- United States

- /

- Basic Materials

- /

- NYSE:LOMA

Assessing Loma Negra (NYSE:LOMA) Valuation After Argentina’s Elections Boost Political Stability and Investor Sentiment

Reviewed by Simply Wall St

The recent congressional elections in Argentina delivered some political clarity, supporting the government's reform agenda. For Loma Negra Compañía Industrial Argentina Sociedad Anónima (NYSE:LOMA), this helped ease uncertainty and set the stage for renewed interest from investors.

See our latest analysis for Loma Negra Compañía Industrial Argentina Sociedad Anónima.

Following a rocky stretch through 2024, Loma Negra’s share price has staged a remarkable turnaround, soaring 27.3% over the past week and 39.2% over the past month, as investor confidence improved sharply after the Argentine elections. Despite volatility earlier this year, its 12.0% total shareholder return over the past twelve months and a robust 76.0% over three years highlight the company’s long-term resilience and upside potential, even as short-term sentiment swings with the political tides.

If renewed optimism around Loma Negra has you rethinking your next move, this is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With sentiment shifting and Loma Negra’s shares rebounding, investors are now faced with a classic question: is this rally just the beginning of renewed upside, or has the market already priced in a brighter future?

Most Popular Narrative: 30.8% Undervalued

At $10.26, Loma Negra Compañía Industrial Argentina Sociedad Anónima trades notably below the narrative’s fair value estimate of $14.82. Analysts indicate significant upside compared to current pricing. With bullish projections for Argentina’s infrastructure and Loma Negra’s future margins, key forward-looking financial assumptions set the backdrop for an optimistic case.

Emerging momentum in bulk cement dispatches linked to industrial, commercial, and large-scale housing developments, combined with early-stage increases in public works across key provinces, positions Loma Negra to gain from accelerated urbanization and infrastructure modernization. This will support revenue expansion and reduce cyclicality.

Curious what’s powering this bold price target? The real story hinges on unprecedented growth projections for sales, profits, and margins, fueled by catalysts rarely seen in the sector. Ready to uncover which metrics push the fair value sharply above the market price? Explore the full narrative to see what makes analysts so optimistic.

Result: Fair Value of $14.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing macroeconomic volatility in Argentina and persistent pressure on pricing in the cement segment could quickly undermine the current optimism for Loma Negra.

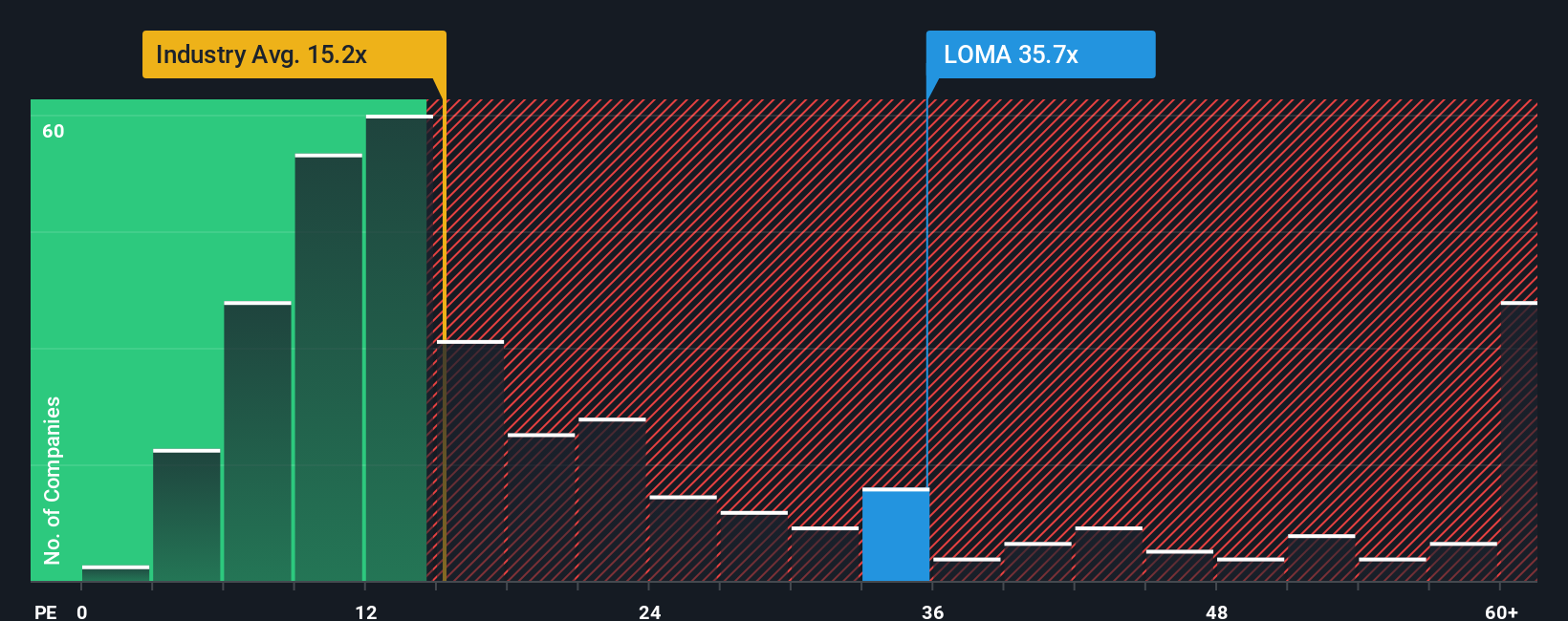

Another View: Price Ratios Flash a Caution Light

While the fair value narrative sees Loma Negra as undervalued, its current price-to-earnings ratio is 33.3x. This is much higher than the global industry average of 15.5x and its peer average of 19x. Even in comparison to a fair ratio of 25.9x, the stock appears expensive, suggesting that recent optimism may already be reflected in its price. Could this indicate more risk than reward at these levels?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Loma Negra Compañía Industrial Argentina Sociedad Anónima Narrative

If you want to dig deeper and see things from your own perspective, you can build your own narrative using the same tools and insights. The process takes just a few minutes, so why not Do it your way?

A great starting point for your Loma Negra Compañía Industrial Argentina Sociedad Anónima research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for the next opportunity to pass you by. Tap into fresh stock picks in booming industries and strengthen your portfolio with greater confidence today.

- Boost your income potential and see which companies are paying strong yields when you check out these 24 dividend stocks with yields > 3%.

- Experience the possibilities at the frontier of technology and uncover growth stories within these 28 quantum computing stocks.

- Spot stocks trading below their true value by starting with these 834 undervalued stocks based on cash flows for opportunities most investors miss.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOMA

Loma Negra Compañía Industrial Argentina Sociedad Anónima

Manufactures and sells cement and its derivatives in Argentina.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives