- United States

- /

- Metals and Mining

- /

- NYSE:HL

Assessing Hecla Mining’s Valuation Following Strong Q3 Earnings, Upgraded Outlook, and Sustained Dividends

Reviewed by Simply Wall St

Hecla Mining (NYSE:HL) stock is getting fresh attention after the company released strong third-quarter numbers, showing higher sales and net income along with increased silver and gold production. Investors are also eyeing updated guidance and ongoing dividends.

See our latest analysis for Hecla Mining.

Alongside these stronger results, Hecla Mining’s share price has been on a remarkable run, now trading at $14.06 with momentum clearly building. Over the past year, the company has delivered a total shareholder return of nearly 148%. Its 90-day share price return of 85% highlights how quickly sentiment has shifted following rising production and renewed guidance.

If you’re looking to broaden your perspective beyond metals, this is a prime moment to find new discovery opportunities through fast growing stocks with high insider ownership

With such exceptional gains and upgraded forecasts in place, the question now is whether Hecla Mining’s current share price truly reflects its long-term growth potential. Investors may also wonder if caution is warranted when considering buying in at this level.

Most Popular Narrative: Fairly Valued

At $14.06, Hecla Mining’s last close price closely matches the most followed narrative’s fair value estimate of $14.14 per share. Attention now turns to the drivers that keep valuation balanced at these levels.

The company's disciplined production ramp-up at Keno Hill, targeting a sustainable throughput of 440 tonnes per day by 2028, alongside proven high-return economics even at conservative silver price levels, sets the stage for steady long-term free cash flow and earnings growth as the mine achieves scale.

Curious about what powers this price? The current narrative is built on projections rarely seen in this sector. There is a bold financial story beneath the surface, one driven by aggressive growth targets and a future profit multiple typically reserved for market outliers. Wondering just how analysts connect these dots? Don’t miss the numbers and nuances inside the full narrative.

Result: Fair Value of $14.14 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, steadily rising capital demands for expansion and the possibility of regulatory delays could create pressure on Hecla’s future cash flow and production growth.

Find out about the key risks to this Hecla Mining narrative.

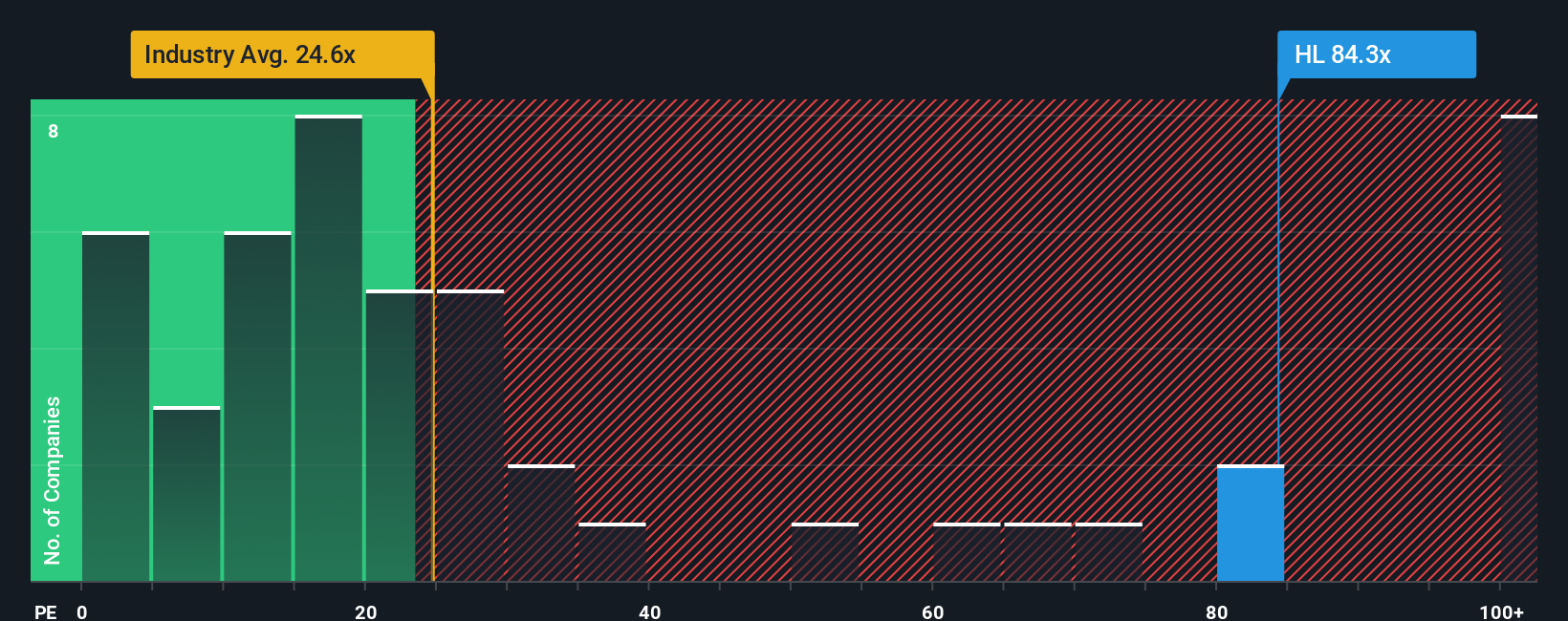

Another View: Market Ratios Raise New Questions

Looking beyond narrative fair value, Hecla Mining trades at a price-to-earnings ratio of 47.4x. This is significantly higher than both industry (20.6x) and peer (19.3x) averages, and well above its fair ratio of 24.2x. Such a premium can signal strong growth optimism, but it also heightens the risk if expectations slip. Is the market overreaching or justifiably bullish?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hecla Mining Narrative

If you see things differently or like to dig into the numbers yourself, you can easily build your own view from scratch in just a few minutes. Do it your way

A great starting point for your Hecla Mining research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Ready to go beyond Hecla Mining? Don’t let a great opportunity slip by. Tap into unique ideas now with these handpicked stock screens:

- Tap new income streams by joining those benefiting from these 18 dividend stocks with yields > 3% with robust yields and lasting payout histories.

- Explore the technology frontier with these 26 quantum computing stocks, where cutting-edge innovation meets bold market growth.

- Participate in the digital transformation by harnessing these 27 AI penny stocks shaping tomorrow’s industries with real-world artificial intelligence advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hecla Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HL

Hecla Mining

Provides precious and base metals in the United States, Canada, Japan, Korea, and China.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives