- United States

- /

- Basic Materials

- /

- NYSE:EXP

Does Eagle Materials' (EXP) Persistent Buybacks Offset Mixed Earnings and Shape Its Investment Appeal?

Reviewed by Simply Wall St

- On July 29, 2025, Eagle Materials reported first quarter results showing sales of US$634.69 million, up from the prior year, but a decrease in net income and diluted earnings per share, alongside the repurchase of 358,000 shares for US$79 million during the quarter.

- The company's disciplined capital allocation, shown by its long-running share buyback program that has retired over 64% of shares since 2004, continues to be a defining feature as it balances growth and shareholder returns.

- Next, we'll explore how Eagle Materials' active buybacks and mixed earnings results influence the company's investment narrative in the current market.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Eagle Materials Investment Narrative Recap

Investing in Eagle Materials often means believing in the resilience of US construction activity, the company’s pricing power in cement and wallboard, and management’s commitment to reliable capital returns. The recent mixed quarter, with higher sales but lower net income and EPS, has little short-term impact on the main catalyst: demand for construction materials in a fluctuating interest rate environment. However, ongoing pressure on volumes and pricing remains a risk to watch closely as the industry moves through this cycle.

The company’s share repurchase update stands out this quarter, as Eagle Materials retired another 358,000 shares for US$79 million, reinforcing a long track record of prioritizing shareholder returns. This action, while meaningful for earnings per share, only marginally addresses the near-term risk of weaker cement volumes, which management continues to flag as an uncertainty tied to weather and regional market trends.

Yet, while reduced cement volumes could dampen growth, what investors might not realize is just how much future earnings could hinge on ...

Read the full narrative on Eagle Materials (it's free!)

Eagle Materials' outlook anticipates $2.6 billion in revenue and $554.6 million in earnings by 2028. This scenario is based on a 5.0% annual revenue growth rate and projects an increase in earnings of about $91 million from the current $463.4 million.

Uncover how Eagle Materials' forecasts yield a $242.40 fair value, a 7% upside to its current price.

Exploring Other Perspectives

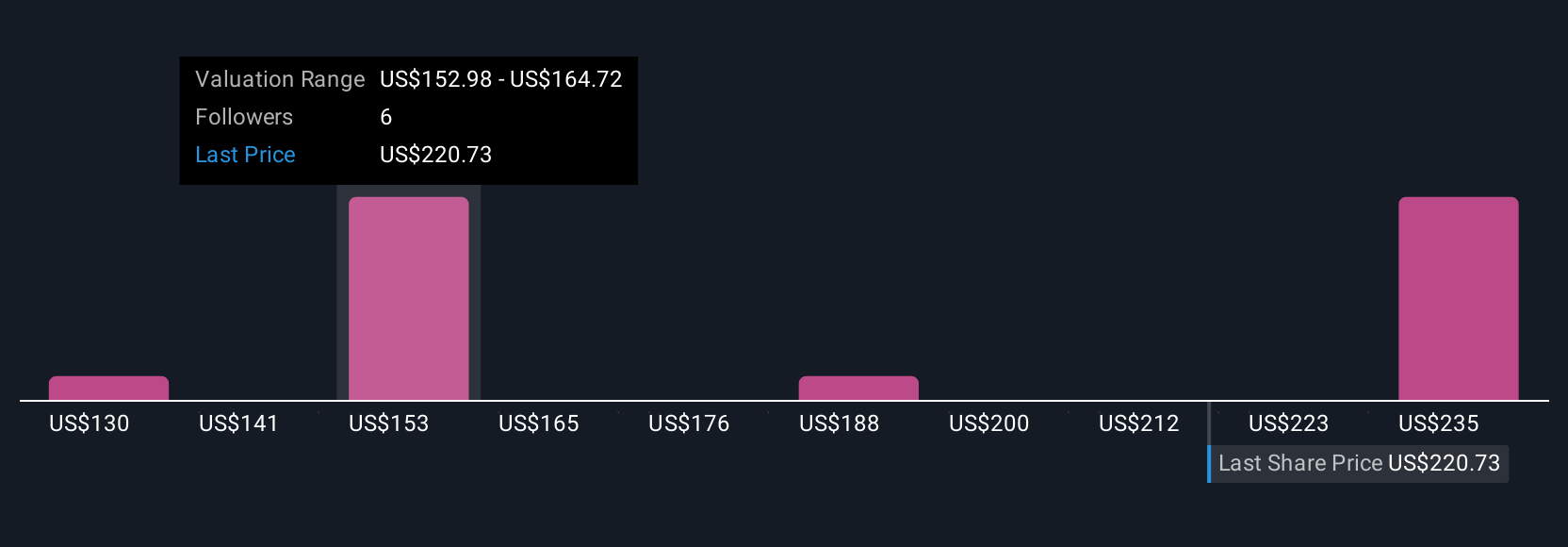

Four private investors in the Simply Wall St Community provided a broad fair value span for Eagle Materials, from US$111 to US$242 per share. At the same time, ongoing fluctuations in cement and aggregate sales volumes suggest performance could diverge from these valuations, making it essential to weigh multiple viewpoints before making any conclusions.

Explore 4 other fair value estimates on Eagle Materials - why the stock might be worth as much as 7% more than the current price!

Build Your Own Eagle Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eagle Materials research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Eagle Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eagle Materials' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eagle Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EXP

Eagle Materials

Through its subsidiaries, manufactures and sells heavy construction products and light building materials in the United States.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives