- United States

- /

- Packaging

- /

- NYSE:GPK

Did Softer Demand and Lowered 2025 Guidance Just Shift Graphic Packaging's (GPK) Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, Graphic Packaging Holding reported solid third-quarter financial results but lowered its full-year 2025 adjusted EPS guidance, citing soft consumer demand.

- The company highlighted success in reducing inventory and expanding into new markets through packaging innovation, though this comes amid ongoing volume declines over the past two years.

- We'll now explore how the cautious full-year outlook and muted consumer demand impact the company's investment narrative and growth prospects.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Graphic Packaging Holding Investment Narrative Recap

For investors considering Graphic Packaging Holding, the core thesis depends on belief in a turnaround in consumer demand and the company’s ability to leverage packaging innovation to drive future growth. The recent downward revision of full-year 2025 EPS guidance highlights persistent volume declines as a near-term risk, while successful inventory reductions and market expansions are incremental positives; for now, the cautious guidance has a tangible impact on the most important catalyst, the timing of any return to sustainable volume growth.

A key announcement linked to these developments is the recent share repurchase activity, with nearly 1.8 million shares bought back this past quarter. This signals ongoing management confidence and may provide some support to per-share earnings figures, though it unfolds alongside headwinds from weaker sales and earnings pressures.

Yet, despite operational progress and active capital management, investors should also be alert to growing signs of...

Read the full narrative on Graphic Packaging Holding (it's free!)

Graphic Packaging Holding is expected to achieve $9.1 billion in revenue and $693.7 million in earnings by 2028. This projection requires annual revenue growth of 1.7% and an increase in earnings of $159.7 million from the current $534.0 million.

Uncover how Graphic Packaging Holding's forecasts yield a $20.04 fair value, a 29% upside to its current price.

Exploring Other Perspectives

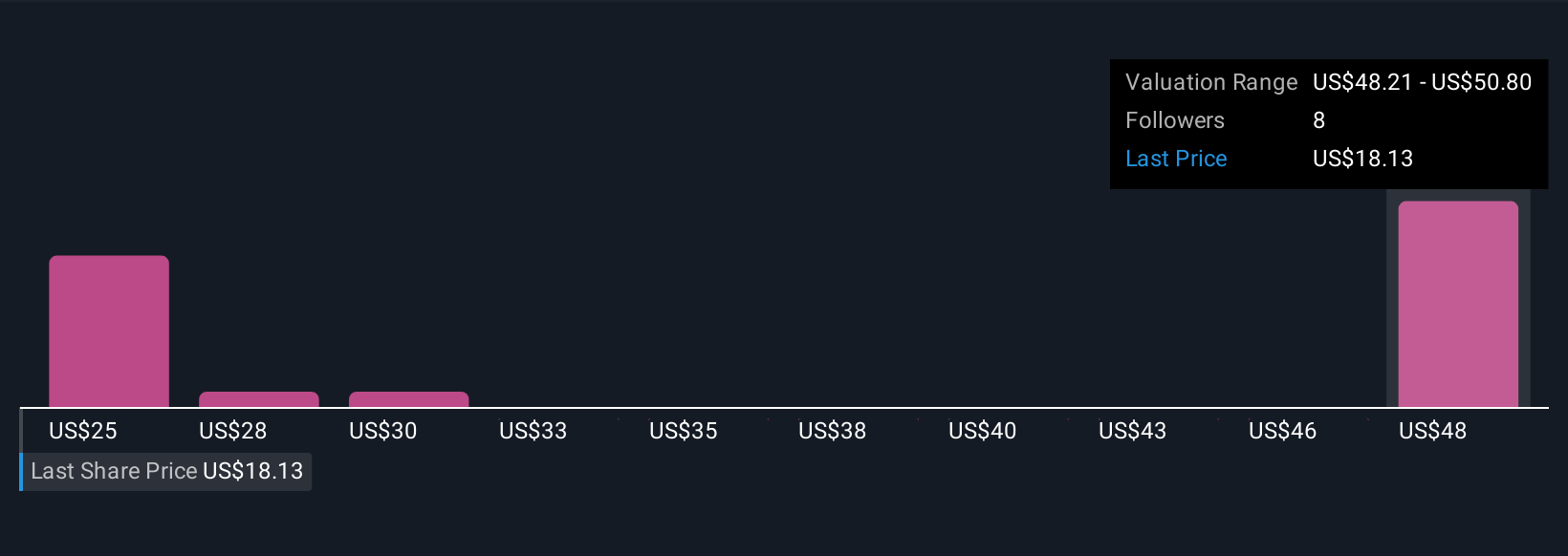

Fair value estimates from the Simply Wall St Community, based on three independent perspectives, span a wide range from US$20.04 to US$32.90 per share. Persistent volume uncertainty remains a top concern that could affect longer-term earnings, encouraging readers to compare these community insights and consider different scenarios for Graphic Packaging’s recovery.

Explore 3 other fair value estimates on Graphic Packaging Holding - why the stock might be worth just $20.04!

Build Your Own Graphic Packaging Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Graphic Packaging Holding research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Graphic Packaging Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Graphic Packaging Holding's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GPK

Graphic Packaging Holding

Designs, produces, and sells consumer packaging products to brands in food, beverage, foodservice, household, and other consumer products in the Americas, Europe, and the Asia Pacific.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives