- United States

- /

- Packaging

- /

- NYSE:IP

International Paper (IP): Five Years of Losses Challenge Forecasts for Profit Turnaround

Reviewed by Simply Wall St

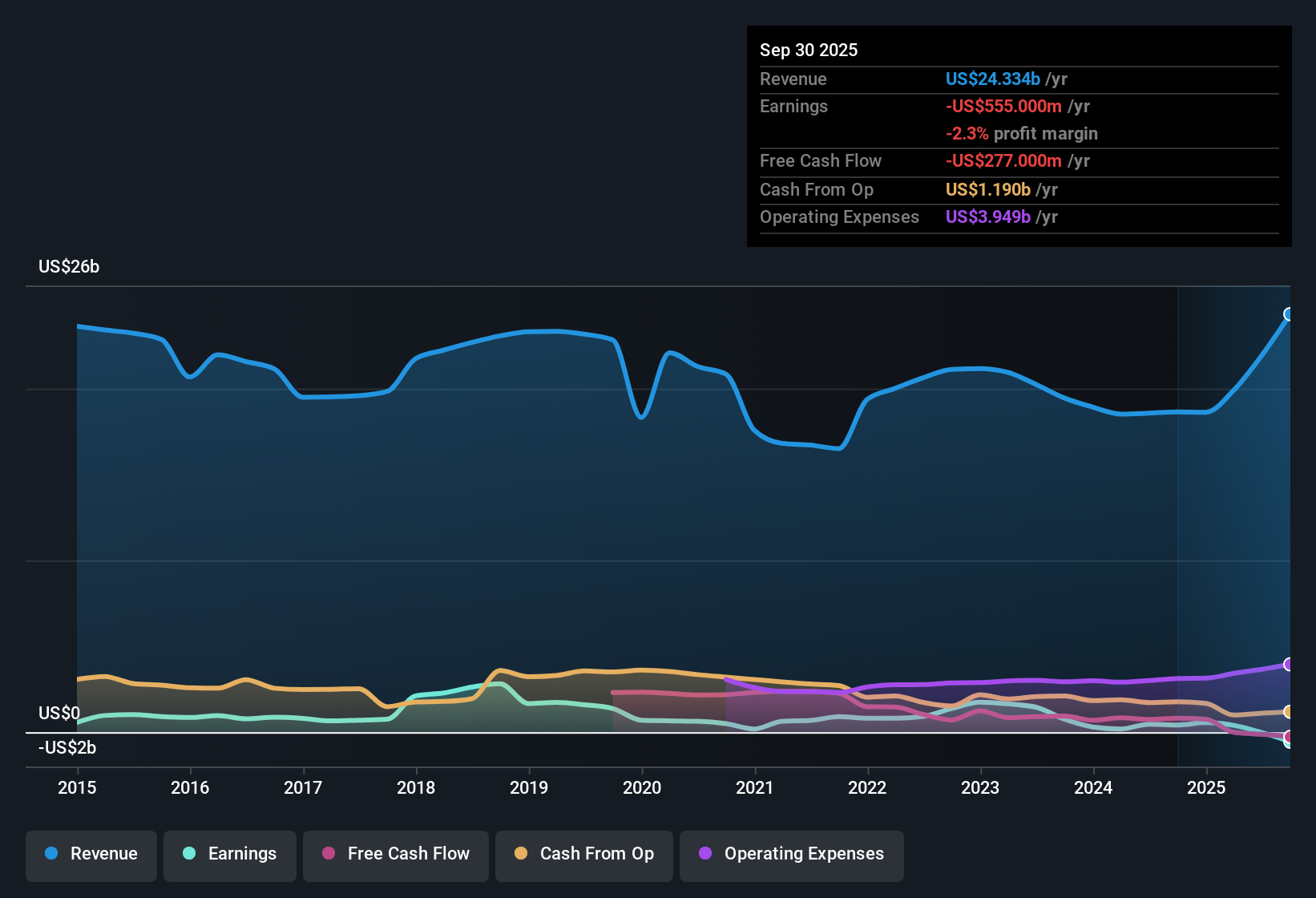

International Paper (IP) remains in the red, with net losses having worsened at an annual rate of 10.5% over the last five years and profit margins showing little sign of improvement. Despite a sluggish past, the market is turning its attention to forecasts that see earnings rebounding by 19.92% per year and the company potentially returning to profitability within three years. With a Price-To-Sales Ratio of 0.9x, below peers and in line with the US Packaging industry, the current share price of $38.63 is notably below the estimated fair value of $78.34. This raises questions about a possible value opportunity even amid the company’s financial challenges.

See our full analysis for International Paper.The next section dives into how these headline numbers compare with prevailing market narratives. This will reveal where expectations align and where the story may take a turn.

See what the community is saying about International Paper

Margin Expansion Hinges on Cost Savings

- Analysts forecast that profit margins will shift from -0.1% today to 7.1% in three years, pointing to a dramatic turnaround if cost efficiency plans work as intended.

- Analysts' consensus view argues that aggressive asset divestitures and investments in automation are essential to boosting margins and competitiveness.

- Portfolio optimization and mill upgrades are expected to cut operating costs and support margin improvement over several years.

- However, persistent challenges such as reliability issues and integration risks could stall these gains, leaving earnings quality exposed if targets slip.

Consensus narrative highlights the unusual gap between International Paper's margin ambitions and its past execution, prompting investors to weigh if execution risks will outweigh promised efficiency gains. 📊 Read the full International Paper Consensus Narrative.

Share Dilution Adds a Caution Flag

- Analysts expect shares outstanding to rise by 7.0% per year over the next three years, a notable dilution rate for investors focused on per-share growth.

- Analysts' consensus view stresses that aggressive transformation requires funding, making dilution and dividend sustainability top risks to long-term returns.

- The strategic case for investing hinges on the company's ability to offset dilution by achieving outsized earnings growth.

- If profit improvement or free cash flow generation lags expectations, dilution could undermine per-share gains and pressure future payout policy.

DCF Valuation Implies Deep Discount

- International Paper's share price of $38.63 is over 50% below its DCF fair value estimate of $78.34, and its Price-To-Sales Ratio of 0.9x is a substantial discount to peer averages.

- Analysts' consensus view frames this apparent undervaluation as a reward, but prices in substantial execution risk and disagreement in earnings forecasts.

- The consensus analyst price target stands at $51.65, which is materially below modelled fair value and reflects ongoing market caution.

- Achieving the fair value hinges on restoring profitability and meeting ambitious margin targets, with the risk of persistent market or operational setbacks keeping investors cautious.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for International Paper on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at these figures from a fresh angle? Craft your own take and see how your viewpoint fits the bigger picture in just minutes. Do it your way

A great starting point for your International Paper research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

International Paper’s reliance on aggressive restructuring and dilution highlights its struggle for consistent profitability and exposes investors to margin and cash flow risks.

If you want companies showing steadier revenue and earnings, focus on stable growth stocks screener (2113 results) which are built to perform across good times and bad.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IP

International Paper

Produces and sells renewable fiber-based packaging and pulp products in North America, Latin America, Europe, and North Africa.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives