- United States

- /

- Paper and Forestry Products

- /

- NYSE:LPX

A Fresh Look at Louisiana-Pacific (LPX) Valuation as Investor Sentiment Cools

Reviewed by Kshitija Bhandaru

Louisiana-Pacific (LPX) has seen its shares trade within a fairly narrow range over the past week, with no major news or events driving significant movement. Investors might be eyeing the stock's valuation and recent performance for clues about its trajectory.

See our latest analysis for Louisiana-Pacific.

Despite some short-term swings, Louisiana-Pacific’s latest share price of $90.14 still leaves it down over 13% year-to-date, reflecting a market that is cautious on growth prospects even after a strong multi-year run. The total shareholder return over the past three years is a robust 68%, and an impressive 209% over five years, showing that long-term holders have been amply rewarded. However, current momentum appears to be fading as sentiment cools.

If you’re keeping an eye on market shifts, this could be a perfect time to spot the next breakout among fast growing stocks with high insider ownership.

With analyst targets suggesting room for upside and shares trading at a discount to recent highs, the question remains: does Louisiana-Pacific offer genuine value at these levels, or is the market already factoring in future growth?

Most Popular Narrative: 14.4% Undervalued

Louisiana-Pacific’s narrative-driven fair value outpaces the latest close, signaling that the consensus perspective places a higher value on future growth and profitability. This gap spotlights the company as one the market might not have fully recognized yet.

Continued product innovation (for example, new textures, prefinished offerings, three-dimensional corners) and penetration into under-served segments like manufactured housing and offsite/modular construction expands the company's total addressable market and should enable further market share gains, providing a long runway for top-line and earnings growth.

Curious what makes this valuation possible? The answer lies in bold forecasts for future margins, shrinking share count, and an upgrade in profitability. These numbers might surprise even seasoned market-watchers. Get the full story behind these high expectations.

Result: Fair Value of $105.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering weakness in US housing starts and sustained pressure on OSB prices could affect volumes, margins, and the trajectory of future growth.

Find out about the key risks to this Louisiana-Pacific narrative.

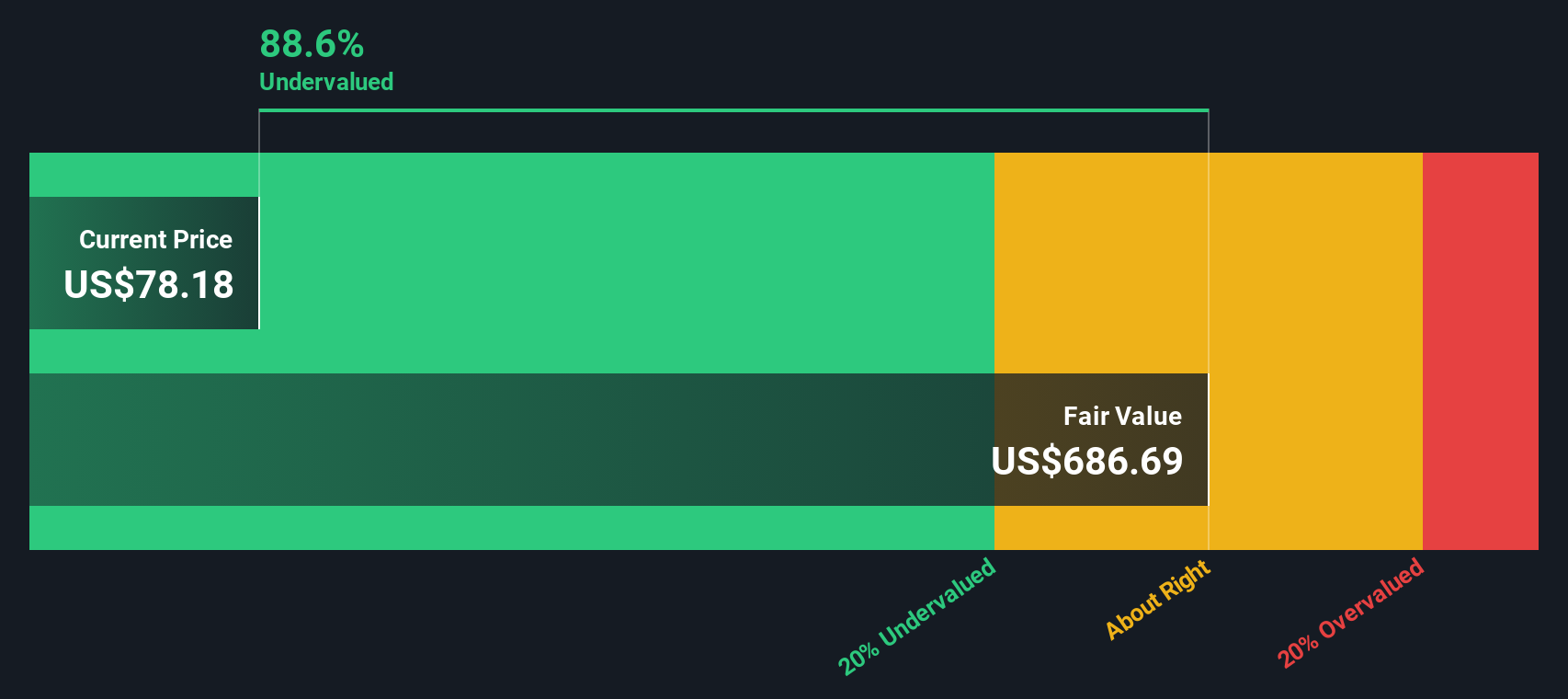

Another View: Discounted Cash Flow Suggests a Higher Risk

While the consensus-based fair value presents Louisiana-Pacific as undervalued, the SWS DCF model tells a very different story. By estimating the company’s future cash flows, this model actually values the shares well below the current price. This suggests investors today may be paying a premium. What if the optimistic projections reflected in consensus targets do not materialize?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Louisiana-Pacific for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Louisiana-Pacific Narrative

If you think there’s a different story in the numbers or want to test your own outlook, it only takes a few minutes to do it your way. Do it your way.

A great starting point for your Louisiana-Pacific research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

You shouldn’t limit yourself to just one stock when there are so many unique opportunities available. Make your next move and stay ahead of the curve.

- Seize growth potential with these 24 AI penny stocks, featuring companies that are redefining industries through machine learning, automation, and real-world artificial intelligence applications.

- Unlock high yield by checking out these 18 dividend stocks with yields > 3%, which includes companies offering reliable returns through consistent and attractive payouts above 3%.

- Capitalize on value plays by seeing which companies appear undervalued based on future cash flows with these 877 undervalued stocks based on cash flows before the rest of the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LPX

Louisiana-Pacific

Provides building solutions for applications in new home construction, repair and remodeling, and outdoor structure markets.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives