- United States

- /

- Chemicals

- /

- NYSE:ESI

Element Solutions (NYSE:ESI) Is Doing The Right Things To Multiply Its Share Price

What trends should we look for it we want to identify stocks that can multiply in value over the long term? Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. Speaking of which, we noticed some great changes in Element Solutions' (NYSE:ESI) returns on capital, so let's have a look.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Element Solutions:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

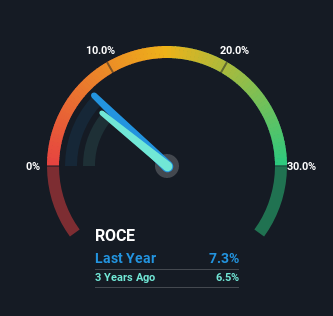

0.073 = US$335m ÷ (US$4.9b - US$344m) (Based on the trailing twelve months to December 2022).

Therefore, Element Solutions has an ROCE of 7.3%. Ultimately, that's a low return and it under-performs the Chemicals industry average of 11%.

Check out our latest analysis for Element Solutions

Above you can see how the current ROCE for Element Solutions compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Element Solutions.

SWOT Analysis for Element Solutions

- Debt is well covered by earnings.

- Dividends are covered by earnings and cash flows.

- Earnings declined over the past year.

- Dividend is low compared to the top 25% of dividend payers in the Chemicals market.

- Annual earnings are forecast to grow faster than the American market.

- Trading below our estimate of fair value by more than 20%.

- Debt is not well covered by operating cash flow.

- Annual revenue is forecast to grow slower than the American market.

What Does the ROCE Trend For Element Solutions Tell Us?

You'd find it hard not to be impressed with the ROCE trend at Element Solutions. We found that the returns on capital employed over the last five years have risen by 201%. That's not bad because this tells for every dollar invested (capital employed), the company is increasing the amount earned from that dollar. Interestingly, the business may be becoming more efficient because it's applying 50% less capital than it was five years ago. If this trend continues, the business might be getting more efficient but it's shrinking in terms of total assets.

The Bottom Line On Element Solutions' ROCE

In summary, it's great to see that Element Solutions has been able to turn things around and earn higher returns on lower amounts of capital. And investors seem to expect more of this going forward, since the stock has rewarded shareholders with a 85% return over the last five years. In light of that, we think it's worth looking further into this stock because if Element Solutions can keep these trends up, it could have a bright future ahead.

Element Solutions does come with some risks though, we found 2 warning signs in our investment analysis, and 1 of those shouldn't be ignored...

While Element Solutions may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Valuation is complex, but we're here to simplify it.

Discover if Element Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ESI

Element Solutions

Operates as a specialty chemicals technology company in the United States, China, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

SoFi Technologies: The Apex Aggregator and the Infrastructure of the Modern Financial System

CSL: The Dip Is the Opportunity

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Recently Updated Narratives

Basic-Fit: Why the Market Is Mispricing Europe’s Largest Low-Cost Gym Operator

DroneShield's Growth Will Drive Revenue Up by 25.39% Amidst New Success

UiPath Inc. (PATH): Agentic AI Pivot and Milestone Profits Set the Stage for Q4 Results

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks