- United States

- /

- Chemicals

- /

- NYSE:KRO

Even With A 36% Surge, Cautious Investors Are Not Rewarding Kronos Worldwide, Inc.'s (NYSE:KRO) Performance Completely

Kronos Worldwide, Inc. (NYSE:KRO) shareholders would be excited to see that the share price has had a great month, posting a 36% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 31%.

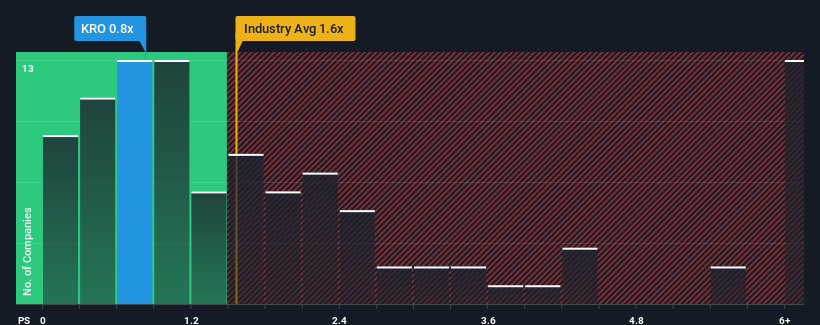

Even after such a large jump in price, it would still be understandable if you think Kronos Worldwide is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.8x, considering almost half the companies in the United States' Chemicals industry have P/S ratios above 1.6x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Kronos Worldwide

What Does Kronos Worldwide's Recent Performance Look Like?

With revenue that's retreating more than the industry's average of late, Kronos Worldwide has been very sluggish. The P/S ratio is probably low because investors think this poor revenue performance isn't going to improve at all. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Kronos Worldwide.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Kronos Worldwide's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 14%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 9.7% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 7.7% each year, which is not materially different.

With this information, we find it odd that Kronos Worldwide is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does Kronos Worldwide's P/S Mean For Investors?

Despite Kronos Worldwide's share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Kronos Worldwide's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Kronos Worldwide, and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Kronos Worldwide, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Kronos Worldwide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:KRO

Kronos Worldwide

Produces and markets titanium dioxide pigments (TiO2) in Europe, North America, the Asia Pacific, and internationally.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives