- United States

- /

- Chemicals

- /

- NYSE:FMC

FMC (FMC) Is Down 53.7% After Dividend Slash and Leadership Shakeup Are Investors Rethinking the Story?

Reviewed by Sasha Jovanovic

- FMC Corporation recently reported third-quarter 2025 results, revealing sales of US$542.2 million and a net loss of US$569.3 million, alongside a reduction in its quarterly dividend to US$0.08 per share and the announced departure of its president.

- This period was marked by asset write-downs related to its India business sale, negative free cash flow guidance, and operational challenges that prompted significant cost-cutting actions.

- We’ll examine how the sharp dividend cut and leadership change are shaping FMC’s investment narrative moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

FMC Investment Narrative Recap

For anyone considering FMC, the key investment thesis rests on confidence in the company’s ability to execute cost cuts, refocus on innovative crop protection products, and leverage growth in select regions like Brazil. The recent quarterly results and updated guidance directly impact the most important near-term catalyst: execution of new product launches and cost transformation, while the biggest current risk, high debt and negative free cash flow, has become even more pronounced due to weak earnings and asset write-downs.

Among the latest announcements, FMC’s decision to slash its quarterly dividend to US$0.08 per share stands out. This move underscores the company’s immediate focus on preserving cash and managing its elevated debt load, which could affect flexibility to invest in pipeline innovation and market expansion if negative free cash flow persists.

However, investors should also be aware that, despite the aggressive cost cuts and focus on new actives, the company’s rising debt-to-EBITDA ratio above 5 times in 2025 raises...

Read the full narrative on FMC (it's free!)

FMC's narrative projects $4.8 billion revenue and $542.8 million earnings by 2028. This requires 5.5% yearly revenue growth and a $413 million earnings increase from $129.7 million today.

Uncover how FMC's forecasts yield a $45.56 fair value, a 221% upside to its current price.

Exploring Other Perspectives

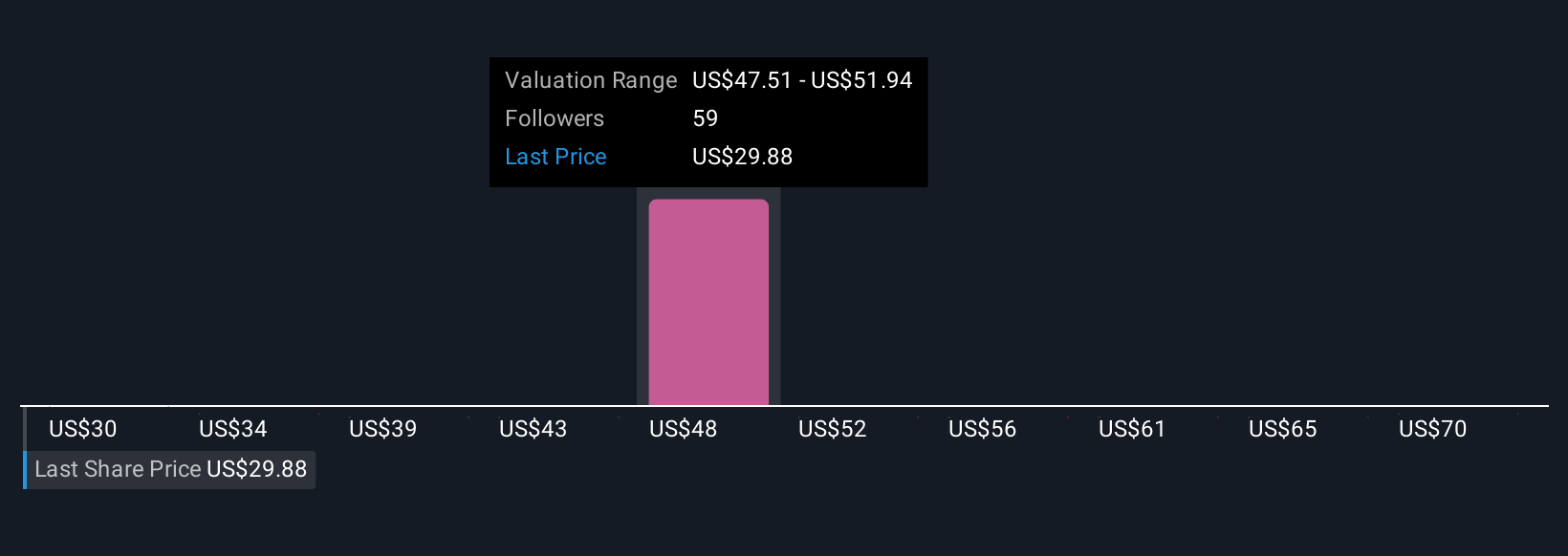

Seven members of the Simply Wall St Community value FMC shares between US$28.59 and US$74.11. While some see upside, ongoing debt pressure and cash flow challenges could prove critical for the company’s recovery path. Explore these diverging perspectives to see how individual views align or differ on FMC’s future.

Explore 7 other fair value estimates on FMC - why the stock might be worth over 5x more than the current price!

Build Your Own FMC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FMC research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free FMC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FMC's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FMC

FMC

An agricultural sciences company, provides crop protection solutions to farmers in Latin America, North America, Europe, the Middle East, Africa, and Asia.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives