- United States

- /

- Chemicals

- /

- NYSE:ESI

Element Solutions (ESI): Evaluating Valuation Following Recent Sector Weakness

Reviewed by Simply Wall St

See our latest analysis for Element Solutions.

Element Solutions’ latest dip comes after a steady few months in which cautious optimism has been fading. While its 1-year total shareholder return is down 6.6%, long-term investors have still seen robust results, with a 41% total shareholder return over three years and a stellar 112% gain over five years. This is clear evidence that momentum may be pausing after an impressive run.

If you’re exploring what else is showing long-term resilience, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With Element Solutions’ share price sitting nearly 24% below the average analyst target and a strong history of value creation, investors may wonder whether the stock is undervalued right now or if future growth is already priced in.

Most Popular Narrative: 19.3% Undervalued

With Element Solutions closing at $25.89 and its narrative fair value estimated at $32.10, many see sizable upside if key business drivers pan out. The following excerpt conveys why some believe a repricing could emerge:

“Accelerating investment in data centers and high-performance computing infrastructure is driving demand for advanced electronics materials and wafer-level packaging solutions. This positions Element Solutions as a key supplier for leading-edge semiconductor and circuit board applications and supports robust future revenue growth.”

Want to understand what’s fueling talk of a move higher? The most popular forecast focuses on rapid expansion in specialty technology markets, tighter product focus, and an ambitious margin play. Eager to see which projections power this bold valuation? Find out what growth levers the narrative relies on behind its fair value call.

Result: Fair Value of $32.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent exposure to cyclical end markets and intensifying global competition could quickly dampen the upbeat projections that support Element Solutions’ valuation narrative.

Find out about the key risks to this Element Solutions narrative.

Another View: What Do Current Market Ratios Reveal?

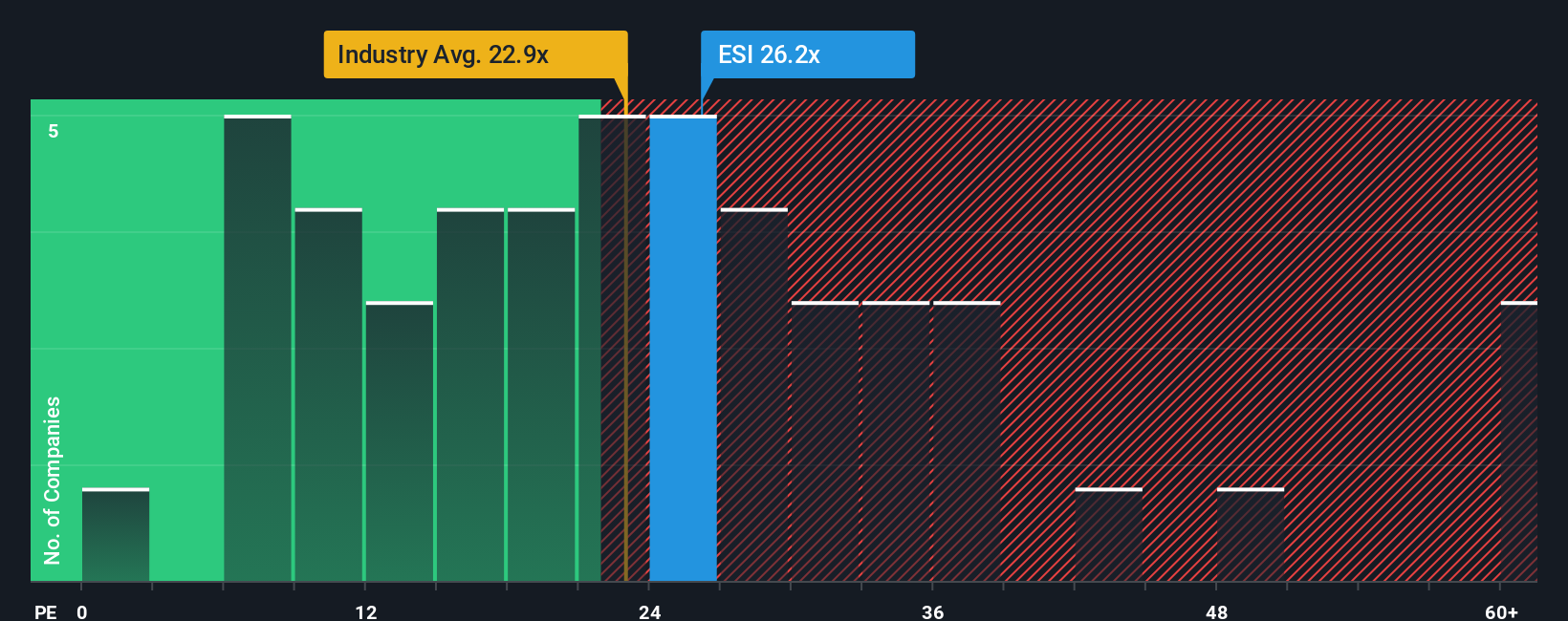

Looking through the lens of earnings-based valuation, Element Solutions trades at a price-to-earnings ratio of 26.2x. That is higher than both the US Chemicals industry average of 23.4x and its peer group at 15.2x. The figure also stands above the market’s fair ratio of 22.1x, which suggests the stock may be leaning toward overvaluation by these standards.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Element Solutions Narrative

If you see the situation differently or want to explore the numbers on your own terms, you can craft your own perspective in just a few minutes. Start now with Do it your way.

A great starting point for your Element Solutions research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Turn opportunity into action, and don’t let fresh trends slip by when new winners could be just a click away on Simply Wall St’s screeners.

- Unlock reliable income streams by checking out these 16 dividend stocks with yields > 3% yielding over 3%. This is designed for investors focused on steady returns.

- Tap into disruptive innovation as you scan these 25 AI penny stocks making waves in artificial intelligence and powering the next digital transformation.

- Supercharge your search for value plays by evaluating these 879 undervalued stocks based on cash flows, which highlights stocks whose prices may not reflect their genuine potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Element Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESI

Element Solutions

Operates as a specialty chemicals company in the United States, China, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives