- United States

- /

- Chemicals

- /

- NYSE:HUN

Huntsman (HUN): Examining Valuation After Q3 Earnings Miss and Dividend Cut

Reviewed by Simply Wall St

Huntsman (HUN) shares responded as the company posted its third quarter earnings, revealing lower sales and ongoing net losses compared to the previous year. The company also announced a reduction in its quarterly dividend.

See our latest analysis for Huntsman.

Huntsman’s share price has been on a wild ride, with a sharp 50% drop year-to-date and a staggering 52% total return decline over the past twelve months. This reflects tough industry conditions and the impact of weaker earnings. While earnings news and the latest dividend cut have driven recent volatility, the modest rebound over the past week and month is not enough to signal a change in momentum just yet.

If you’re looking to branch out beyond rebounds and turnarounds like this, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

The question now is whether Huntsman’s steep decline leaves it undervalued in the eyes of investors, or if the latest earnings and dividend cut mean that any hopes for a rebound are already reflected in the price.

Most Popular Narrative: 16.5% Undervalued

With Huntsman closing at $8.70 and the most popular narrative assigning a fair value of $10.42, the stage is set for a potentially significant upside if these assumptions hold. But what’s driving this optimistic number? Let’s dig into the key thinking behind it.

Demand for Huntsman's advanced materials and polyurethane-based products is expected to benefit from accelerating global trends in sustainability, energy efficiency, and lightweighting, especially as infrastructure and construction activity resumes, and the EV/clean tech markets expand. This supports potential for higher long-term revenue growth and greater market share.

What’s fueling such a bullish outlook for Huntsman? There is one aggressive forecast for profit margins hiding behind the scenes, along with a valuation multiple that rivals tech darlings. See which growth bets could rewrite Huntsman’s fortunes. There is more to this narrative than meets the eye.

Result: Fair Value of $10.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent overcapacity in polyurethanes or intensified overseas competition could further pressure Huntsman’s margins and challenge the prospects for a sustained recovery.

Find out about the key risks to this Huntsman narrative.

Another View: What Does the DCF Model Say?

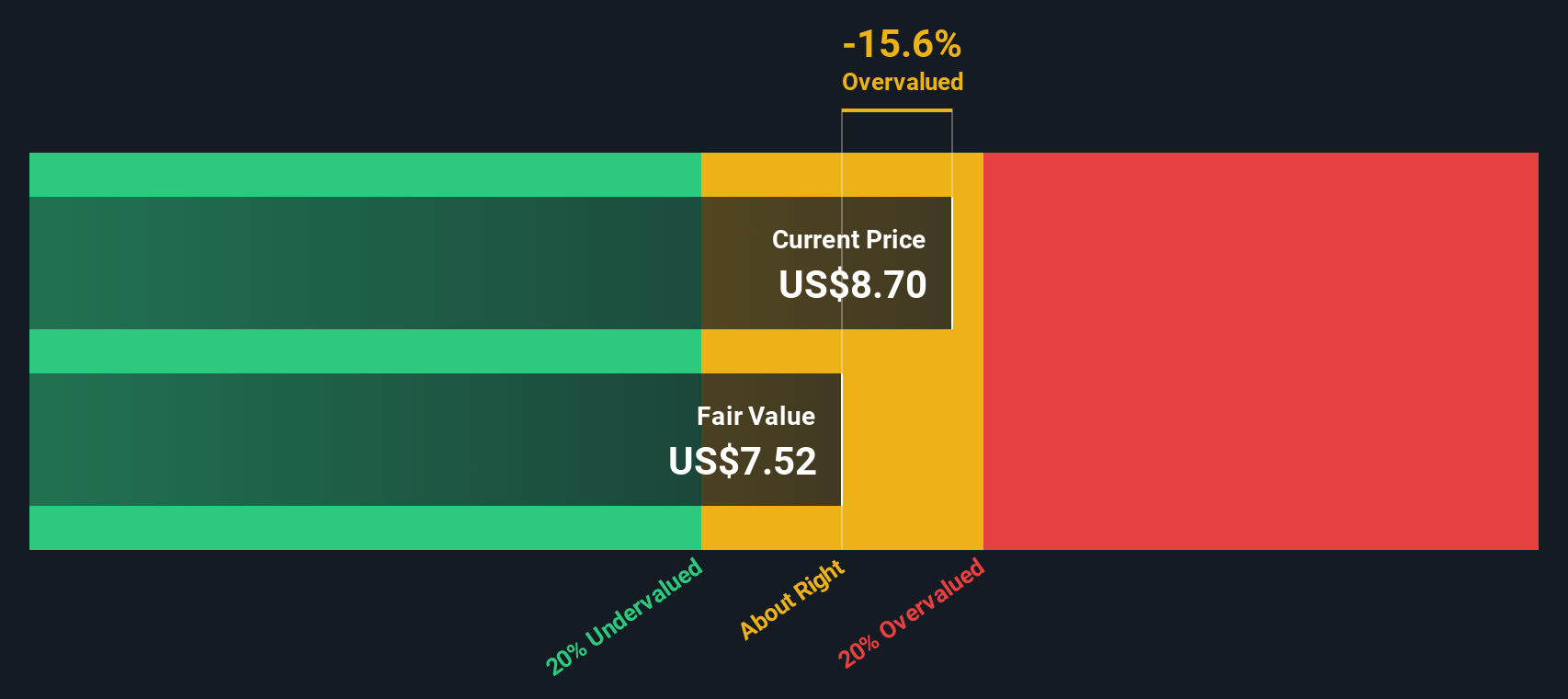

While the market narrative suggests Huntsman is undervalued, our SWS DCF model calculates a fair value of $7.52, which is notably below the current price of $8.70. This model points toward potential overvaluation and raises the question: is the market pricing in a turnaround that is not yet delivered?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Huntsman for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Huntsman Narrative

If you want to dig into the numbers for yourself and come to your own conclusions, you can assemble a narrative in just a few minutes. Do it your way

A great starting point for your Huntsman research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss out on other high-potential opportunities. Simply Wall Street’s powerful screeners help you spot tomorrow’s winners, value gems, and trends others overlook.

- Accelerate your portfolio with the hottest tech trends by targeting these 25 AI penny stocks designed to benefit from the rise of artificial intelligence.

- Get ahead of the next big surge by searching for these 886 undervalued stocks based on cash flows with proven upside potential based on strong cash flows.

- Unlock rapid growth stories by focusing on these 3588 penny stocks with strong financials leading the charge in innovation and emerging markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huntsman might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUN

Huntsman

Manufactures and sells diversified organic chemical products worldwide.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives