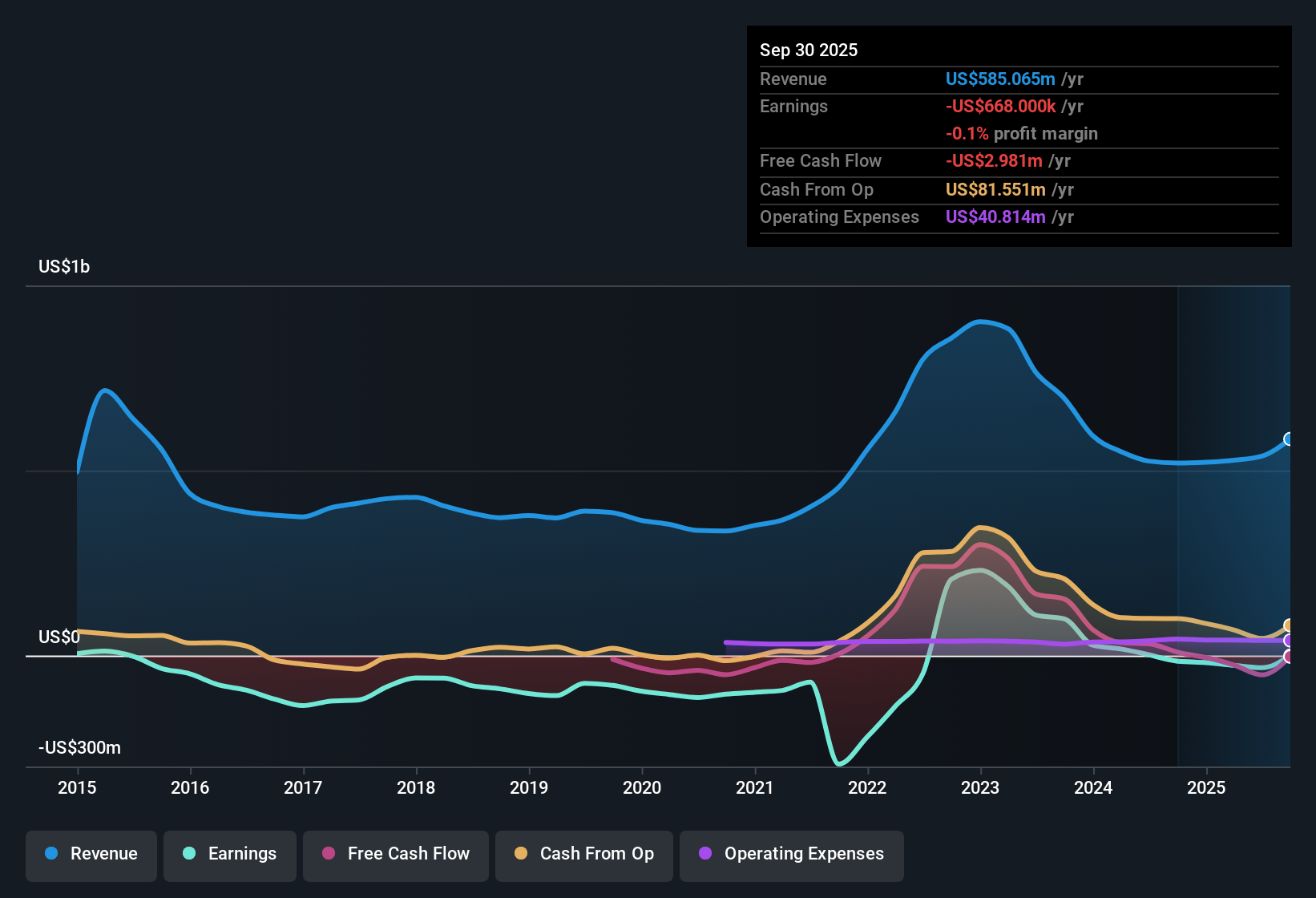

LSB Industries (LXU) remains unprofitable but has made noticeable progress, reducing its losses by an average of 31.1% each year over the last five years. Looking ahead, analysts see potential in the company, with earnings forecasted to grow 35.62% per year and profitability expected within the next three years. Despite trailing broad US market growth rates, shares trade at $8.28, a notable discount to the estimated fair value of $12.91. LXU’s shift toward profitability and perceived value presents a compelling angle for investors.

See our full analysis for LSB Industries.Now, let’s see how these earnings results stack up against the main market narratives. This is where the numbers and the stories meet.

See what the community is saying about LSB Industries

Margins Expand Toward Positive Territory

- Profit margins are projected to increase from -6.2% today to 6.3% within three years, signaling a key shift toward consistent profitability.

- Analysts' consensus view highlights margin expansion as a critical driver for earnings momentum and improved stability.

- Moving sales into higher-margin industrial and decarbonized products, alongside investment in efficiency, strongly supports the optimistic outlook for a swing to positive net income.

- Cost-plus contracts are cushioning the business from commodity price swings. This aligns with the expectation of more stable margins year over year.

Natural Gas Volatility Remains a Key Risk

- LSB’s earnings remain sensitive to fluctuations in natural gas prices, with higher energy costs in the latest quarter partly offsetting the gains from higher production and prices.

- Analysts' consensus view points out that exposure to natural gas and ongoing investment needs could hinder margin progress.

- Critics highlight that while longer-term contracts smooth some revenue swings, heavy capital expenditure for aging plants and decarbonization projects could pressure cash flow and increase debt if returns disappoint.

- Limited diversification in nitrogen-based fertilizers means the company’s fortunes are still closely tied to cyclical agricultural demand, intensifying the impact of input cost spikes.

Valuation Discount Versus DCF Fair Value

- Shares trade at $8.28, which is a notable discount to the $12.91 DCF fair value and also below the Price-to-Sales industry average of 1.2x. This reinforces the case for potential upside if growth targets are met.

- Analysts' consensus view contends the discounted price could represent an opportunity if margin and earnings gains are realized.

- While LXU’s Price-to-Sales ratio of 1x is above the peer average of 0.7x, it remains attractive relative to sector leaders given projected profit growth of 35.62% per year.

- The analyst price target of $10.10 implies 22.0% upside from the current share price, but this depends critically on management executing margin and volume improvements.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for LSB Industries on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique angle on LSB's numbers? In just a few minutes, you can draw your own conclusions and share your perspective. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding LSB Industries.

See What Else Is Out There

LSB Industries faces uncertainty because of its reliance on natural gas prices and significant investment needs, which could strain margins and cash flow.

If you’re seeking businesses with steadier financial footing, check out solid balance sheet and fundamentals stocks screener (1984 results) to spot companies built on healthier balance sheets and less exposed to risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LXU

LSB Industries

Engages in the manufacture, marketing, and sale of chemical products in the United States.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives