- United States

- /

- Chemicals

- /

- NYSE:ESI

Will Rising Sales and a New Shelf Registration Change Element Solutions' (ESI) Growth Narrative?

Reviewed by Simply Wall St

- Element Solutions Inc recently reported its second quarter results, with sales rising to US$625.2 million while net income and earnings per share declined year-over-year, and also filed a shelf registration enabling future issuance of various securities.

- The combination of higher sales and the potential for new capital-raising options signals both active market participation and future financial flexibility for the company.

- We'll examine how the earnings decline alongside plans for possible capital raising could influence Element Solutions’ growth narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Element Solutions Investment Narrative Recap

To believe in Element Solutions, investors should feel confident about the company's exposure to rising demand in electronics and advanced packaging, while balancing that opportunity against exposure to cyclical end-markets and ongoing margin pressures. The latest quarterly results, with sales up but earnings and EPS down, add nuance to the short-term outlook; however, these changes don't appear to fundamentally shift the current catalysts or the biggest risk, cyclical weakness in key industrial markets, at this stage.

The most relevant recent announcement is the filing of a shelf registration, allowing for potential future issuance of new securities. This move gives Element Solutions flexibility to raise capital if needed, which can be a positive in funding growth or managing through industry cycles, but does not directly address or amplify the immediate challenges tied to underlying demand across their end markets.

However, investors should be aware that if the softness in Western industrials persists, it could influence...

Read the full narrative on Element Solutions (it's free!)

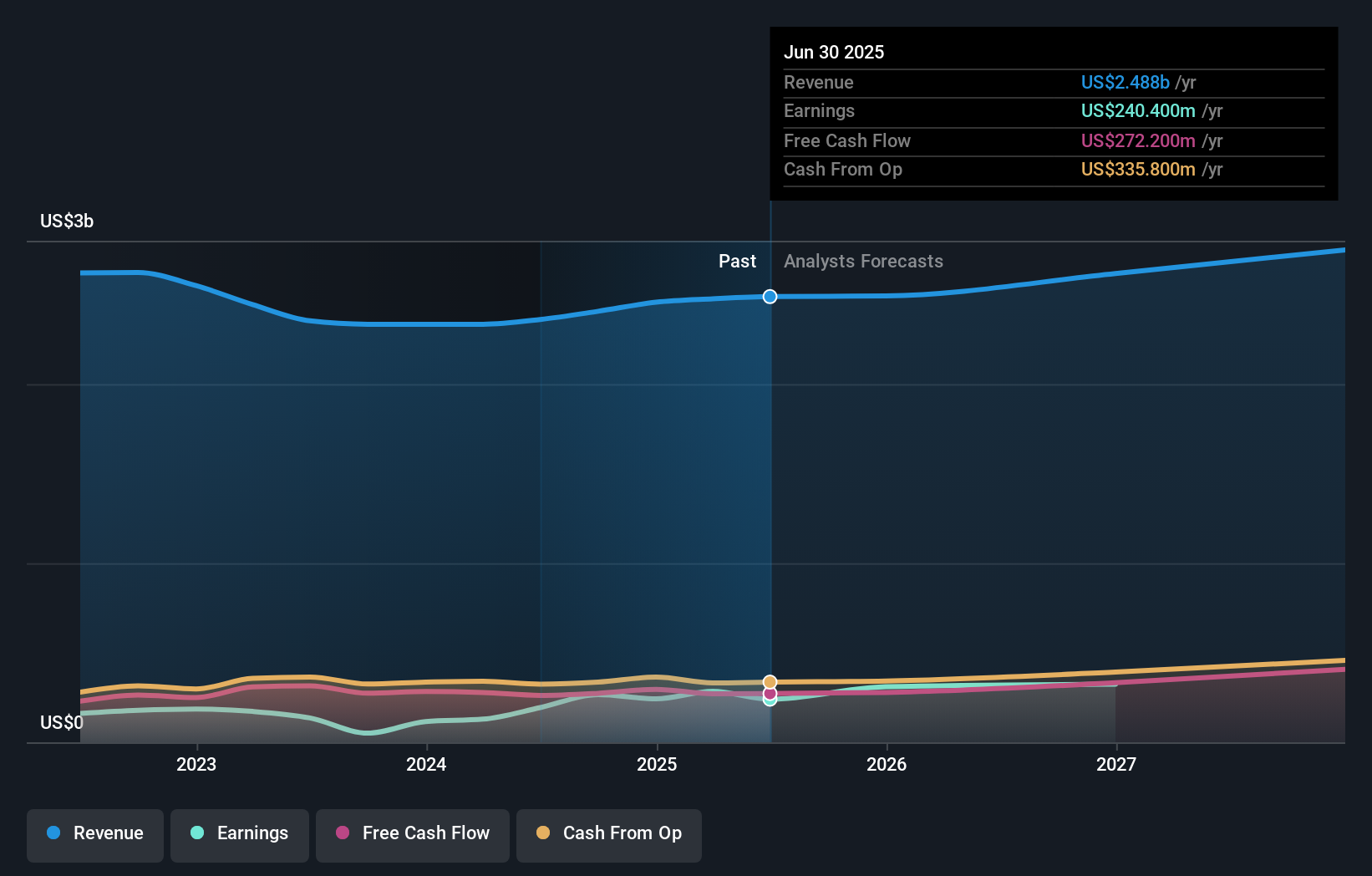

Element Solutions' outlook projects $2.7 billion in revenue and $368.0 million in earnings by 2028. This is based on a 2.6% annual revenue growth rate and a $83.4 million increase in earnings from the current $284.6 million.

Uncover how Element Solutions' forecasts yield a $28.60 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Element Solutions' fair value between US$22.47 and US$28.60, across two independent analyses. Given uncertain industrial demand, consider how these diverse estimates might reflect sharply different expectations for the company's resilience and future performance.

Explore 2 other fair value estimates on Element Solutions - why the stock might be worth as much as 21% more than the current price!

Build Your Own Element Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Element Solutions research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Element Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Element Solutions' overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Element Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESI

Element Solutions

Operates as a specialty chemicals company in the United States, China, and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives