- United States

- /

- Chemicals

- /

- NYSE:EMN

Eastman Chemical (EMN): Assessing Valuation After Earnings Miss and Weaker Guidance

Reviewed by Simply Wall St

Most Popular Narrative: 8.2% Undervalued

According to community narrative, Eastman Chemical is considered modestly undervalued, with analysts projecting a higher fair value than the current share price implies.

"Eastman's ongoing success and expansion in molecular recycling/methanolysis (including debottlenecking at Kingsport and operational improvements) positions the company to capture premium pricing and win volume as regulations and customer demand for recycled content accelerate. This is particularly notable as mechanical recycling underperforms in key end markets, which could drive sustained revenue growth and EBITDA margin expansion."

Curious about how sustainability innovation could supercharge future earnings? This narrative hints at big moves in recycling and specialty materials, all backed by key profit and growth assumptions. The analyst consensus is banking on steady improvements, margin gains, and premium pricing in line with global megatrends. Want to see the exact forecasts and what has to break right for EMN to reach that price target? Take a closer look at the full financial playbook fueling this valuation.

Result: Fair Value of $76.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, continued trade tensions and weak demand in key segments could present challenges to Eastman’s recovery and place future earnings under pressure.

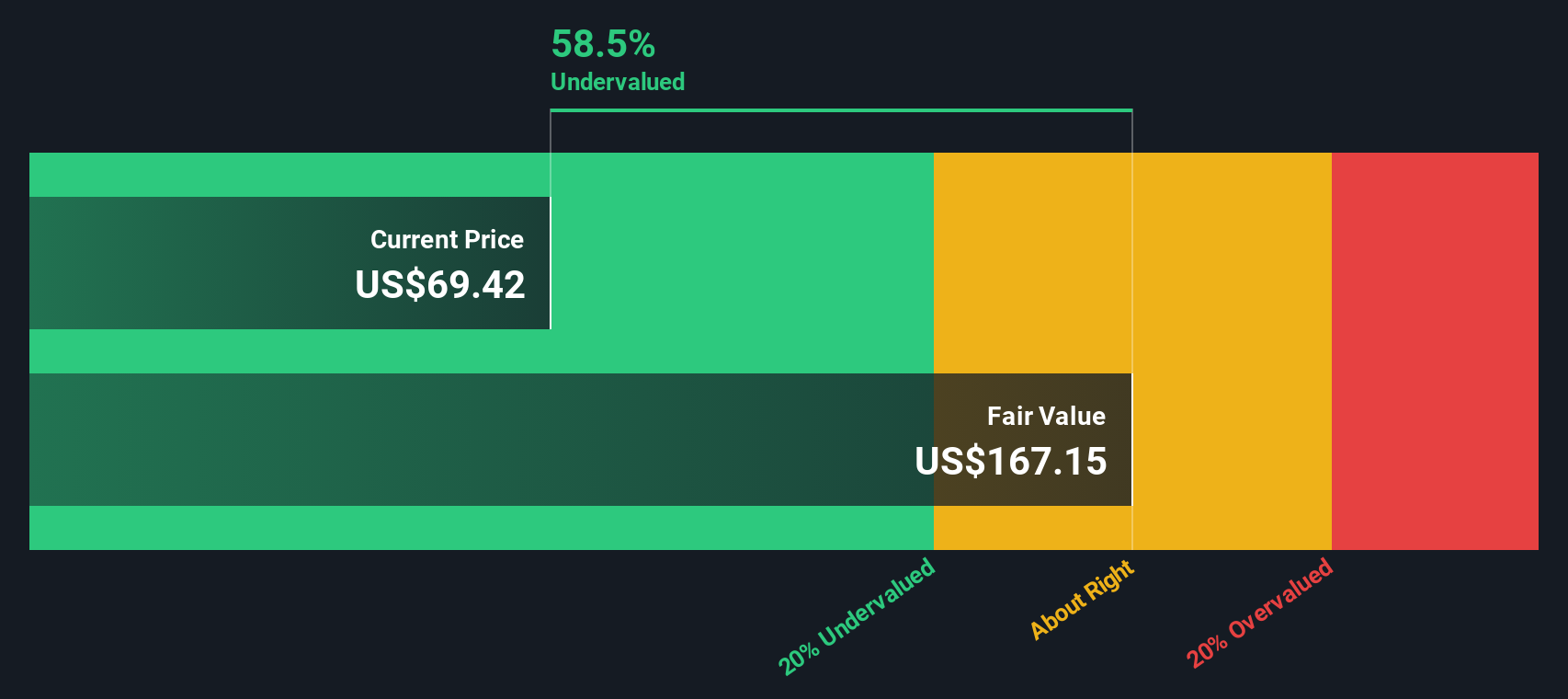

Find out about the key risks to this Eastman Chemical narrative.Another View: SWS DCF Model Weighs In

Looking beyond analyst expectations, our DCF model takes a fresh perspective on Eastman Chemical's value. This approach suggests the stock could be trading at a significant discount and presents a different angle on the company’s outlook. Which method will ultimately prove right as the story unfolds?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Eastman Chemical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Eastman Chemical Narrative

If you see things differently or prefer to dive deeper into the numbers yourself, you can shape your own viewpoint in just a few minutes. Do it your way

A great starting point for your Eastman Chemical research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t stick to just one opportunity when there are unique markets and innovative companies catching attention right now. Make your next move with confidence and see what else could belong in your portfolio:

- Unlock high potential with AI penny stocks, which are reshaping industries through artificial intelligence breakthroughs and emerging technologies.

- Spot undervalued gems by using undervalued stocks based on cash flows, which highlights stocks showing real promise based on strong cash flow fundamentals.

- Boost your income with reliable performers. Tap into dividend stocks with yields > 3% and focus on companies delivering consistent yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastman Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:EMN

Eastman Chemical

Operates as a specialty materials company in the United States, China, and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives