- United States

- /

- Paper and Forestry Products

- /

- NYSE:LPX

Louisiana-Pacific (LPX): Examining Current Valuation as Industry Trends Steady the Stock

Reviewed by Simply Wall St

See our latest analysis for Louisiana-Pacific.

Louisiana-Pacific’s 1-year total shareholder return is down 32.2% even as share price losses have started moderating in recent weeks, suggesting that negative momentum may be easing and risk perceptions are beginning to balance out. After a turbulent stretch for building materials stocks, the long-term story still points to impressive growth with a 127.8% five-year total return.

If cyclical swings in the building sector have you rethinking your portfolio, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With Louisiana-Pacific still trading well below analyst price targets despite recovering fundamentals, the question remains: is this an attractive entry point for value-focused investors, or has the market already captured the company’s future growth prospects?

Most Popular Narrative: 29.5% Undervalued

Louisiana-Pacific’s narrative fair value sits at $105.88, far above its last close of $74.66. This suggests significant upside potential, but is it realistic? Analyst and investor attention is focusing on how much momentum sustainable materials and new product adoption can deliver for LPX’s next phase.

*Continued product innovation (e.g., new textures, prefinished offerings, three-dimensional corners) and penetration into under-served segments like manufactured housing and offsite/modular construction expands the company's total addressable market and should enable further market share gains, providing a long runway for top-line and earnings growth.*

Wondering what hidden assumptions are powering this bullish target? The narrative hinges on ambitious profit margin gains and a forward multiple that rivals top growth sectors. Curious about which growth bets the consensus is making to reach that high fair value? Dig deeper to see what underpins these projections.

Result: Fair Value of $105.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in housing starts or a prolonged downturn in OSB pricing could quickly challenge the more optimistic outlook for Louisiana-Pacific.

Find out about the key risks to this Louisiana-Pacific narrative.

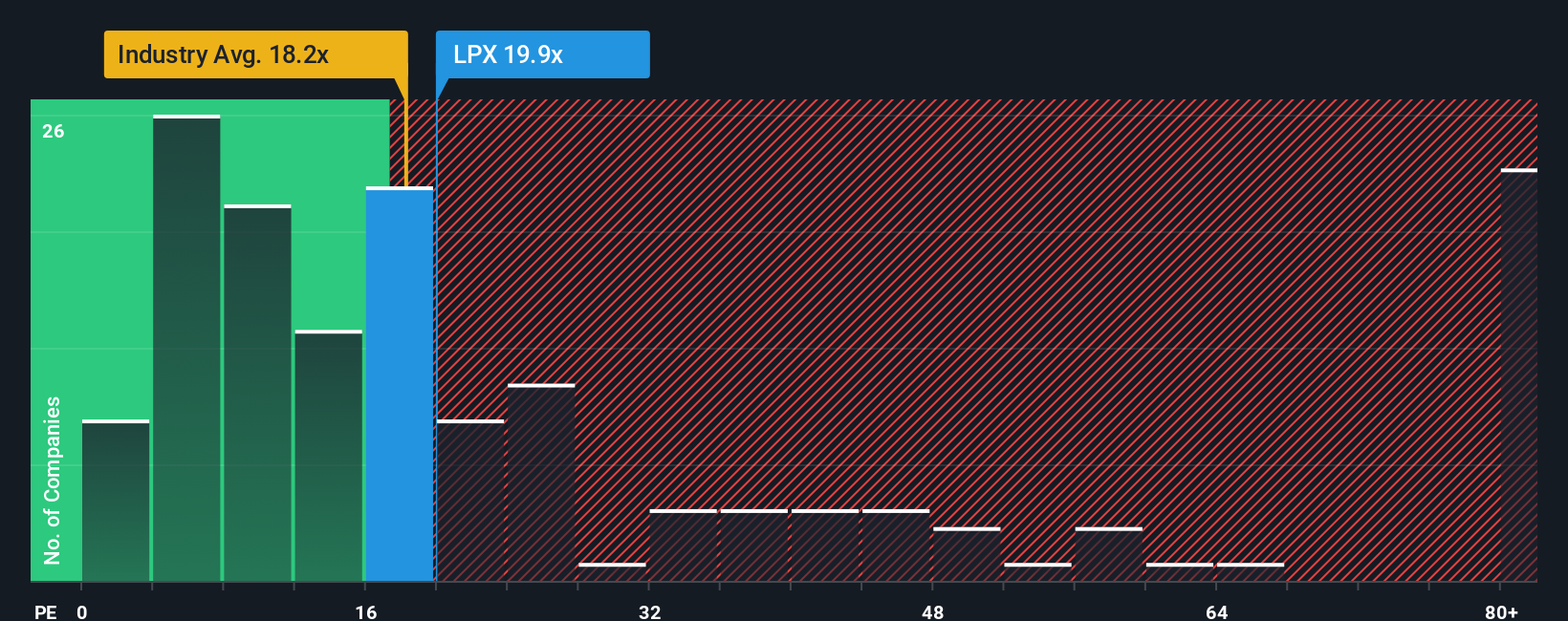

Another View: Taking a Closer Look at PE Ratios

A different approach compares Louisiana-Pacific’s share price to earnings, revealing that it trades at 24.1 times earnings, which is higher than the global industry average of 18.7 but lower than its peer average of 58.7. Interestingly, this is a slight discount to the fair ratio of 25.7, hinting the stock may offer some value. Do these metrics signal lingering upside, or could they hide valuation risks if market expectations shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Louisiana-Pacific Narrative

If you see things differently or want to dig deeper, you can shape your own perspective and build a personalized view in just minutes. Do it your way.

A great starting point for your Louisiana-Pacific research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unlock your next winning opportunity with stocks selected for their growth, innovation, and income potential. These screens highlight sectors and trends you might not have considered yet.

- Spot tomorrow’s standout small caps before the crowd by starting with these 3579 penny stocks with strong financials built on strong financials and high upside potential.

- Accelerate your portfolio with artificial intelligence leaders by tapping into opportunity with these 27 AI penny stocks, powering advances across industries like automation, data analytics, and robotics.

- Target lasting value by reviewing these 901 undervalued stocks based on cash flows, featuring companies the market may be overlooking and offering a strategic edge for value-focused investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LPX

Louisiana-Pacific

Provides building solutions for applications in new home construction, repair and remodeling, and outdoor structure markets.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives